Solana based tokens make comeback riding on potential airdrops and meme coin frenzy

- Solana based assets like MYRO, POPCAT, SOLAMA, LOAF made a comeback amidst demand for SOL ecosystem tokens.

- Potential airdrops, large netflows and rise in total volume of assets locked are likely catalyzing gains in SOL ecosystem tokens.

- Backpack Exchange, Kamino Finance see rise in TVL and meme coins have noted price rallies in the past week.

Solana ecosystem assets and protocols have observed an increase in activity and relevance among market participants as traders respond to potential airdrop announcements and meme coin frenzy.

Bitcoin price rally past $70,000, to a new all-time high, likely catalyzed gains in altcoins. Solana-based assets are likely to benefit from capital rotation.

Also read: Solana-based MYRO is an outlier, soars almost 70% despite meme coins crashing

Solana based protocols see rise in TVL and activity

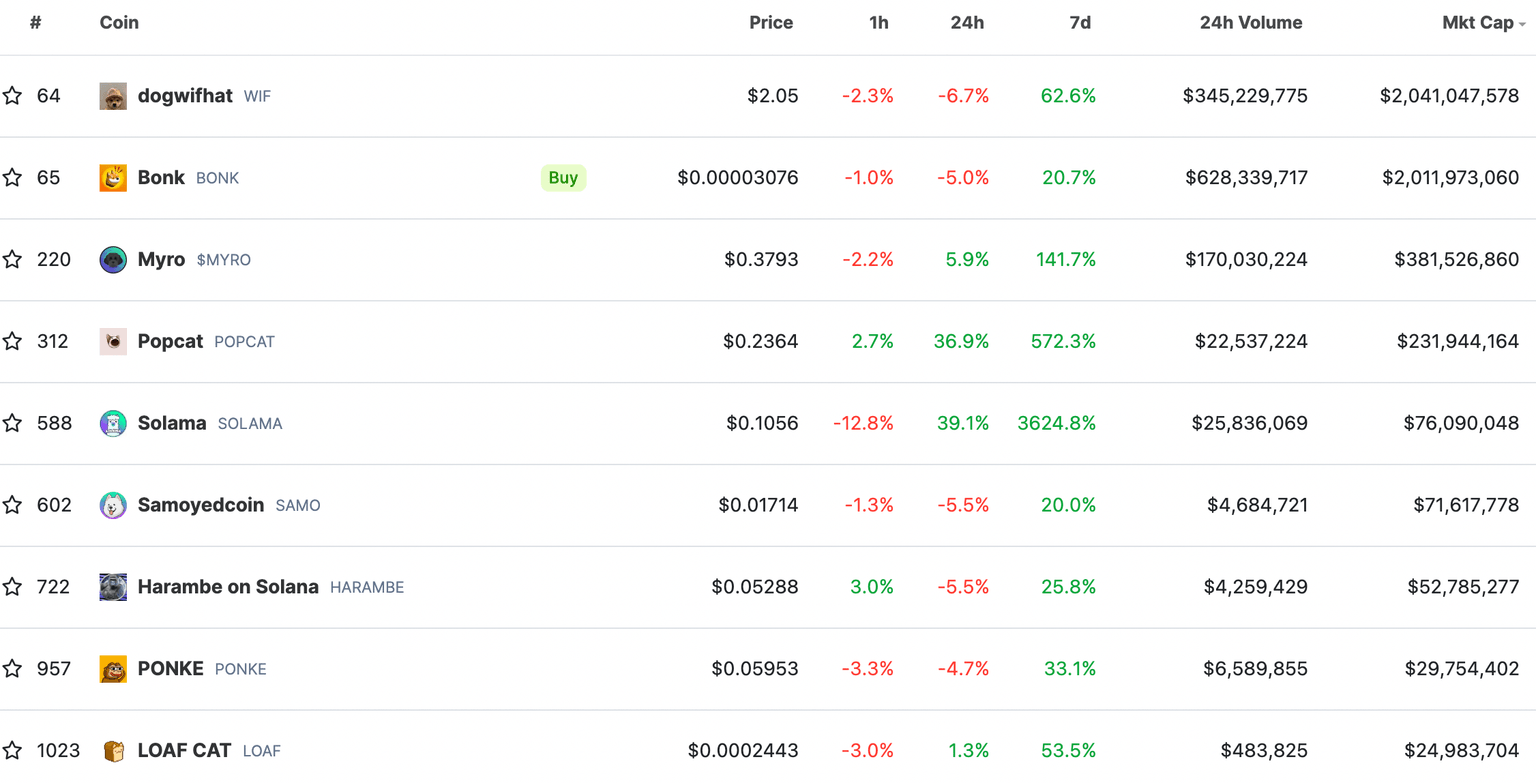

Solana’s trading volume hit a new all-time high with $3.4 billion in volume, of which 15% or nearly $530 million was attributed to meme coins, as seen on Dune Analytics. Solana-based meme coins Dogwifhat (WIF), Bonk (BONK), Myro (MYRO), Popcat (POPCAT) and Solama (SOLAMA), among others have noted a massive increase in their prices on the weekly timeframe.

Solana-based meme coins. Source: CoinGecko

Solana-based MEV Infrastructure company Jito Labs recorded a peak in revenue, $1.2 million in validator tips on Friday. The project has noted an increase in user activity. Similarly, Backpack Exchange recorded its largest daily netflow after announcing its first snapshot on March 18. The exchange has $73 million in assets and obtained $9 million in user deposits overnight.

The TVL of Solana-based protocol Kamino Finance increased by 34% after the project announced its airdrop. This increase likely comes from its Lend product.

The possibility of a potential airdrop has sparked interest among market participants and is likely catalyzing higher volume and activity among users.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.