SHIB Price Prediction: Shiba Inu looks primed for reversal

- SHIB price is recovering after a 40% crash over the past week.

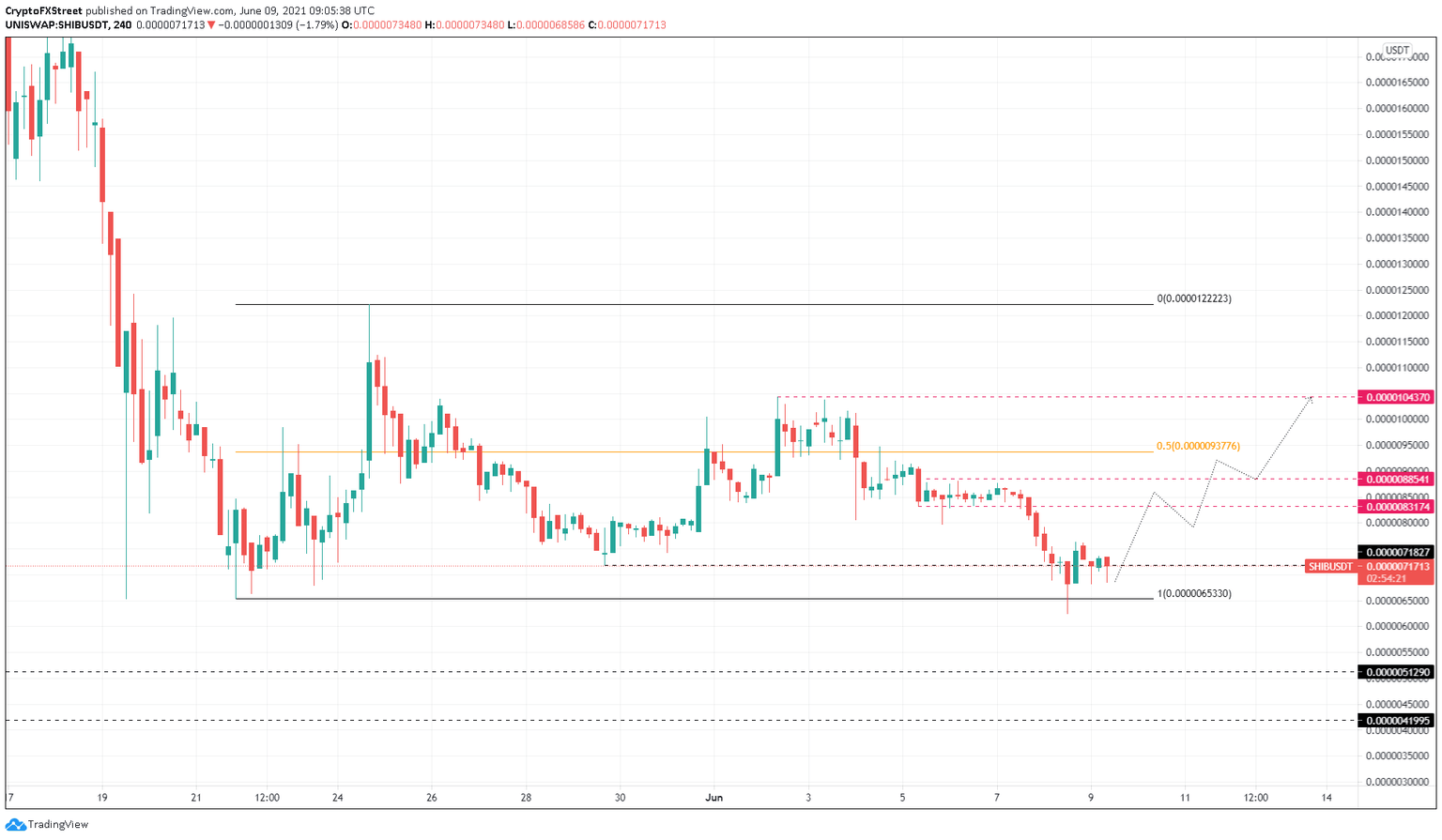

- Shiba Inu might advance toward the 50% Fibonacci retracement level at $0.000000938.

- A breakdown of the swing low at $0.00000624 formed on June 8 will invalidate the bullish thesis.

SHIB price has been on a descending trend for more than a week as it shed almost half of its gains. This downswing saw a reversal as it tagged a range low and is hinting at a move toward equilibrium.

SHIB price looks to head higher

SHIB price is currently trading above a support level at $0.00000718 after the failed recovery attempt to move higher. The buyers are looking to tag the first resistance level at $0.00000832 if the current bullish outlook persists.

Beyond this barrier, Shiba Inu could rise to $0.00000885, the subsequent swing high. If the buyers continue to pile up, the dog-themed cryptocurrency could retest the 50% Fibonacci retracement level at $0.00000937.

In a highly bullish case, SHIB price might sweep the swing high at $0.0000104.

SHIB/USDT 4-hour chart

Unlike other altcoins, Shiba Inu is not showing the willingness to head higher. Therefore, investors need to exercise caution. The supply barriers ranging from $0.00000832 to $0.00000885 are critical in confirming an upswing.

Hence, a short-term bullish momentum that fails to slice through these levels will indicate the possibility of a downswing.

A breakdown of the range low at $0.00000653 will invalidate the bullish thesis and kick-start a 22% downswing to $0.00000513. If the sellers continue to keep piling up the ask orders, SHIB PRICE might slide to $0.0000042.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.