Solana hovers around $160 as SOL-based stablecoin hits $1 billion market cap

- PayPal stablecoin PYUSD reaches a $1 billion market capitalization after expanding to Solana from Ethereum in May .

- Solana-based PYUSD has a market share of 64% against Ethereum’s 36%.

- Solana hovers around $160 on Tuesday, nearly unchanged on the day.

Solana-based PayPal stablecoin (PYUSD) has exceeded the $1 billion threshold in market capitalization, supporting the Solana network’s on-chain activity and demand. Solana’s native token SOL price hasn’t moved following the news and it is trading broadly unchanged on Tuesday at around $160.

Demand for Solana-based PYUSD drives stablecoin to $1 billion

PayPal launched its stablecoin on Ethereum in August 2023 and expanded PYUSD to the Solana chain in May 2024. PYUSD is backed by liquid assets and redeemable 1:1 with US Dollars. Solana announced in an official tweet on Monday that PYUSD market capitalization surged to $1 billion. The SOL network accounts for 64% of the stablecoin’s market share.

PYUSD Market Cap

PYUSD crossing the $1 billion market cap is a key milestone for traders since stablecoin represents fiat on/off-ramp for traders. Retail demand is represented by stablecoin market share on the Solana chain.

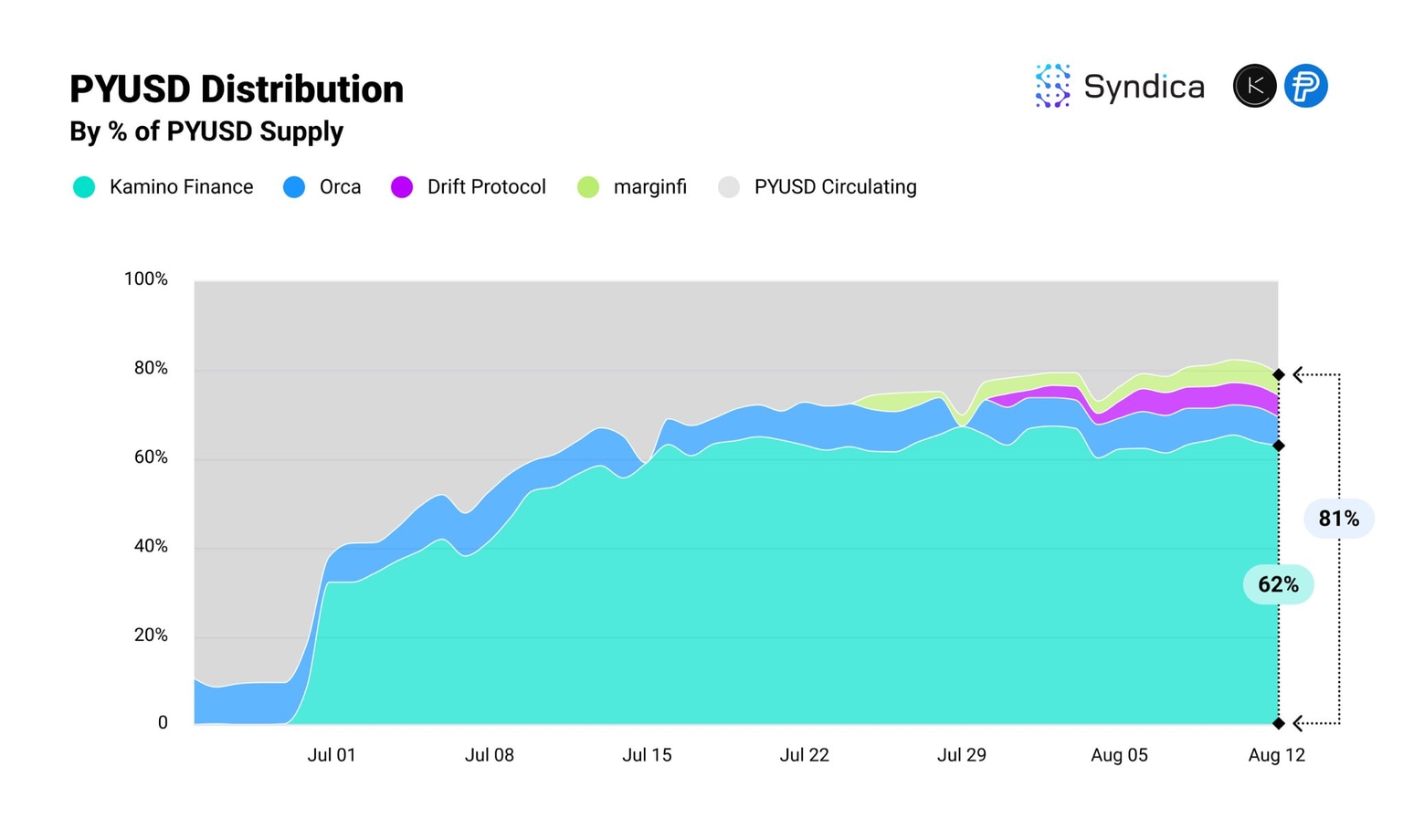

Solana network is the primary chain for PYUSD with token incentives that boost the asset’s adoption in DeFi protocols like Kamino Finance and Syndica.io.

PYUSD distribution per Artemis data

Data from crypto intelligence tracker Artemis shows that PYUSD supply moves within the Solana network at a fraction of Ether’s cost. The median transaction fee for peer-to-peer PYUSD transfers is a tenth of a cent on Solana.

Solana could be poised for double-digit gains

Solana is in a long-term upward trend, hovering close to $160. SOL trades at $156.92 at the time of writing, and the altcoin could extend its gains by 11.75% to $175.39, a key resistance level for Solana as it aligns with the upper boundary of the Fair Value Gap (FVG) between $172.91 and $175.39.

Before reaching the FVG, SOL faces resistance at $160.09, the 50% Fibonacci retracement of the decline from its March 18 top of $210.18 to the August 5 low of $110.

The momentum indicators Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) support the bullish thesis for SOL. RSI reads 55.48, signaling strength in SOL’s price trend. MACD shows green histogram bars above the neutral line, this implies the underlying positive momentum in Solana’s price trend, on the daily timeframe.

SOL/USDT daily chart

In the event of a correction in the altcoin’s price, Solana could find support in the Fair Value Gap (FVG) extending between $154.08 and $155.25.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.