Bears threaten to send Solana price below $20

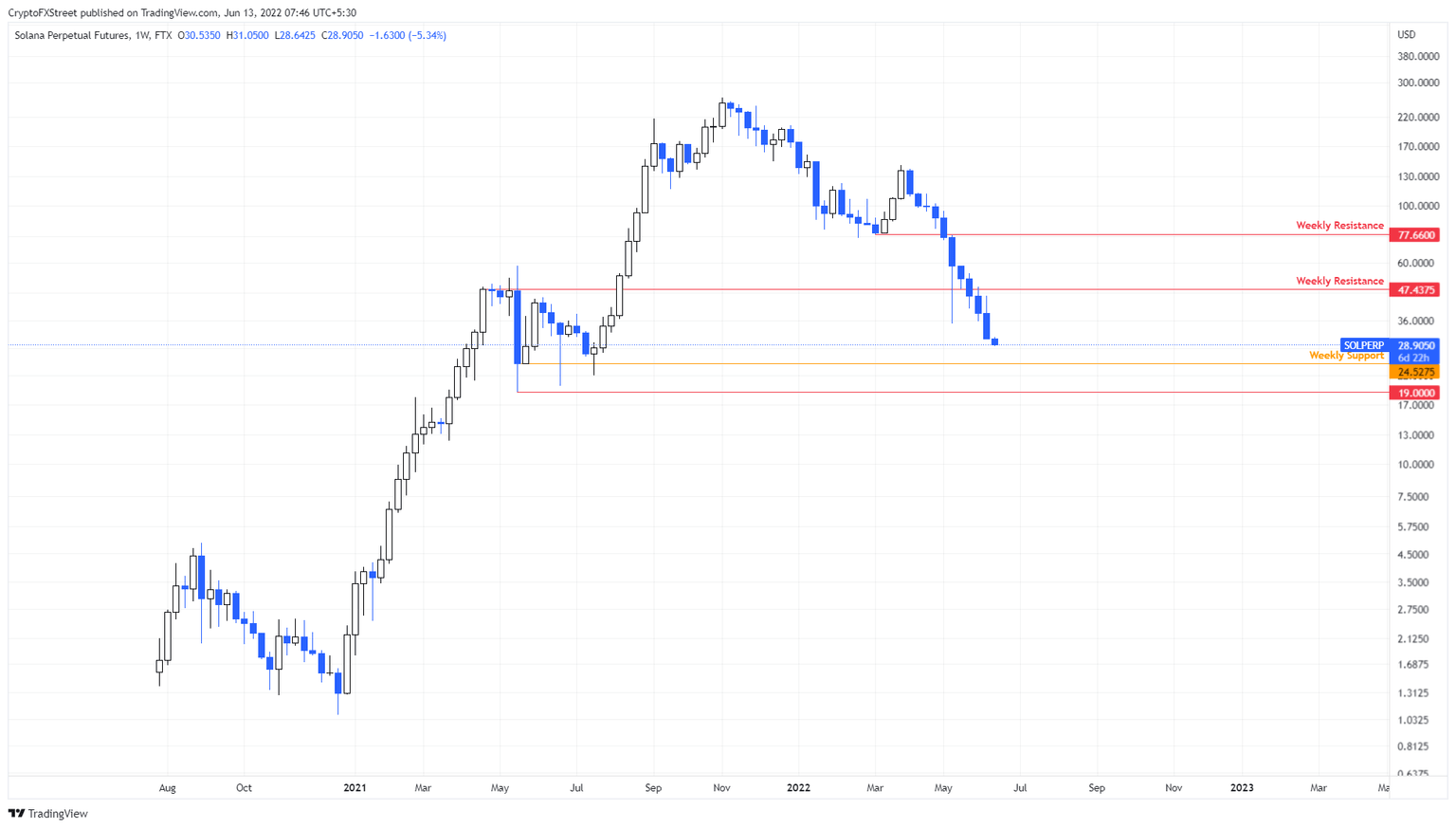

- Solana price is suspended between the weekly support level at $24.52 and the weekly resistance level at $47.43.

- A 20% crash seems likely; a breakdown could see SOL revisit the $19 foothold.

- A weekly candlestick close above $47.43 will invalidate the bearish thesis.

Solana price has been on a freefall since April 4 and has produced not one but nine weekly consecutive down candlesticks. With the crypto market looking as bearish as ever, investors can expect more bleeding.

Solana price continues to nosedive

Solana price has dropped roughly 88% from its all-time high at $261.51. This downswing was a result of multiple reasons with the most recent being the LUNA crash. So far, SOL has crashed 20% over the last week and is currently trading between the $47.43 resistance barrier and the $24.52 support level.

Due to the lack of immediate footholds, the likelihood of a further crash in Solana price is high. Investors can expect a 20% drop to $24.52. While this barrier is a significant one, market makers or smart money might push SOL to $19 to collect the sell stops.

In total, Solana price could shed 36% from the weekly open at $30.53 before buyers step in and scoop the altcoin at a discount.

SOL/USDT 1-week chart

While things are looking extremely bearish for the crypto market, including Solana price, a resurgence of buying pressure could alleviate the selling pressure. If SOL produces a weekly candlestick close above $47.43, it will denote a bullish engulfing move and invalidate the bearish thesis.

In such a case, Solana price might attempt a minor rally to retest the $77.66 resistance barrier.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.