Shiba Inu Price Prediction: SHIB whale demand plunges as Solana memes dominate

- Shiba Inu price plunges towards $0.000025 on Wednesday, losing 20% since December 9.

- Solana meme coins like Fartcoin (FART) and Goatseus Maximus (GOAT) have dominated the meme coin sector since the market rebound began.

- On-chain data shows an 83% decline in SHIB whale transactions exceeding $100,000 between December 9 and December 18.

Shiba Inu price opened trading at $0.000026 on Wednesday, its lowest opening price in 20 days dating back to November 29. On-chain data shows SHIB token struggling to attract whale demand as Solana memes dominate social channels.

Shiba Inu price plunges 20% despite crypto market recovery

Following the flash crash triggered by rising geopolitical risks on December 9, positive macroeconomic indicators in the US have lifted demand for crypto assets.

However, while top assets such as Bitcoin, Ripple (XRP) and Cardano (ADA) have recorded double-digit gains since December 10, Shiba Inu price has headed in the opposite direction.

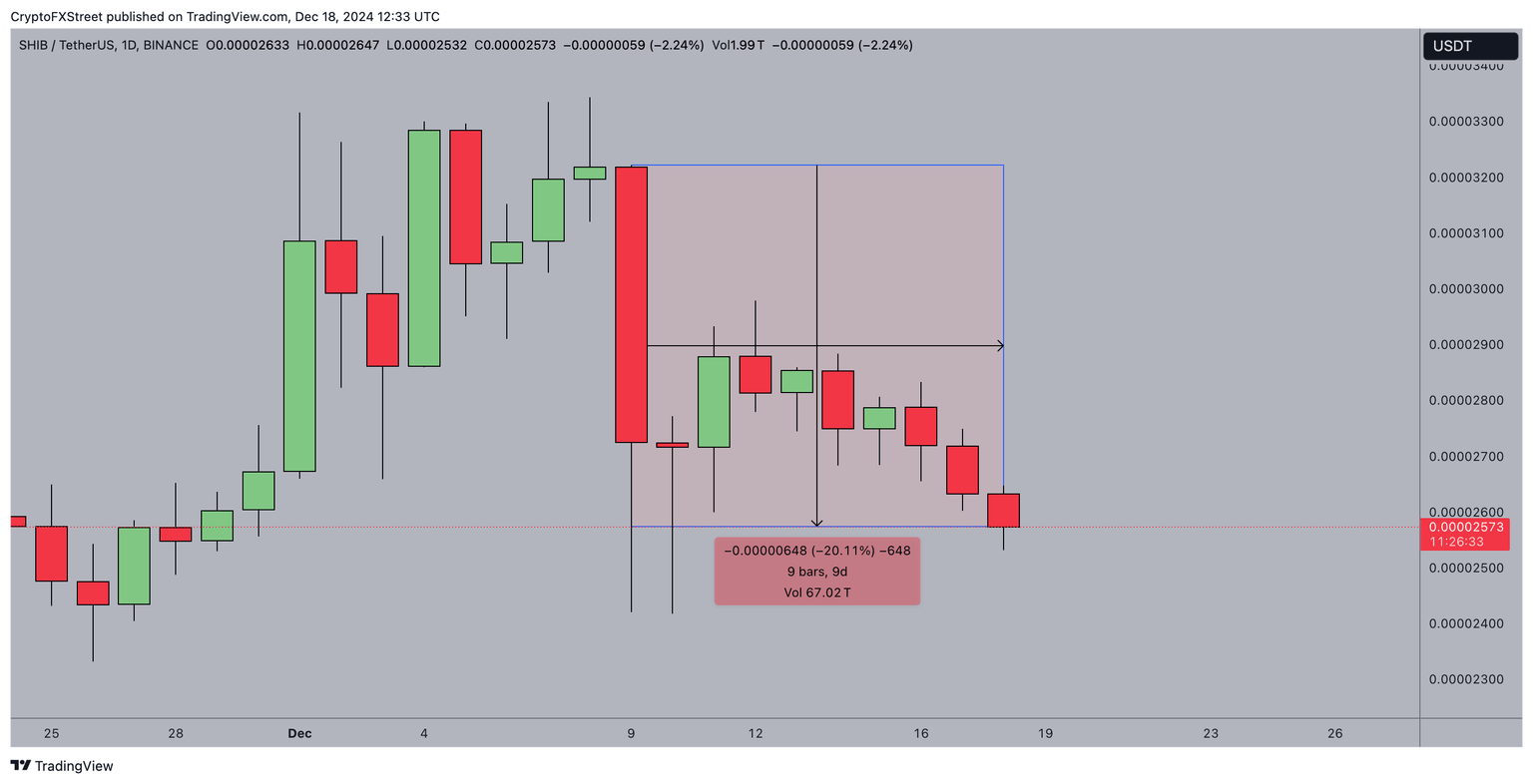

The SHIB/USDT daily price chart shows how SHIB price has failed to join the crypto market recovery phase over the past week.

