Shiba Inu Price Prediction: This Po3 setup could propel SHIB by 20%

- Shiba Inu price edges close to triggering a rally after elaborate consolidation inside a Po3 setup.

- A successful breakout could send SHIB up from 20% to 27% to tag the $0.00000964 and $0.0000101 levels, respectively.

- A daily candlestick close below the $0.00000684 support level will invalidate the bullish thesis for the dog-themed cryptocurrency.

Shiba Inu price has set up a Power of 3 setup, which forecasts massive gains for the altcoin. The predicted rally, however, is contingent that SHIB can flip a critical resistance level into a support floor.

Also read: Shiba Inu introduces ‘Shibacals’ to link nfts to real-world items – SHIB jumps

Shiba Inu price edges closer to catalyzing a swift rally

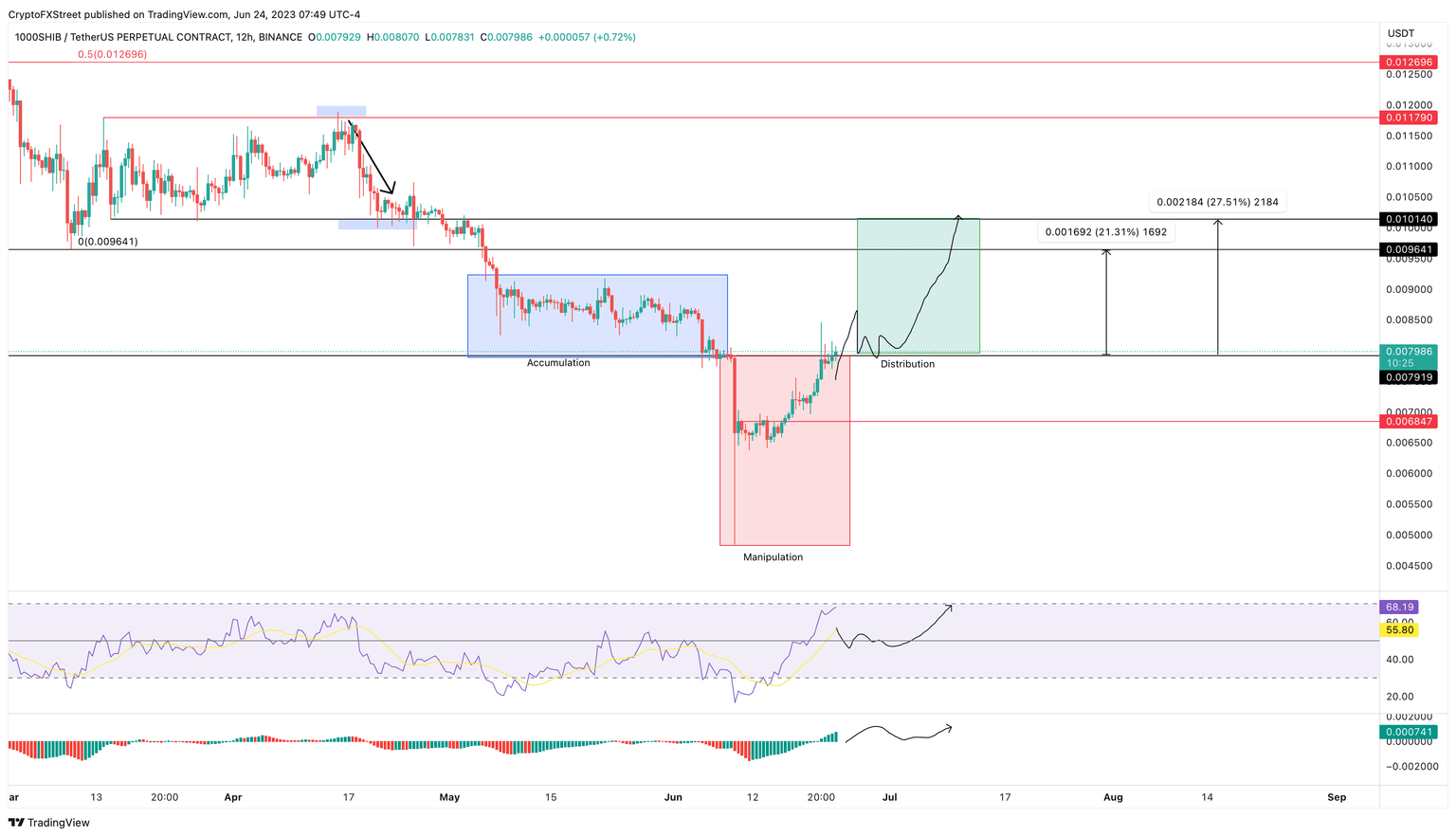

Shiba Inu price has shown incredible resilience to bears over the past few days. The result of which is a 25% ascent in the last nine days. Considering the price action of SHIB between May 8 and June 24 reveals the foundation of a Power of Three (Po3) setup.

This technical formation contains three distinctive phases:

- The asset needs to consolidate above a significant support level, which in SHIB’s case is the $0.00000791, This is the accumulation phase.

- Following this stage, the asset drops lower to collect liquidity below a key swing low and take out early bulls, which is a clear sign of manipulation. Hence, this is the manipulation phase.

- The last stage involves a recovery above the recently broken critical support level, which will confirm the start of the next phase - Distribution.

The last phase is the most volatile one and often results in massive moves.

Currently, Shiba Inu price is edging closer to recovering above the $0.00000791 hurdle and flipping it into a stable support level. Doing so will confirm the breakout from the Po3 setup and kick-start a distribution phase for SHIB.

The ideal take-profit levels for Shiba Inu price include $0.00000964 and $0.0000101, which are roughly 20% and 27% away from the current position at $0.00000797.

SHIB/USDT 12-hour chart

While the Po3 setup for Shiba Inu price hints at a minimum of 20% gain for SHIB holders, a failure to break above the $0.00000791 will signal a weak buyers’ camp. Furthermore, a breakdown of the $0.00000684 support level will invalidate the bullish thesis for the dog-themed cryptocurrency.

In such a case, Shiba Inu price could slide 6.30% and retest the June 14 swing low at $0.00000641.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.