Shiba Inu enters 96% bull run as whales continue accumulating SHIB

- Ethereum whale bought $11.5 million worth of SHIB tokens on Tuesday.

- Shiba Inu token has reached 783,739 holders, large wallet investors accumulate SHIB tokens through the dip.

- SHIB was briefly the cryptocurrency with the largest turnover on exchanges Binance and Coinbase on Monday.

Shiba Inu continues to enjoy support from large wallet investors. SHIB has just hit an all-time high above $0.000044.

Analysts predict rally in SHIB price as whales continue accumulating the memecoin

Shiba Inu, popularly known as the "Dogecoin-killer," is riding on a wave of fandom. There have been several updates in the SHIB ecosystem, and the memecoin has updates lined up, as the Shibarium and Shiboshi game launches are likely to occur within the next few months.

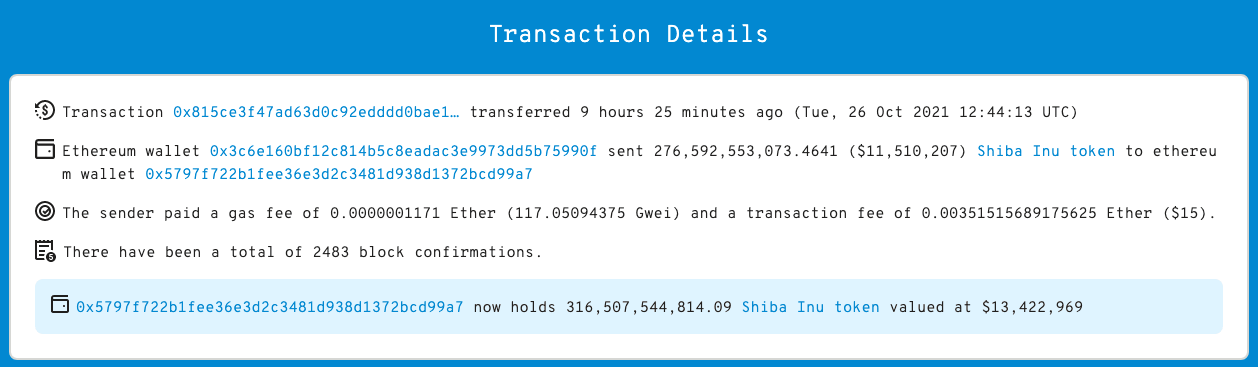

Historically, there has been a trend of whale accumulation in Shiba Inu following a price drop. SHIB price has just dropped nearly 5% from its recent all-time high, while an Ethereum whale recently added $11.5 million worth of SHIB tokens.

Ethereum whale transaction for purchase of $11.5 million worth of SHIB tokens.

The token has crossed 783,739 holders as large-wallet investors continue accumulation. When SHIB hit a new all-time high, the memecoin's on-chain activity exploded. SHIB trade volume on spot exchanges Binance and Coinbase briefly surpassed all other cryptocurrencies.

According to crypto data aggregator CoinMarketCap, the daily trade volume of SHIB was able to surpass Ethereum, emerging as the third most-traded cryptocurrency momentarily.

Analysts still have a bullish outlook on SHIB price, predicting a 96% rally. Pseudonymous cryptocurrency analyst @IncomeSharks has set a price target of $0.0001. SHIB price has appreciated 45% in the past 7 days.

$SHIB - Let's try a more visual representation of what would have to happen for even a target of $0.001 to hit. You know just repeat 24 of the most historic months ever. pic.twitter.com/1xSLJ4B8jq

— IncomeSharks (@IncomeSharks) October 26, 2021

In the meantime, US Senate candidate Shannon Bray shared his bullish outlook on SHIB in a recent tweet:

Good morning y'all. The sun isn't up yet but $shib is. Hopefully the #SHIBARMY got some sleep last night because today is going to be amazing. pic.twitter.com/1KHFTP8H5O

— Shannon Bray (@ShannonBrayNC) October 26, 2021

FXStreet analysts have evaluated the SHIB price trend and predicted a 90% surge in the memecoin's price.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.