Shiba Inu must watch out for the bull trap as SHIB bears remain in control

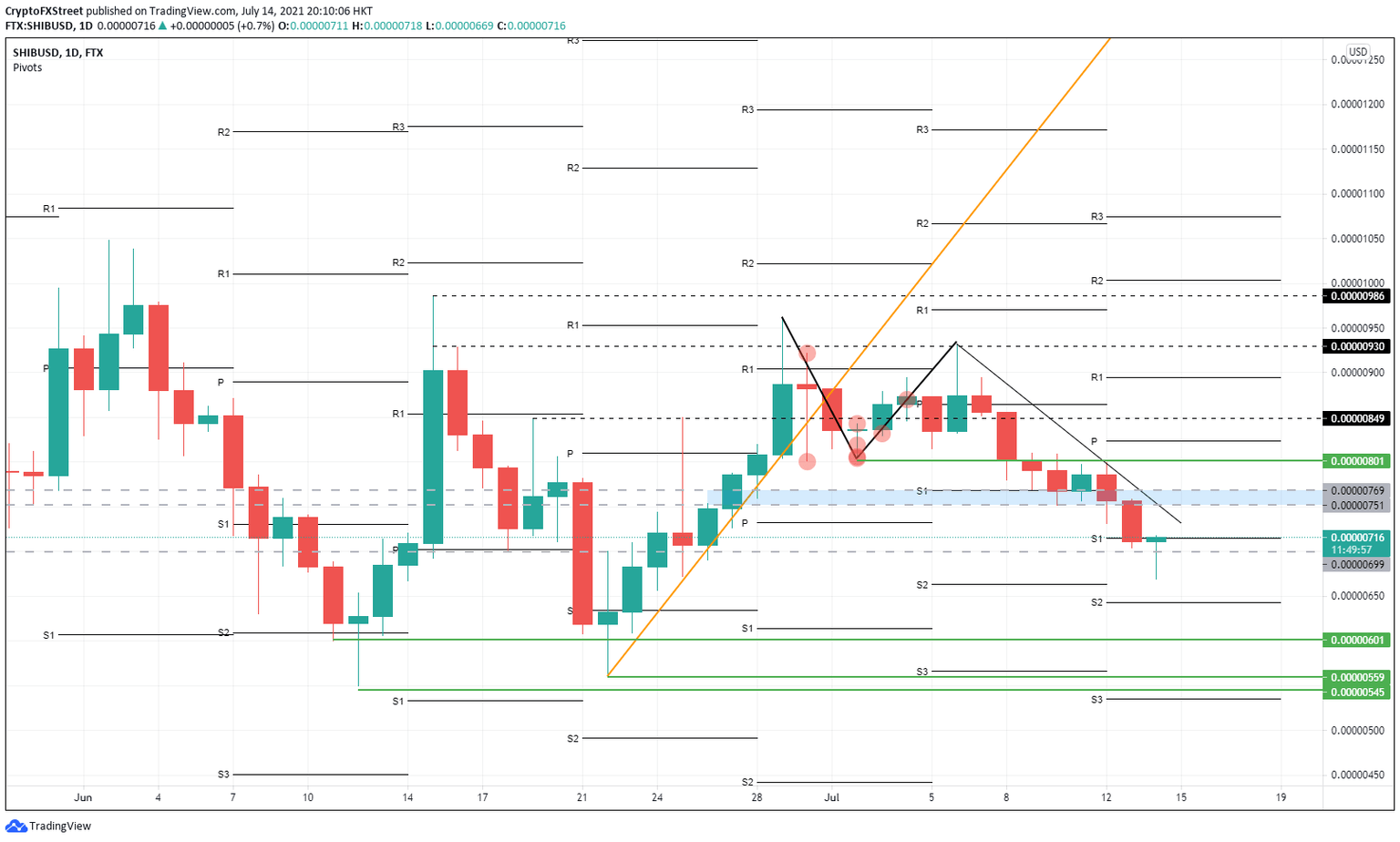

- Shiba Inu was under pressure from a technical rejection at $0.00000800.

- Since then, SHIB is dipping lower and making new lows.

- The reversal today looks promising, but technically it shouts bull trap.

Shiba Inu looked set for a jump higher just two weeks ago. Instead, it has dropped 28% in value over the past nine days. The glut in cryptocurrencies is helping short sellers to push prices further down.

Keep calm, and buy SHIB

Short sellers are enjoying the tailwind across the board with the souring sentiment in cryptocurrencies. There is certainly a case for buyers to go long SHIB, but not at levels today. Although price action is up, a bull trap looks to be forming with a monthly S1 pivot as resistance after it broke to the downside yesterday when that support could not hold. The rule of thumb in technical analysis is that support becomes resistance.

Thus, do not be too hopeful that SHIB will break or stay above that S1 monthly pivot level at $0.00000800.

Another proof that sellers are in control is that the wicks of the candles are lower at the top of the candle and longer at the bottom of the candle. Add to that the respecting of the downward black trend line, and there are enough reasons for buyers to stay out for now.

The best approach for SHIB is to let short-sellers have their fun for now and wait for better entry points, as long as the negative sentiment is ruling cryptocurrencies in general.

Further downward, $0.00000600 as the first port of call for buyers to step into SHIB. Just a few cents below, $0.00000560 and $0.00000550 as a double platform where buyers can surely go long.

As the short sellers are very much dictating price action, do not step into SHIB with the formation of that bull trap just below the monthly S1 pivot level. Instead, wait for the entry lower. Entry can also be when market sentiments flare-up, and only then can SHIB break that black descending trend line to the upside.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.