Shibarium daily transactions nearly double overnight, might support SHIB price recovery

- Shiba Inu scaling solution Shibarium noted a spike in daily transactions, total transaction count exceeding 4 million.

- Daily transaction count on Shibarium hit 43,690 early on November 23.

- SHIB price declined nearly 4% in the past week, rising activity could fuel Shiba Inu recovery.

Shibarium, the scaling solution for Shiba Inu, observed an increase in transaction activity. The rise in transaction count is indicative of higher activity on Shibarium, fueling a bullish outlook among traders for SHIB price.

Also read: FTT rallies 25% as it benefits from FTX revival hopes, Binance saga

Shibarium transactions double overnight

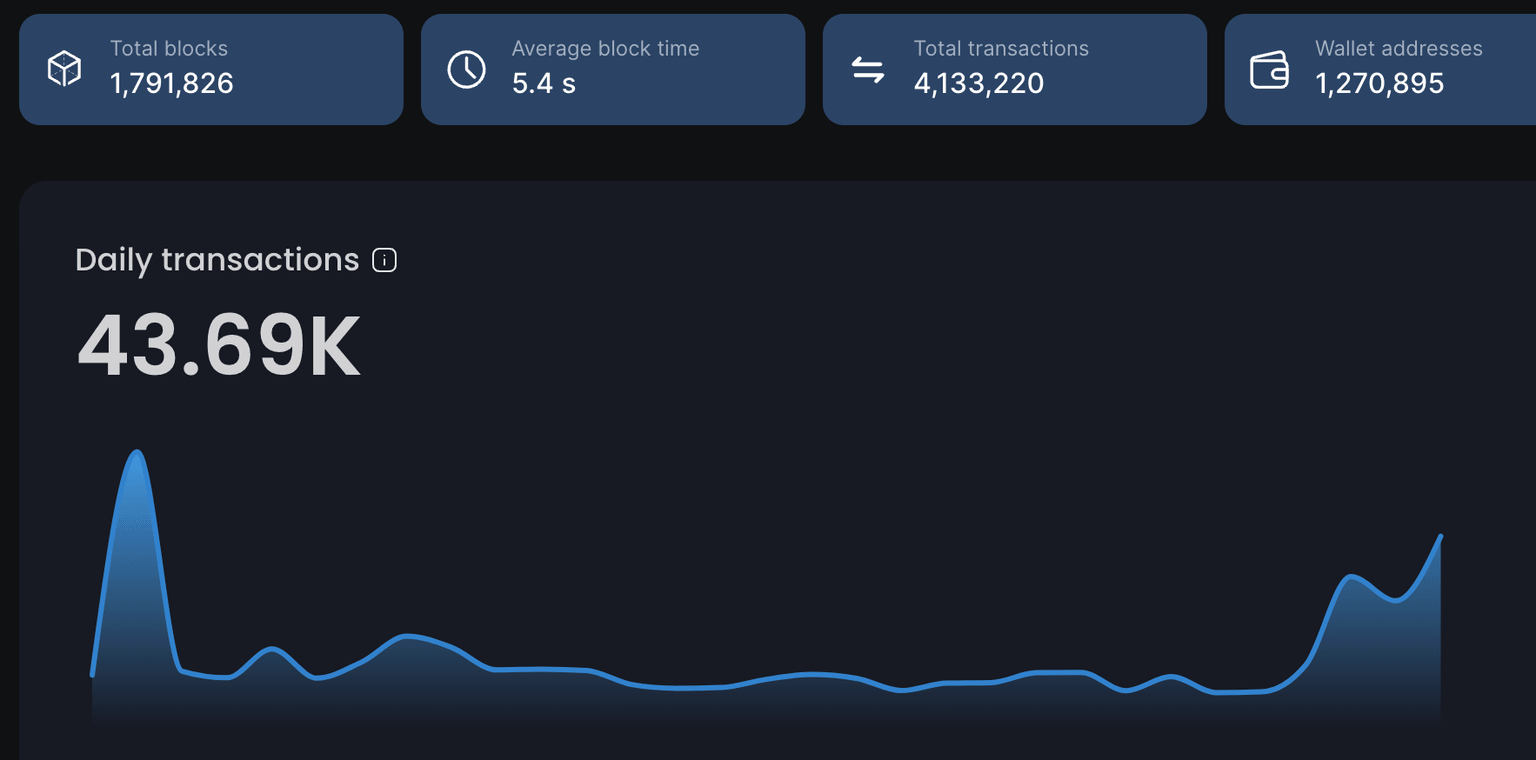

Shibarium’s total transaction count crossed the 4 million mark. The protocol has accumulated a total of 4,133,220 transactions since its launch. Between November 22 and 23, daily transactions on Shibarium nearly doubled, from 29,280 to 43,690, overnight.

