Solana Price Prediction: $30 could be on the cards for SOL

- Solana price has rallied by 140% since January 1.

- SOL shows potential for a 25% rally to $30.

- The trade idea depends on the $20 liquidity zone remaining breached.

Solana price maintains its bullish stance. key levels have been defined to gauge the centralized smart contracts' price trajectory.

Solana price still in an uptrend

Solana price is going through a consolidation phase after a jaw-dropping display of bullish stregnth. In just 30 days, the centralized smart contract token managed to rally by 177%, forcing traders to consider whether the market bottom is in.

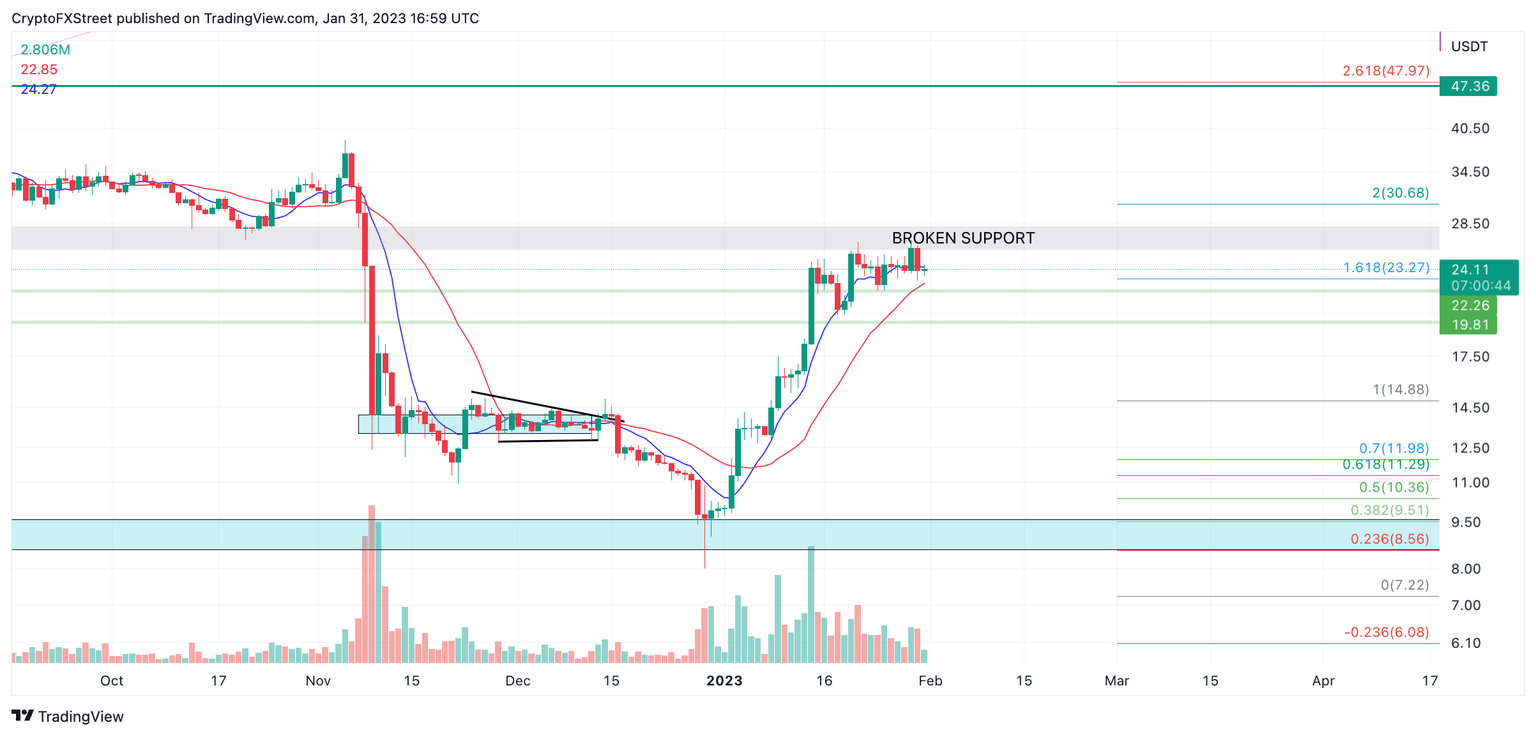

Solana price currently auctions at $24.13. The congestion near the mid $20 zone has been going on for roughly two weeks. The 8-day exponential moving average (EMA) mainly supports the back-and-forth price action. The 21 Day simple moving average (SMA) has yet to be retested since being breached during the early stages of the stunning rally. For this reason, traders are likely placing buy limits at the indicator and anticipating a retest-and-rally signal.

The volume indicator is in favor of the bulls as there is a tapered pattern throughout the consolidation. The pattern suggests bears in the market may solely be retail, and that bulls in profit are holding on to their positions.

The next target for traders will aim for will be the psychological $30 price level. The bullish scenario creates the potential for a 25% rise from Solana’s current market value.

SOL/USDT 1-Day Chart

Invalidation of the bullish trade idea could occur if the bears happen to breach the $20 liquidity zone. In doing so, they could catalyze further decline targeting previous resistance zones within the rally, likely at $16 and potentially $12.50. The Solana price could decline by 50% if the bears were to succeed.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.