Solana tests resistance again, bulls push SOL towards $125

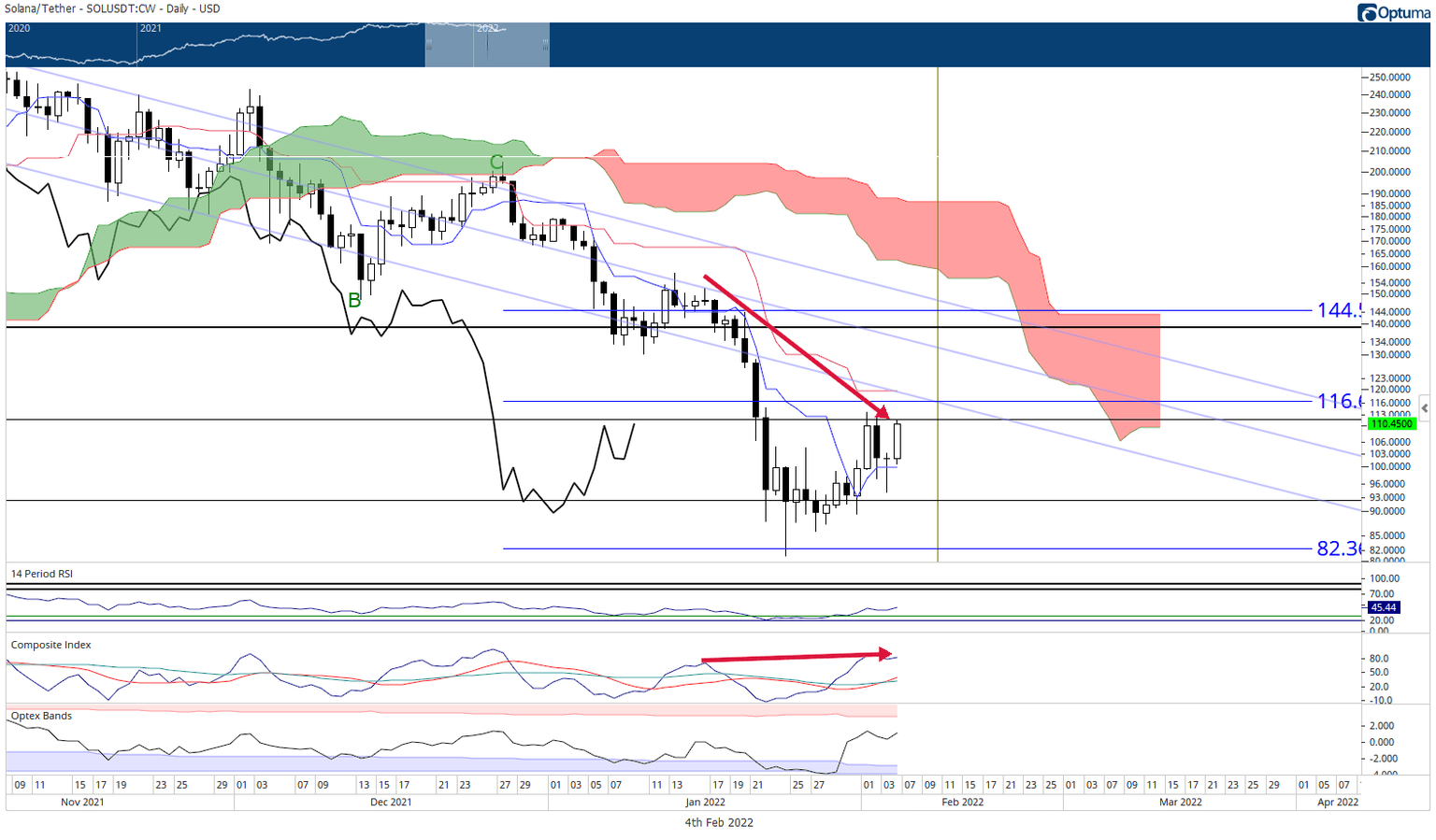

- Solana price was rejected near the $110 resistance zone but quickly recovered to test it again.

- Some short sellers may be trapped if bulls can rally SOL into the prior bull flag.

- Downside pressure remains.

Solana price action has had its whipsaws this week, more so than most high market cap cryptocurrencies. However, buyers appear undeterred this week as they make another run at the $110 resistance level despite some negative news and fundamentals.

Solana price bulls look for a breakout above $110 to test $125

Solana price action on Wednesday and Thursday looked like a very strong probability of a bearish continuation occurring. There were many good reasons to bet on that happening for bulls and bears who thought that Solana would dip lower. One of the primary reasons was the hidden bearish divergence while SOL was trading against a critical resistance level.

Many new short positions were added on derivatives exchanges which are now likely feeling the squeeze as Solana has returned to that critical $110 zone. If bulls wish to position Solana to initiate a new bull run, then a daily close at or above $120 is necessary.

A close above $120 means that Solana price closed above the Kijun-Sen, 38.2% Fibonacci retracement, prior 100% Fibonacci expansion, and the bottom trendline of a former bull flag. Additionally, a close at $120 would invalidate the current hidden bearish divergence that may continue to weigh on Solana price.

If bulls fail to push Solana to $120, the recent retest of $110 could be a bull trap and the final retest before a push toward the $75 zone begins.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.