As depicted above, SHIB price has tumbled 20% from $0.0000032 in December to hit the $0.000025 level at press time on Wednesday.

Shiba Inu whale demand declines 82% amid Solana meme dominance

Since December 10, Solana memecoins have attracted substantial capital inflows, overshadowing legacy memecoins like Shiba Inu (SHIB) and Dogecoin (DOGE).

Notably, Fartcoin (FART) surged in prominence, adding over $600 million to its market cap, while Goatseus Maximus also posted significant gains.

This appears to have negatively impacted whale demand for legacy memecoins like Shiba Inu and Dogecoin.

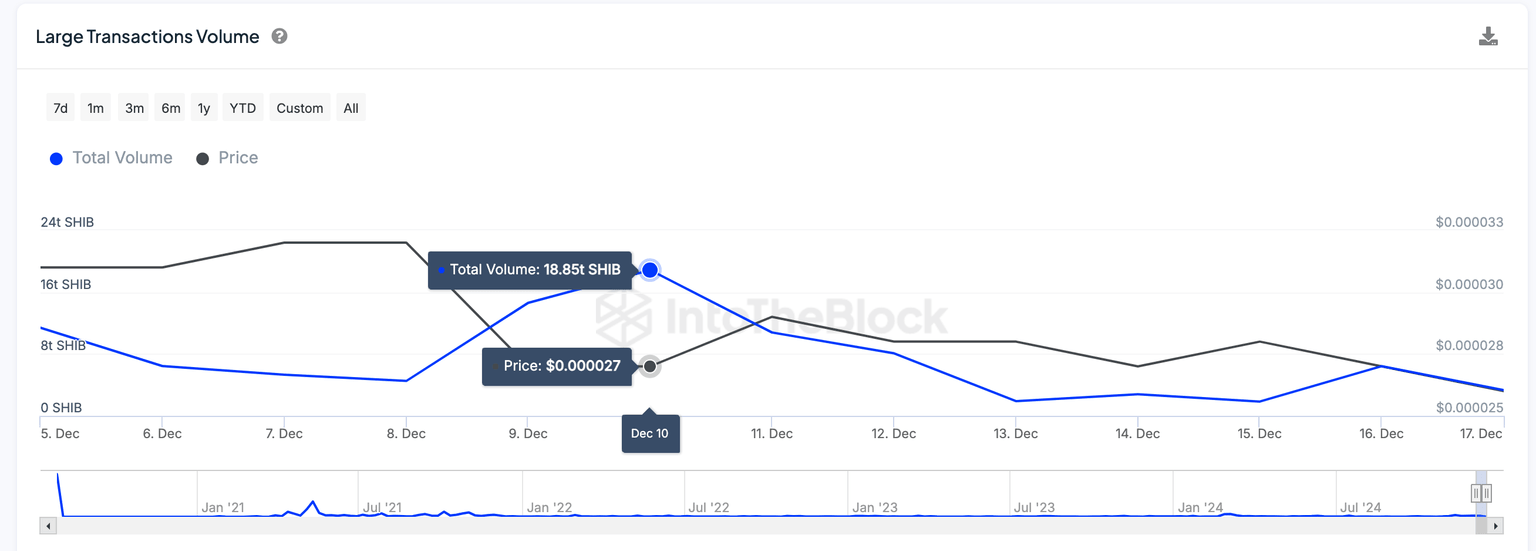

IntoTheBlock's data underscores this shift, revealing a sharp decline in SHIB’s large transactions.

The large transactions chart below shows the daily number of single trades that exceed $100,000. This provides insight into the large investors trading activity around certain market events.

As seen above, Shiba Inu whales traded 18.85 trillion SHIB on December 9.

But since then, they have persistently dialled down their trades with only 3.3 trillion SHIB traded in large transactions on December 17.

This shows that there has been an 82% decline in demand for SHIB among whale investors in the last 9 days, coinciding with the 20% price dip.

A drop in whale activity typically reduces market liquidity and weakens investor confidence, potentially amplifying further sell-offs and price corrections.

If this trend continues, Shiba Inu's ability to recover could be hindered by the growing dominance of Solana’s memecoin ecosystem.

