Shiba Inu price could soar 65% if SHIB price estimates are correct

- Shiba Inu price recovers after the successful test of the May 19 low at $0.00000607.

- Descending channel originating on June 3 has been resolved with the developing surge higher.

- According to CoinMarketCap, the total number of SHIB price estimates for June 30 only exceeded by BTC estimates.

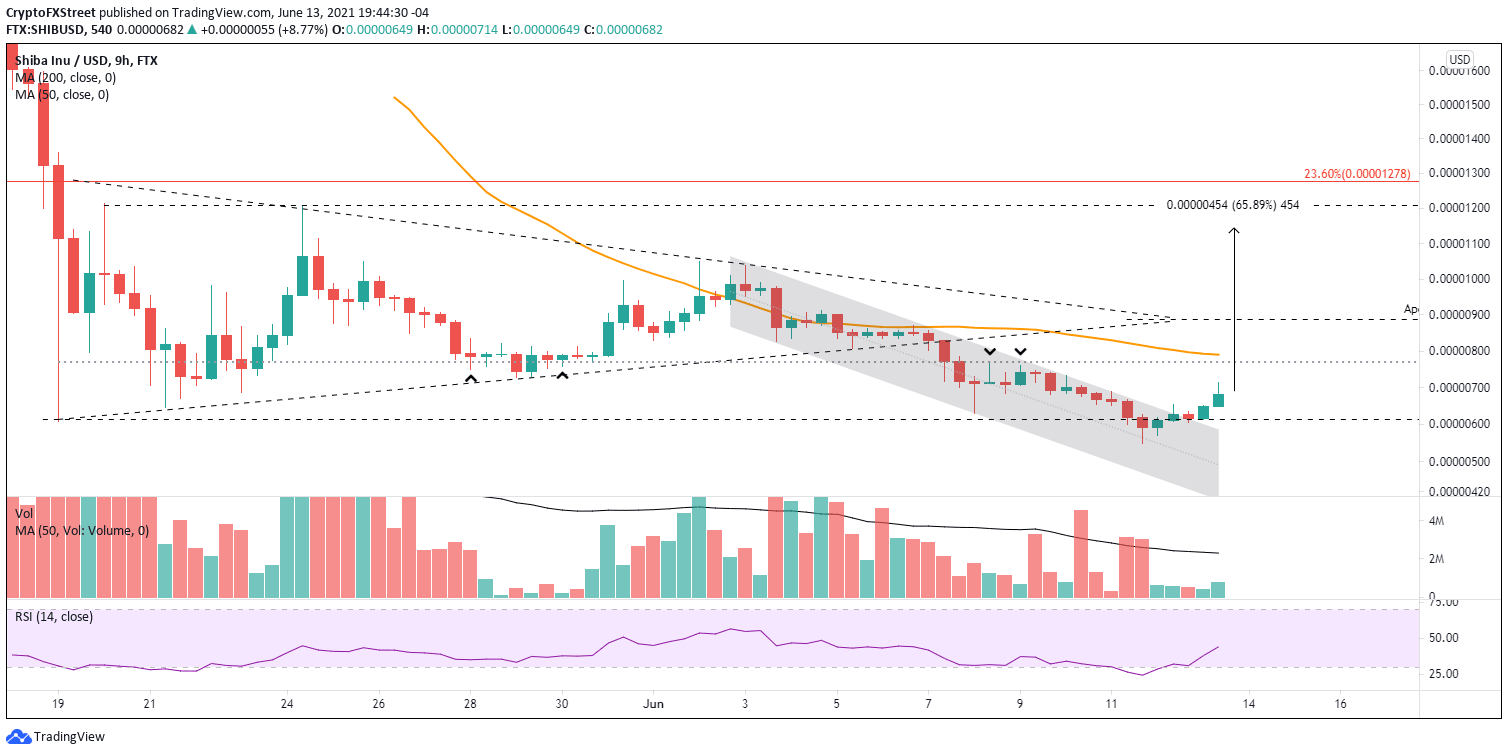

Shiba Inu price had been locked in a descending channel since June 3, before overcoming the channel’s upper boundary on June 12 and followed up by today’s 10% gain. The favorable price action developed after a brief decline below the May 19 low, creating a bear trap for some investors. A continuation of the SHIB rebound will be met with solid resistance at $0.00000770.

Shiba Inu price clarifies structure after a period of indecision

It took a compelling reversal to release Shiba Inu price from the descending channel and drown the skepticism inspired by the bearish price structure. As anticipated in a June 11 FXStreet article, there is no immediate resistance for SHIB until the interesting range that hovers around the $0.00000770 level. It was resistance June 7-9 and support June 27-30, and an area of price congestion May 21-23.

The $0.00000770 level is reinforced by the 50 nine-hour simple moving average (SMA) at $0.00000791. A close above those two levels should propel Shiba Inu price to the apex line of the multi-week symmetrical triangle at $0.00000888, offering SHIB traders and investors a 29% gain from the current price.

More aggressive levels include the June 2 high of $0.00001048 and the rough confluence of the May 24 high of $0.00001204 with the May 20 high of $0.00001214. Fibonacci levels do not come into play until $0.00001278, the 23.6% retracement of the May plunge.

A detraction of this new, emerging SHIB rally is the absolutely low commitment shown in the total volume. On the intra-day charts ranging from four hours to twelve hours, none of the positive candlesticks since yesterday’s low have been supported with above-average volume. A point to consider if the rally continues to develop.

SHIB/USD 9-hour chart

As long Shiba Inu price remains above the May 19 low, SHIB investors should be focused on the upside potential for the rookie cryptocurrency. However, if Shiba Inu price does register a daily close below the May 19 low, this rebound will have been just a dead-cat bounce.

It is easy to dismiss the relevance of SHIB in the more extensive cryptocurrency complex. Still, it is interesting to note that as of June 10, the meme token ranks second, behind only Bitcoin in the CoinMarketCap Top 10 Cryptoassets with Most Price Estimates. The report shows SHIB with 9,864 price estimates for June 30 with an average price of $0.00001143.

Here's the latest Top 10 Price Estimates for Jun $BTC $SHIB $ADA $ETH $DOGE $MATIC #SAFEMOON $XRP $RIPPLE $VET $VTHO $ICP pic.twitter.com/lsfSb5HRqK

— RESEARCH 24/7 (@smallcappick) June 10, 2021

Assuming that the estimate average is correct, it would equal a 66% gain for Shiba Inu price from the current price and elevate SHIB near the May 24 high at $0.00001204. Something to analyze with the digital asset up 10% today.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.