Shiba Inu flips Ethereum and Solana trade volume on Binance as on-chain activity explodes

- Shiba Inu daily trade volume on the world's largest cryptocurrency exchange has exceeded Ethereum and Solana.

- Commission-free exchange Robinhood teased SHIB listing on a recent Instagram story, no official announcement yet.

- Ethereum whales continue SHIB accumulation as the memecoin's on-chain activity explodes.

- The Shiba Inu holder who turned $8,000 to $5 billion has moved SHIB holdings to four new wallets.

Shiba Inu token's on-chain activity witnessed a massive spike as SHIB daily trade volume exceeding Ethereum, Solana and Binance Coin on Binance. Rumors of a Robinhood listing have fueled the rise in SHIB trade volume across spot exchanges.

Shiba Inu coin flipped Ethereum and Ethereum-killers on world's largest exchange

According to data from crypto data aggregator CoinGecko, the daily trade volume (24h) for Shiba Inu has exceeded Ethereum, Binance Coin, Solana, Dogecoin, and others Ethereum-killer projects in the USD Tether markets.

Rumors of Shiba Inu token's listing on Robinhood pushed the memecoin's price higher over the past month. The commission-free exchange recently published a question featuring the Shiba Inu token on an Instagram story, sparking the rumors of an upcoming SHIB listing.

A petition to list SHIB on Robinhood hosted on Change.org has now exceeded 500,000 signatures, making it one of the most popular ones on the platform.

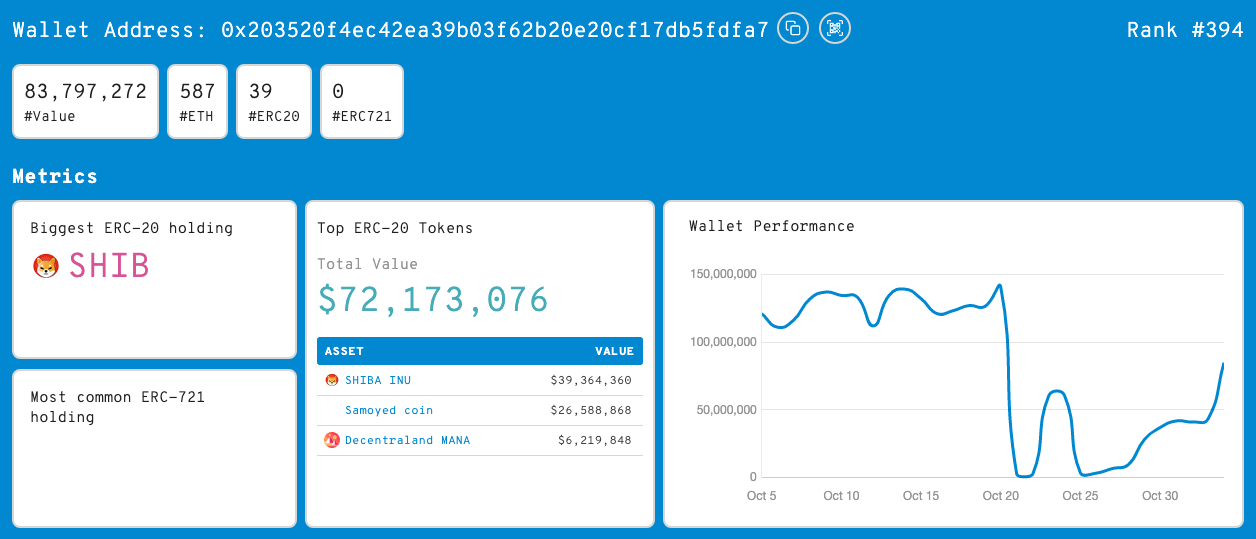

While proponents have criticized the memecoin for its large concentration by whale wallets, large wallet investors continue SHIB accumulation. An Ethereum whale recently added 153 billion SHIB tokens to their portfolio.

The whale wallet's largest ERC-20 holding is the SHIB token.

SHIB accumulation by Ethereum whale.

Historically, accumulation by whales has triggered a rally in SHIB, sending the Shiba-Inu-themed cryptocurrency to its all-time high.

Another mysterious whale, famous for turning a profit of over $5 billion from an $8,000 purchase of SHIB tokens in August 2020, is moving holdings to new wallets. The new wallets are not associated with exchanges, and experts are awaiting a move by the SHIB whale.

The wallet was dormant for over a year, and started moving the SHIB token holdings on November 3.

A cryptocurrency analyst at the YouTube channel "TheFinanceValueGuy," recently analyzed the SHIB price trend. The analyst has noted that the SHIB token has notoriously bounced from $0.00005 several times in the past.

The analyst believes that selling pressure from whale accounts has triggered the recent drop in SHIB price. Drawing similarities in SHIB and DOGE price trends, the analyst expects Shiba Inu to hit a new all-time high.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.