RPL price coils up for a breakout fueled by a 70% rise in Rocket Pool network growth

- Rocket Pool price is filling up a pennant, forecasting a 60% value growth.

- The optimism in RPL comes amid a burgeoning ecosystem, including the recent integration with Zksync Era.

- Santiment data indicates a 70% increase in network growth in just under a month.

- However, investors should wait for confirmation once the price breaks out of the pattern.

Rocket Pool (RPL) price has been very unstable since the onset of 2023. This came as the altcoin navigated the bear market as well as the indocility of Bitcoin (BTC). Nevertheless, the Rocket Pool ecosystem has doubled down on network developments that have since excited a reaction from the token.

Also Read: Lido Finance, Rocket Pool tokens rally as traders stake $180 million in Ethereum within 48 hours

RPL price bodes well with positive network developments

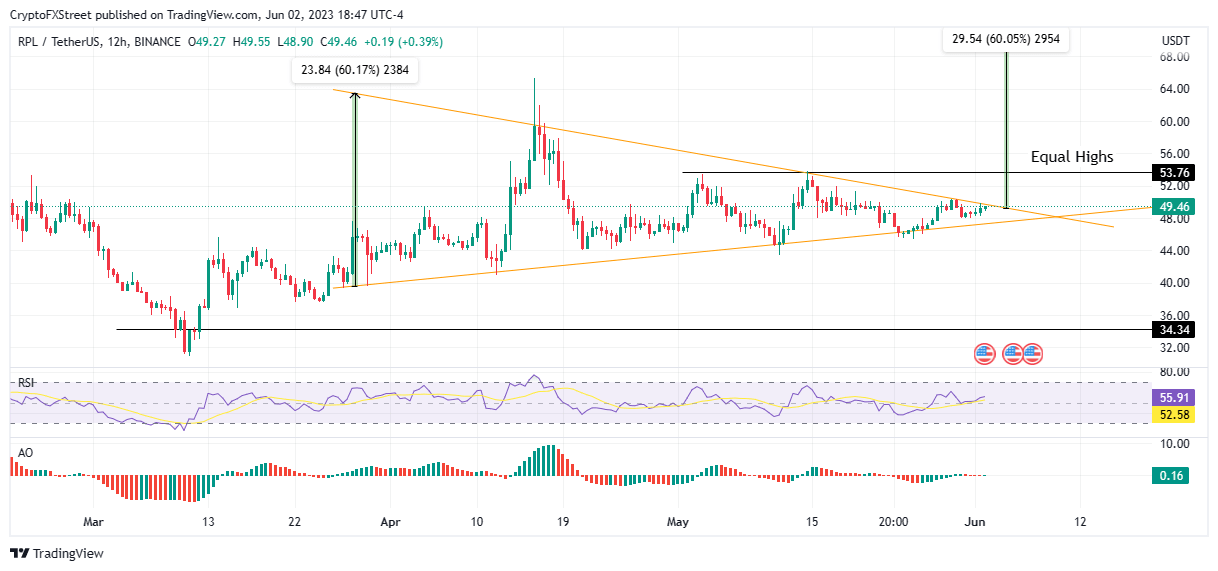

Rocket Pool (RPL) price is poised for a breakout after months of consolidation within a pennant triangle. This technical formation forecasts a continuation, with the pennant representing a period of indecision at the midpoint of the full move. The price is contained by a small symmetrical triangle, starting wide and converging to a point as the pattern develops.

The pattern concludes once the price breaks out of the triangle in the direction of the preceding trend, in this case, bullish. The target is estimated by measuring the length of the mast and extending it in the direction of the breakout, in this case, 60% north. The impulsive move would see Rocket Pool price shatter the equal highs around $$53.76 before an extended neck to the psychological $78.80 target.

This bullish outlook is supported by the optimism in the Relative Strength Index (RSI), which was moving upwards. This inclination, coupled with the Awesome Oscillators (AO) drawing toward the midline, suggested a rising bullish momentum. This adds credence to the upside postulation described above.

RPL/USDT 12-hour Chart

On-chain metrics, 70% network growth

Santiment data indicates commendable growth in the Rocket Pool network, a bullish fundamental for RPL price. Specifically, the network is up a staggering 70% in less than a month. Network growth in this respect defines the number of new addresses being created on the network daily. It illustrates user adoption over time and can be used to identify when the project is gaining or losing traction.

Recently, the Rocket Pool network, a liquid staking derivatives provider, joined forces with Zksync Era, an Ethereum (ETH) layer 2 (L2), to leverage the latter's liquid staking product. The partnership sprouts from a shared vision to offer faster speeds and lower transaction costs.

Rocket Pool is coming to @zksync Era!

— Rocket Pool (@Rocket_Pool) June 1, 2023

You'll soon be able to liquid stake your ETH on zkSync Era by simply holding rETH in your wallet. Just like on mainnet and other L2's, $rETH will continue to accrue staking rewards automatically

(1/3) pic.twitter.com/8HLus9hUwO

Conversely, RPL price could breach the pennant's lower boundary amid buyer momentum, potentially falling below the $34.34 support floor.

Also Read: zkSync DEX Merlin hacked for $1.82 million immediately after CertiK audit

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B01.50.09%2C%252003%2520Jun%2C%25202023%5D-638213463354954482.png&w=1536&q=95)