Solana network outage provokes upwards of $2 million in long position liquidations

- Solana suffered a five-hour-long network outage, causing the blockchain to halt all block production for the period.

- While normalcy has been restored, the incident marked the eleventh outage within two years.

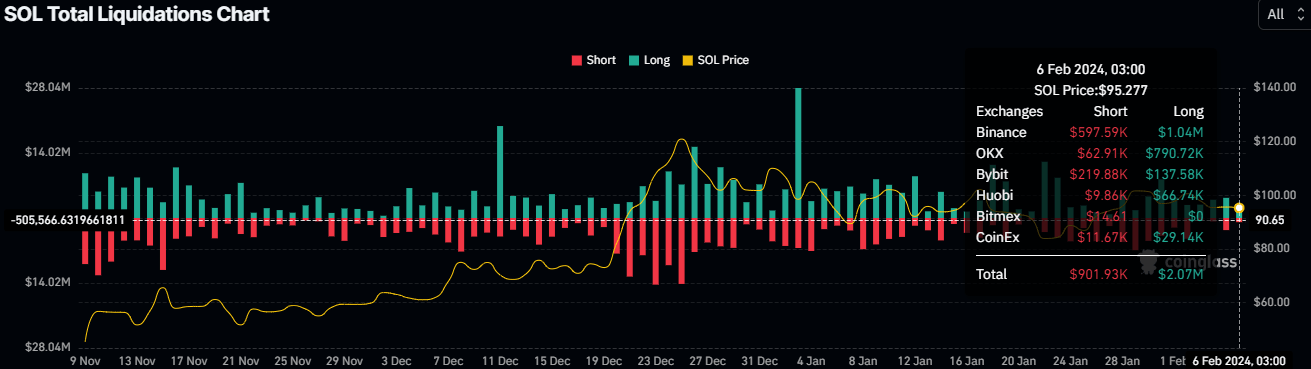

- Over $2 million in long positions for SOL were liquidated, alongside $10 million in open interest wiped out in 24 hours.

Solana made headlines on Tuesday after the blockchain suffered downtime around 10:22 GMT, with the incident lasting five hours before normalcy was restored. Reports indicate that the downtime demanded a network upgrade and a reboot of the cluster by validator operators.

Also Read: Solana-related meme coins face massive price correction as initial euphoria wanes

Solana blockchain outage, summary of incident report

Solana blockchain was compelled to pause all block productions on February 6 after a network outage. The incident contributed to the $2.07 million long positions that were liquidated in the last 24 hours. About $10 million in open interest also went down the drain, dropping from $1.36 billion to $1.35 billion between February 5 and 6.

SOL Liquidations

An incident report from the Solana blockchain highlighted, “Block production on Solana mainnet beta resumed at 14:57 UTC (9:47 a.m. ET), following a successful upgrade to v1.17.20 and a restart of the cluster by validator operators. Engineers will continue to monitor performance as network operations are restored.”

Engineers from across the ecosystem are investigating an outage on mainnet-beta. This thread will be updated as more information becomes available https://t.co/rfeioQ6BG9

— Solana Status (@SolanaStatus) February 6, 2024

VanEck’s Head of Research, Mathew Sigel, attributed the outage to a failure in the “Berkeley Packet Filter” mechanism to deploy upgrades and execute programs on Solana.

Solana outage, what happened?

— matthew sigel, recovering CFA (@matthew_sigel) February 6, 2024

BPF loader, the “Berkley Packet Filter,” which is the mechanism to deploy upgrade and execute programs on Solana, failed. This seems to relate to a previous SMID (Solana Improvement Proposal) that altered some of the features including the adding a…

Notably, the incident marked the eleventh outage since 2022, with a chronicle of downtimes, forks and challenges on the Solana blockchain showing that the extreme downtime collectively lasted multiple days.

A chronicle of downtimes, forks and challenges on the Solana blockchain

- September 14, 2021: a DDoS attack caused the network 17 hours and 12 minutes of downtime.

- January 6 - 8, 2022: What was presumed to be a DDoS attack lasted multiple days.

