Shiba Inu price gains in jeopardy as it tags crucial support level

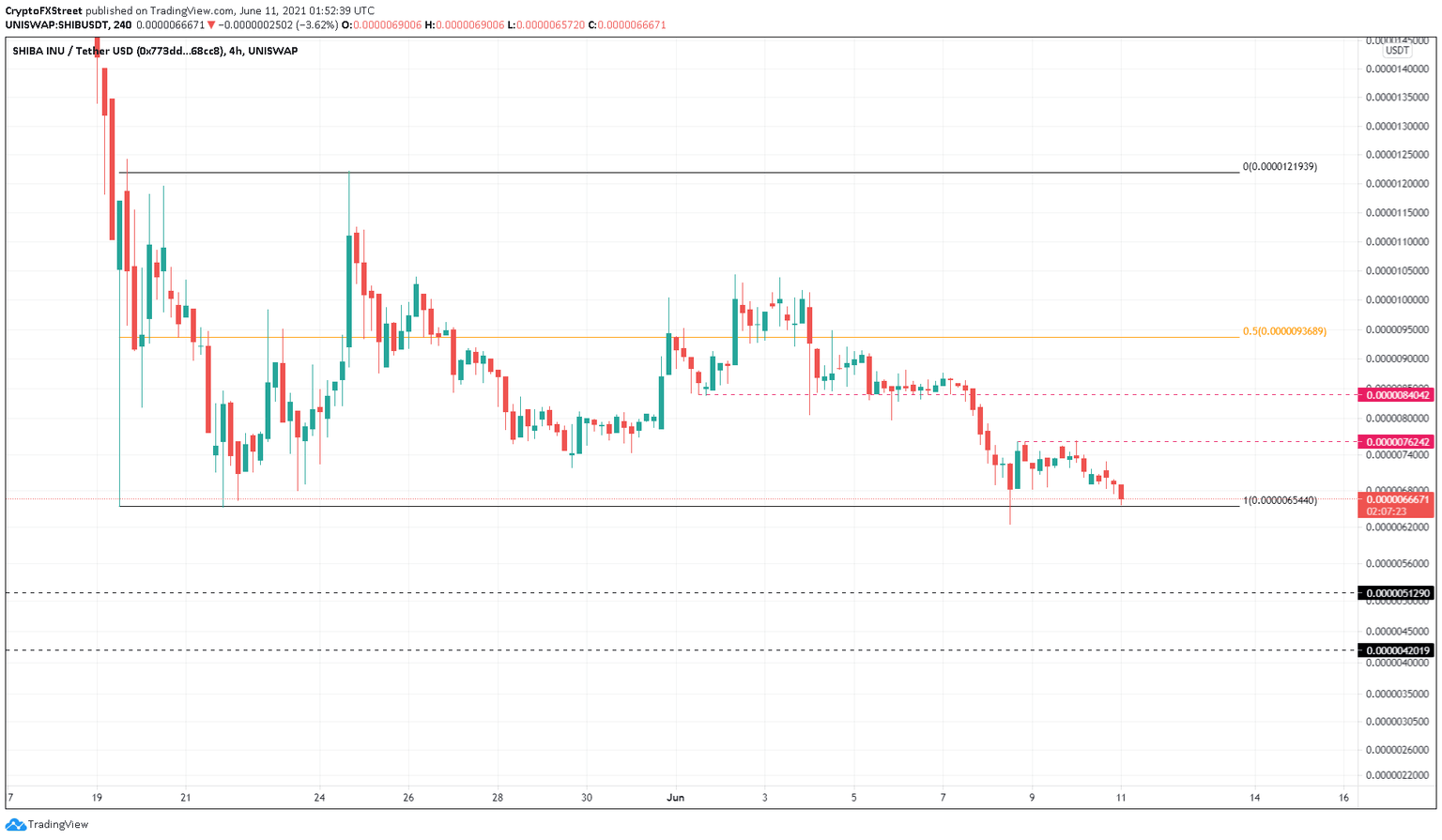

- Shiba Inu price is trading above the range’s lower end at $0.00000654.

- A breakdown of this barrier might result in a 25% drop to $0.00000513.

- If the buyers make a comeback, SHIB could tag resistance levels at $0.00000762 and $0.00000840.

Shiba Inu price shows little to no connection with the crypto markets as it failed to rally on June 8. Additionally, SHIB continued to descend while most altcoins were on a rally, following Bitcoin.

Shiba Inu on dangerous grounds

Shiba Inu price saw a hyperbolic run between May 7 and May 10, during which it rose a gigantic 2,933%. Despite its 83% drawdown, SHIB managed to stay rangebound and above its seemingly significant support level at $0.00000654, coinciding with the range’s swing low.

At the time of writing, Shiba Inu price is testing this barrier for the fourth time in the last 22 days. While the overall directional bias for this dog-themed cryptocurrency has been bearish, SHIB could see a bounce.

The basis for this uncertainty lies in the fact that the meme coins like Shiba Inu are driven by hype cycles and retail frenzy.

Therefore, a potential spike in buying pressure or social volume could effectively launch SHIB price by 16% to tag the immediate resistance level at $0.00000762. Breaching this will allow the buyers to retest $0.00000840 and subsequently the 50% Fibonacci retracement level at $0.00000937.

SHIB/USDT 4-hour chart

If the potential upswing explained above fails to occur and investors continue to book profits, there is a high chance that Shiba Inu price will continue to descend. A breakdown of the range low at $0.00000654 will signal the start of a downswing.

A 25% decline to the immediate support barrier at $0.00000513 seems likely if this were to happen.

Under extremely bearish situations, Shiba Inu price might even tag $0.00000420, which is an 18% drop from the previous support.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.