Coinbase declares readiness for spot Bitcoin ETF approvals as BlackRock goes on the leaderboard

- Coinbase spokesperson says the platform is ready for spot BTC ETF approvals.

- Part of the preparations include capacity to handle increased trading volumes, liquidity and general demand.

- Meanwhile, BlackRock has become the first issuer to publicly complete SEC’s known requirements for spot bitcoin ETF approval.

Coinbase Inc. has been critical in the multi-month race for Spot Bitcoin Exchange Trade Funds (ETFs). Its position as the largest crypto exchange in the US gives it an edge and serves as a key driver for its popularity. With such a helm, institutional players have identified it as a potential partner to bolster their filings in an attempt to convince the US Securities and Exchange Commission (SEC) for approval.

Coinbase is ready for spot ETF approvals

Coinbase has said that it is ready for spot BTC ETF approvals. This is after the US-based exchange reached Surveillance Sharing Agreements (SSA) with multiple filers. As part of the preparations, the platform has fortified and streamlined its systems to handle more trading volumes, increased liquidity, and general demand pressure.

Coinbase ready for spot bitcoin ETF launches…

— Nate Geraci (@NateGeraci) December 29, 2023

All systems go.

via @Yueqi_Yang pic.twitter.com/isQw0908bI

This show of confidence comes as the proposed window is barely a week out, set to open on January 5, 2024.

SSA, short for Surveillance Sharing Agreement, is an arrangement between crypto exchanges and regulators or market surveillance providers such as the SEC to increase the crypto market's integrity as well as transparency. Among the ways this is achieved is the sharing of trading information.

Operating a significant part of the US-based spot-trading platform for Bitcoin, Coinbase commands a sizable portion of US-based and USD-denominated Bitcoin trading.

It collaborates with the Chicago Board Options Exchange (CBOE) ETF applications, a partnership that started on June 21. Besides the CBOE, BlackRock and Fidelity also listed Coinbase as SSA in their iShares Bitcoin Trust as indicated on Nasdaq's 19b-4 form.

If approved, BlackRock and CBOE would be able to share trade data with the commission, and book information, among other relevant market data. This would help put out or reduce the SEC's suspicion of market manipulation and allow it to confirm the lack thereof.

BlackRock goes on the leaderboard

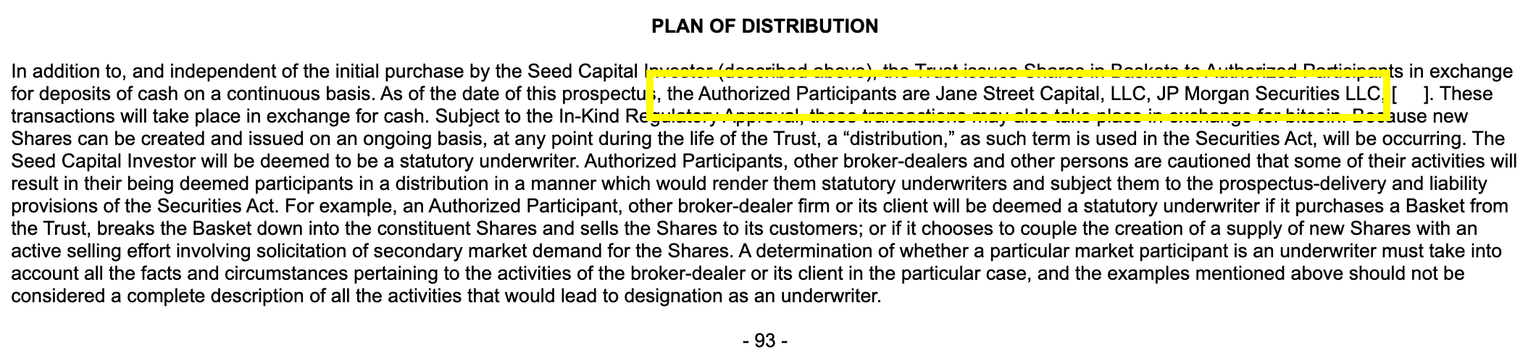

Elsewhere, after multiple amendments and the recent capitulation to the SEC’s request for ETFs to do cash redemptions, BlackRock has become the first potential issuer to publicly complete SEC’s known requirements for spot bitcoin ETF approval, according to Nate Geraci, President of ETFStore. It comes after an update to its S-1, where it names Jane Street and JPMorgan as its authorized participants (APs) for its cash redemption transactions.

BlackRock S-1

Citing ETF specialist Eric Balchunas on the development, “Looks we have our first horse that at the starting gate.”

BlackRock just dropped its updated S-1 and it DOES name the APs: Jane Street and JPMorgan (which is kinda ironic). Looks we have our first horse that at the starting gate. pic.twitter.com/H3UmaesygJ

— Eric Balchunas (@EricBalchunas) December 29, 2023

With BlackRock’s heft in the market, this significantly increases the chances of approval. The naming of the APs, particularly where JPMorgan is concerned, is broadly ironic, considering the bank’s CEO Jamie Dimon recently said the only true use case for Bitcoin is for criminals, urging the government to ban it. In 2014, when Bitcoin price was at $816.20, Dimon said, “[Bitcoin] is a terrible store of value." The turn of events is a textbook illustration of how smart money operates.

Crypto ETF FAQs

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Is Bitcoin futures ETF approved?

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Is Bitcoin spot ETF approved?

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.