- January 10, 2022: What was assumed to be the same DDoS attack.

- January 22, 2022: The network suffered 29 hours of downtime with lots of duplicate transactions causing congestion and outages.

- March 28, 2022: RPC nodes forked off during the upgrade to v1.9.

- April 30, 2022: Network suffered a 7-hour outage due to millions of NFTs being minted.

- May 27, 2022: Block times delayed up to 30 minutes.

- June 1, 2022: A 5-hour outage due to a runtime bug triggered by the durable nonce transactions feature allowed, under a specific set of circumstances, for a failed durable nonce transaction to be processed twice.

- October 1, 2022: A misconfigured node resulted in lost data, requiring a restart from a previous point, which apparently crashed the entire chain.

- February 28, 2023: About 20 hours of downtime as Solana Mainnet experienced a large forking event.

- February 6, 2024: A 5-hour downtime due to failure in the Berkley Packet Filter mechanism used to deploy an upgrade and execute programs on Solana.

It remains anybody’s guess on how this could weigh in on the Solana versus Ethereum rivalry, with the longstanding debate over their individual efficiency, development and scalability. While Solana's energy consumption has long been an advantage over Ethereum's higher energy usage, Ethereum’s edge comes on the back of its robust developer community.

The two blockchains are often pitted against each other, owing to the fact that they both rely on proof-of-stake (PoS) methods, which are considered more environmentally efficient.

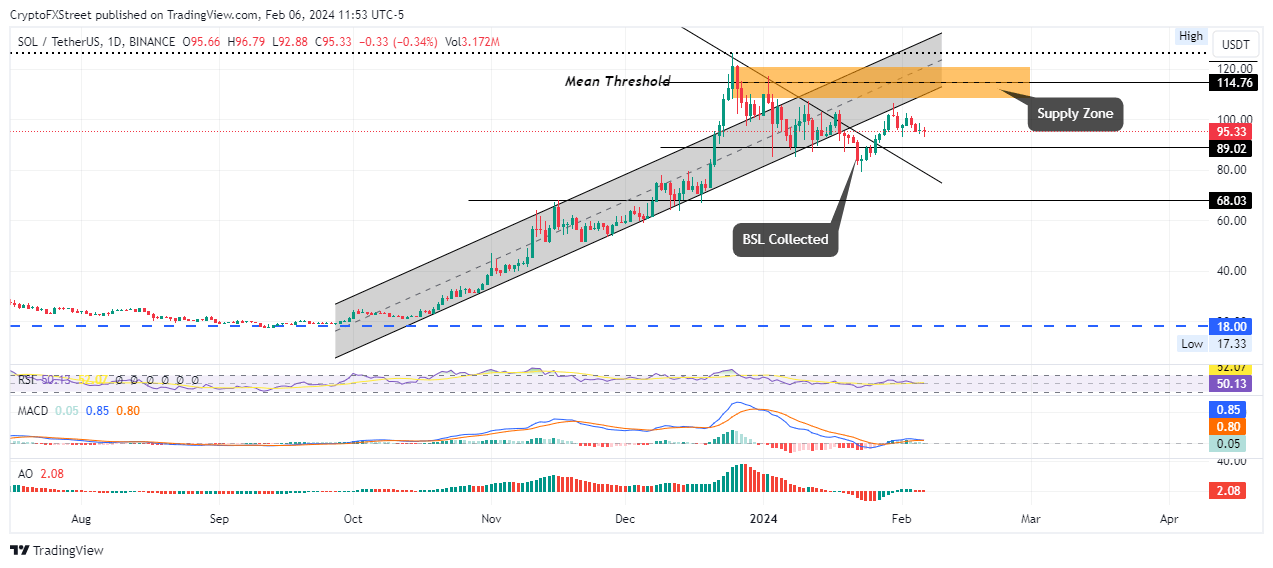

At the time of writing, Solana price is trading for $95.33, registering a 0.16% drop in 24 hours. Trading volume is down 5%, pointing to shifting interest away from SOL.

SOL/USDT 1-day chart

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.