Shibarium transaction count

The increase in transactions is indicative of rising activity, a bullish sign for the Shiba Inu ecosystem. SHIB price declined nearly 4% in the past week. The meme coin wiped out its gains in the recent correction. The increase in utility and the rapid adoption of Shiba Inu’s scaling solution could fuel a bullish thesis for SHIB price.

SHIB holders gained 11.23% in the past month when the meme coin rallied alongside Bitcoin. SHIB price is up nearly 2% in the last 24 hours and the cryptocurrency could begin its recovery.

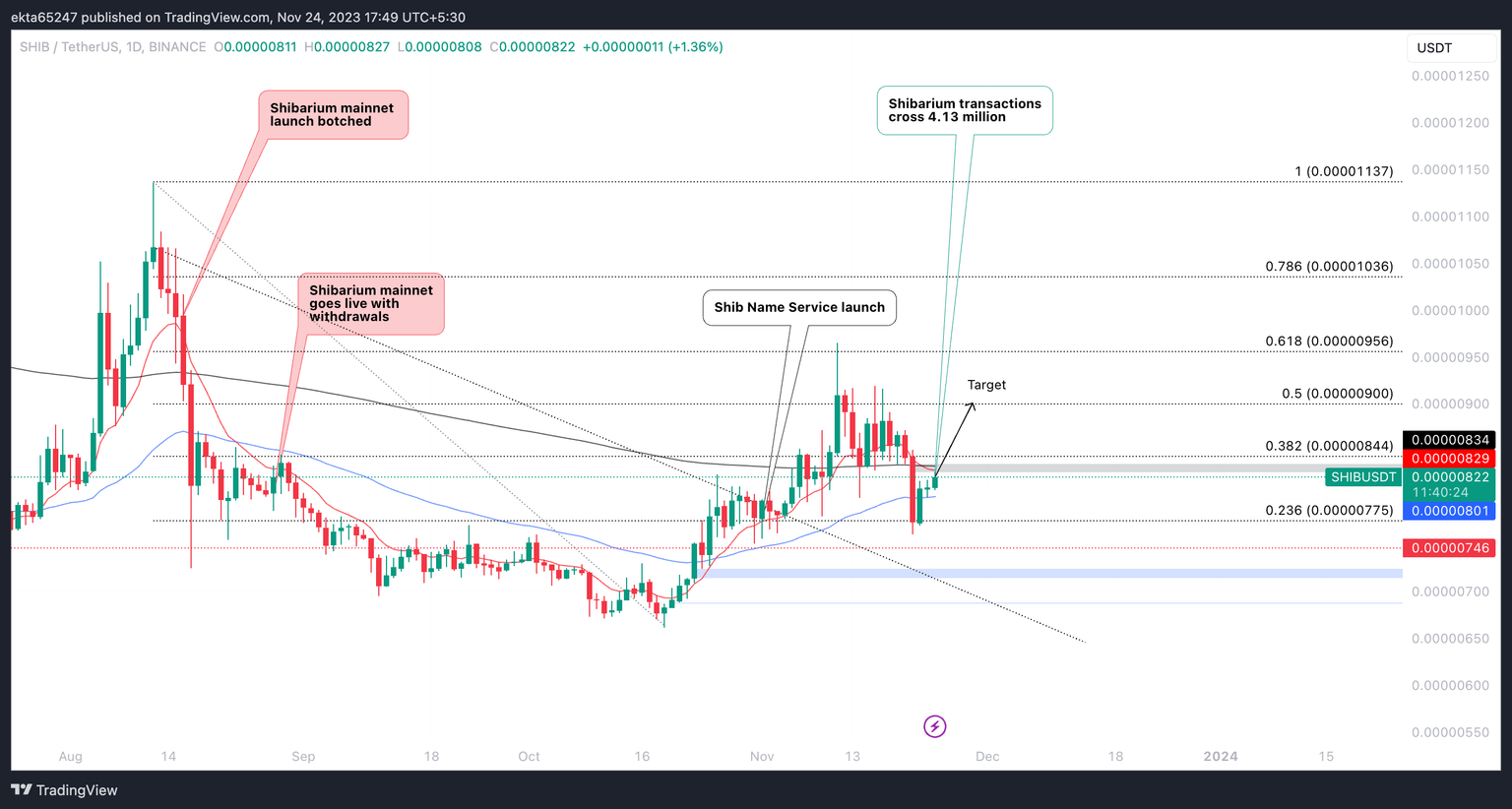

As seen in the SHIB/USDT 1-day price chart, Shiba Inu eyes the $0.00000900 target, the 50% retracement of SHIB’s decline from its August 12 local top of $0.0000113 to October 19 bottom of $0.00000664. SHIB price could rally nearly 10% in its run-up to the $0.00000900 target.

SHIB/USDT 1-day chart

If SHIB price sees a daily candlestick close below the 50-day Exponential Moving Average at $0.00000801, it could invalidate the bullish thesis. SHIB price is likely to find support at the 23.6% retracement at $0.00000775.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.