Russia recognizing crypto as a form of currency validates Wells Fargo's hyper-adoption outlook

- Russian regulators hope to bring the crypto industry out of the shadows through its acceptance as a currency.

- Accepting Bitcoin as a means of exchange opens the door to legal crypto-related business activities.

- Analysts set a target of $50,000 for Bitcoin as the asset hits new milestones.

- Apple jumped after adding a new feature for merchants to accept crypto payments.

Russian regulators accepted Bitcoin as a currency in a watershed moment for cryptocurrency. Wells Fargo recently revealed it is not too late to jump on the Bitcoin bandwagon, driving higher institutional adoption in the crypto industry.

Russia's adoption of Bitcoin and crypto marks key milestone

Russia's central bank has reached an agreement to amend existing cryptocurrency laws and recognize cryptocurrency as a medium of exchange. The new agreement is in line with Russia's goal to classify cryptocurrencies as a standard currency like the Ruble and not a financial asset.

The legislation related to the classification will be drawn up before February 18, 2022. The regulation seeks to integrate the circulation of cryptocurrencies in the country's financial system, opening up business opportunities for crypto-related services and platforms.

The draft document reads:

The establishment of rules for the circulation of cryptocurrencies and control measures will minimize the threat to the stability of the financial system and reduce the use of cryptocurrencies for illegal purposes since a complete ban on the segment of operations related to their circulation is impossible.

The acceptance of Bitcoin and cryptocurrencies as legal tender in Russia would allow licensed operators to declare their income through the country's banking system, with identity checks in place.

Russia’s acceptance of Bitcoin as a currency comes at a time when Wells Fargo shared a bullish outlook for crypto. Analysts at Wells Fargo compared the adoption of Bitcoin and cryptocurrencies to the internet.

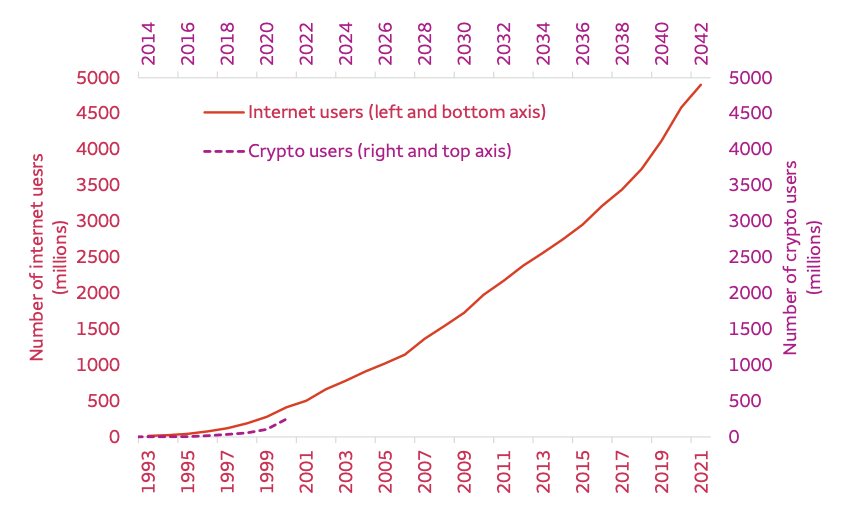

Cryptocurrency adoption rates look to be following the path of other earlier advanced technologies, particularly the internet. If this trend continues, cryptocurrencies could soon exit the early adoption phase and enter an inflection point of hyper-adoption.

Analysts believe that the regulatory progress seen in cryptocurrencies over the past few years could be one of the main drivers for adoption.The legal and oversight frameworks that are being put in order worldwide could solidify cryptocurrencies as investable assets.

Internet usage history vs crypto users

Wells Fargo suggests it is not too late to invest in cryptocurrencies. With the Russian regulator’s move to legalize Bitcoin, Apple also seems to be joining the crypto craze. The American multinational technology company will introduce a feature to enable users to use the "tap to pay" feature to make cryptocurrency payments.

The new payment system will work with “contactless credit and debit cards, and other digital wallets through a simple tap to the iPhone.”

We just introduced Tap to Pay on iPhone, a great way for millions of small businesses to accept contactless payments right from their iPhone. It’s easy, secure, and will be coming out later this year. https://t.co/w6P6oS7grm

— Tim Cook (@tim_cook) February 9, 2022

Analysts have evaluated Bitcoin price and anticipate that the correction could soon be over, enabling BTC to resume its uptrend.

The great bear market of 2022 has been cancelled.

— .eth (@PARABOLIT) February 9, 2022

Bull run continues. $BTC pic.twitter.com/qZQ0Wz5ALl

On the other hand, FXStreet analysts forecast that from a short-term perspective Bitcoin is well-positioned to march towards $50,000.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.