Shiba Inu Price Forecast: $0.000025 support at risk

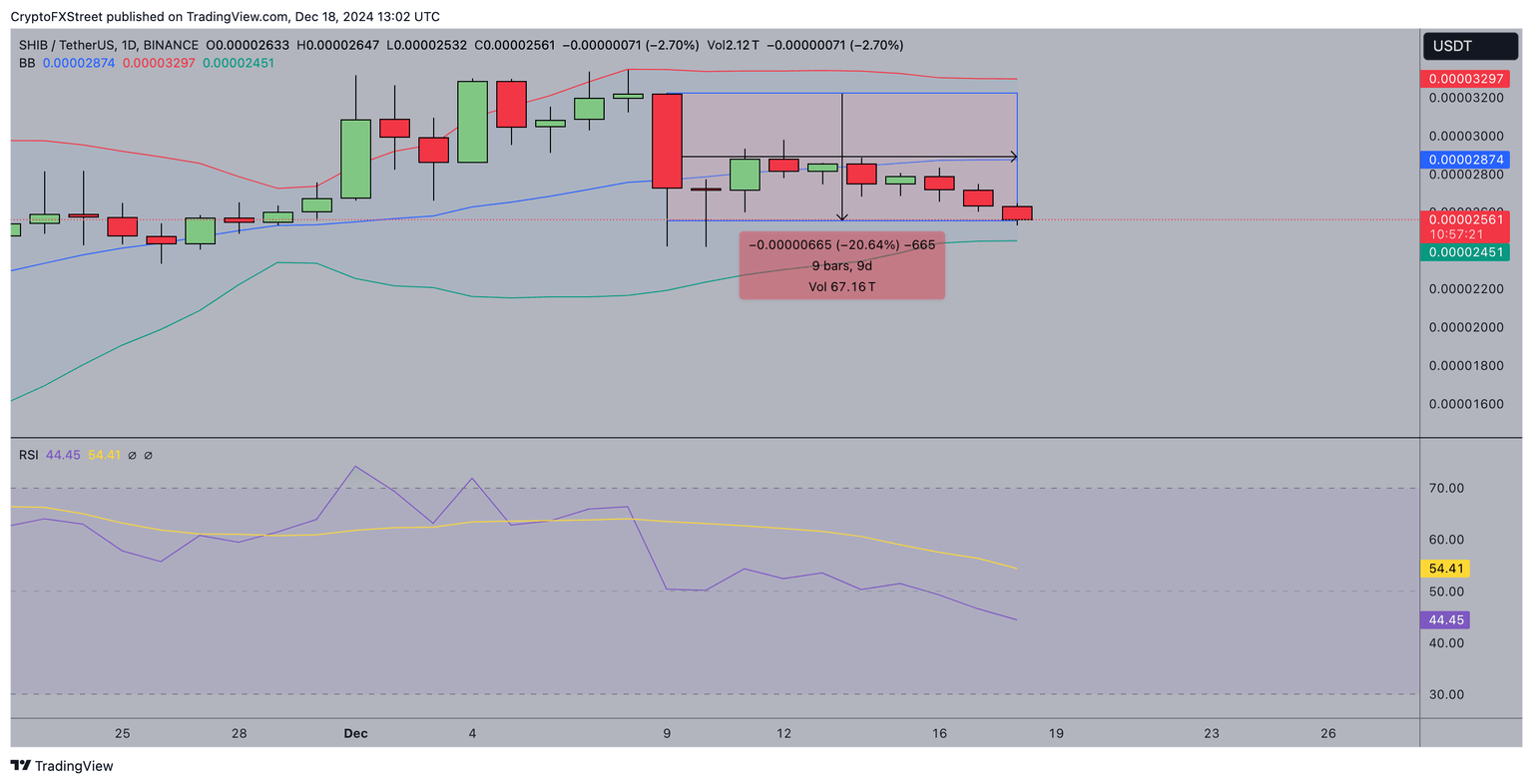

Shiba Inu price appears under mounting bearish pressure, with a key $0.00002561 support zone at risk of breaking down.

The attached SHIB/USDT chart highlights a prolonged nine-day downtrend, culminating in a 20.64% price drop.

Notably, the Relative Strength Index (RSI) has slipped below 50 to 44.45, signaling waning buying momentum and further bearish dominance.

Shiba Inu Price Forecast | SHIBUSDT

Currently, SHIB faces immediate resistance at $0.00002874, aligning with the midline of the Bollinger Bands.

A decisive reclaim above this level could ignite a short-term rally, especially if it coincides with a significant volume spike, as seen in previous breakout attempts.

Sustained demand may propel prices toward the upper Bollinger Band resistance near $0.00003297.

However, failure to hold above the critical $0.00002561 support risks triggering further sell-offs.

The next major support lies at $0.00002451, where bulls must step in to defend the structure.

A breach below this level could invalidate any bullish outlook, potentially driving SHIB toward $0.00002200, exacerbating bearish sentiment.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.