Solana Price Prediction: SOL is on a downward spiral to $50

- Solana price action is testing its final support before a capitulation move begins.

- Bulls are absent and conspicuously avoidant.

- Upside potential remains, but conviction by buyers is needed.

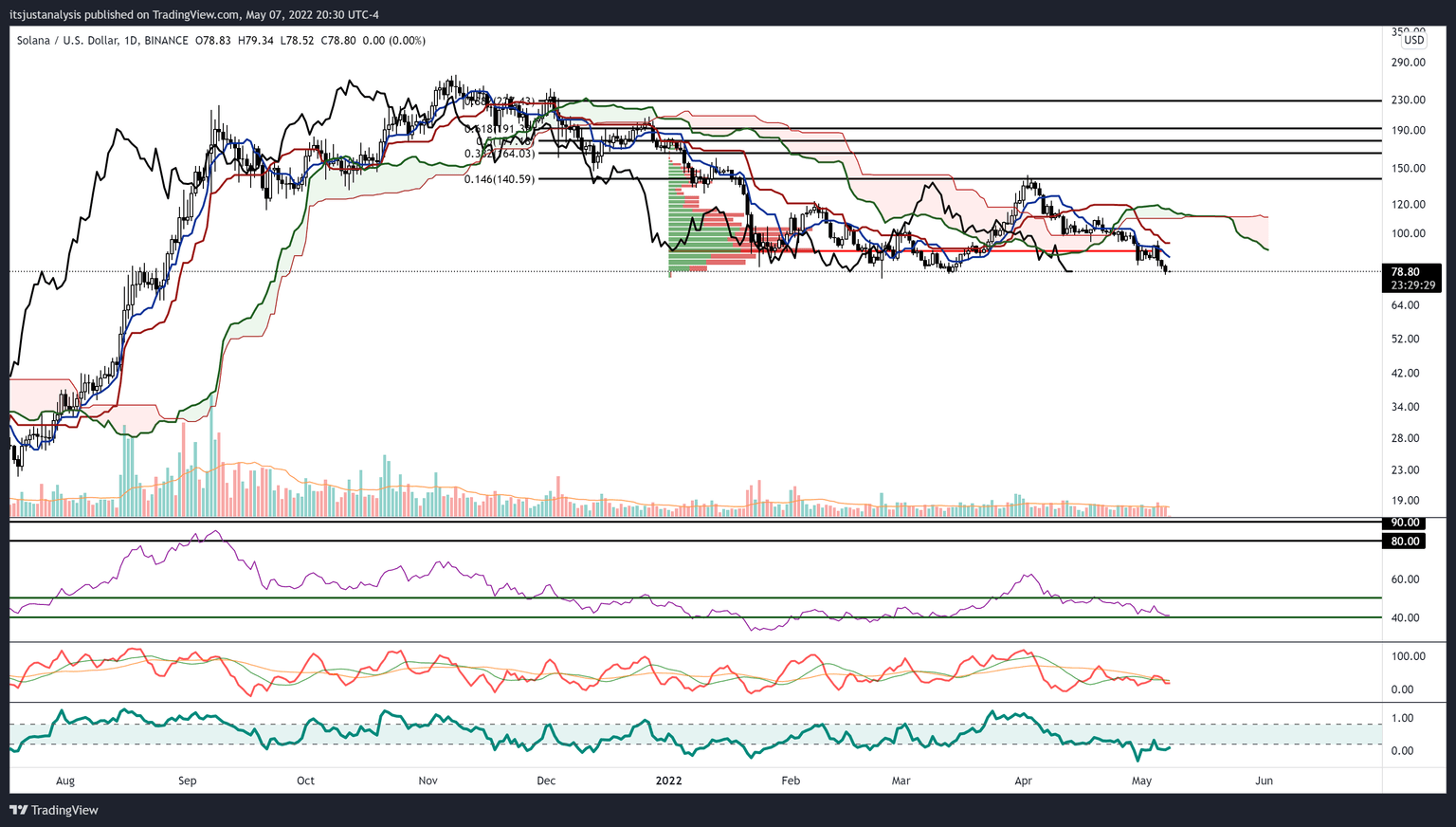

Solana price action remains exceptionally bearish, with zero near-term support. SOL has broken down below its 2022 Volume Point of Control at $90 and is close to pushing new 2022 lows.

Solana price shows a total absence of buyers, major lows incoming

Solana price remains within an Ideal Bearish Ichimoku Breakout, signaling to traders that a long-term and persistent sell-off is likely to culminate with a massive and abrupt drop.

From a Volume Profile perspective, Solana price action is in price discovery mode until it hits the next high volume node. That next high-volume node doesn’t appear until the $50 value area. In the 2021 Volume Profile, the high volume node from $25 to $50 was the second largest high volume node but the longest from the time spent in that range – nearly 120 days.

The longer Solana price spends below the daily Ichimoku Cloud and the 2022 Volume Profile ($90), it is increasingly likely that a flash crash towards the $50 level will occur.

However, the daily Solana price chart isn’t without some bullish data. There is regular bullish divergence between price and the %B oscillator and price and the Composite Index. Additionally, the Relative Strength Index remains in bull market conditions and is currently testing the final oversold level at 40 for the first time since converting back into a bull market.

SOL/USDT Daily Ichimoku Chart

Bulls will need to close Solana price at or above $120 to confirm an Ideal Bullish Ichimoku breakout to give a clear signal that a new uptrend is about to continue.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.