Ripple's XRP eyes recovery following executives' dinner with Donald Trump

- XRP has slightly recovered from the recent market decline, which sparked over $670 million in realized profits.

- Ripple President hints that an XRP ETF could be the next crypto to debut on Wall Street after Bitcoin and Ethereum.

- XRP's next move may be influenced by a breakout of a bullish pennant following its bounce off the 50-day SMA support.

Ripple's XRP is up 2% on Wednesday following positive sentiments surrounding its CEO Brad Garlinghouse's recent dinner with incoming US President Donald Trump. If the recent recovery sentiment prevails, XRP could stage a breakout above the upper boundary line of a bullish pennant pattern.

XRP leads crypto market recovery after CEO's dinner with Trump

After the crypto market plunged on Tuesday, XRP investors realized profits of over $670 million. Most of the transacted coins came from less than one-year-old holdings, revealing the heavy influence of volatility on short-term holders.

XRP Network Realized Profit/Loss. Source: Santiment

However, unlike other top cryptocurrencies, XRP has recovered slightly from the selling pressure. The recovery is driven by positive market sentiment surrounding Ripple CEO Brad Garlinghouse and CLO Stuart Alderoty's recent dinner with Donald Trump.

Most experts predict that the positive relationship between Ripple and the incoming Trump administration could signal an end to its legal battle with the Securities and Exchange Commission (SEC).

Great dinner last night with @realDonaldTrump & @s_alderoty.

— Brad Garlinghouse (@bgarlinghouse) January 8, 2025

Strong start to 2025! pic.twitter.com/UjM6lahUG4

Additionally, with SEC Chair Gary Gensler expected to step down from office on January 20, his replacement, Paul Atkins, may not pursue the agency's appeal against Judge Analisa Torres' final ruling on its case against Ripple.

The SEC had earlier appealed Judge Torres' ruling focusing on institutional sales of XRP and personal transactions by Ripple executives Brad Garlinghouse and Chris Larsen.

Meanwhile, in a recent interview with Bloomberg Crypto, Ripple President Monica Long stated that new crypto ETFs will launch in 2025, with spot XRP "likely to be next in line after Bitcoin and Ethereum."

XRP's next move could be determined by breakout direction from bullish pennant

Ripple's XRP experienced $15.28 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long positions is $10.18 million, while short liquidations accounted for $5.10 million.

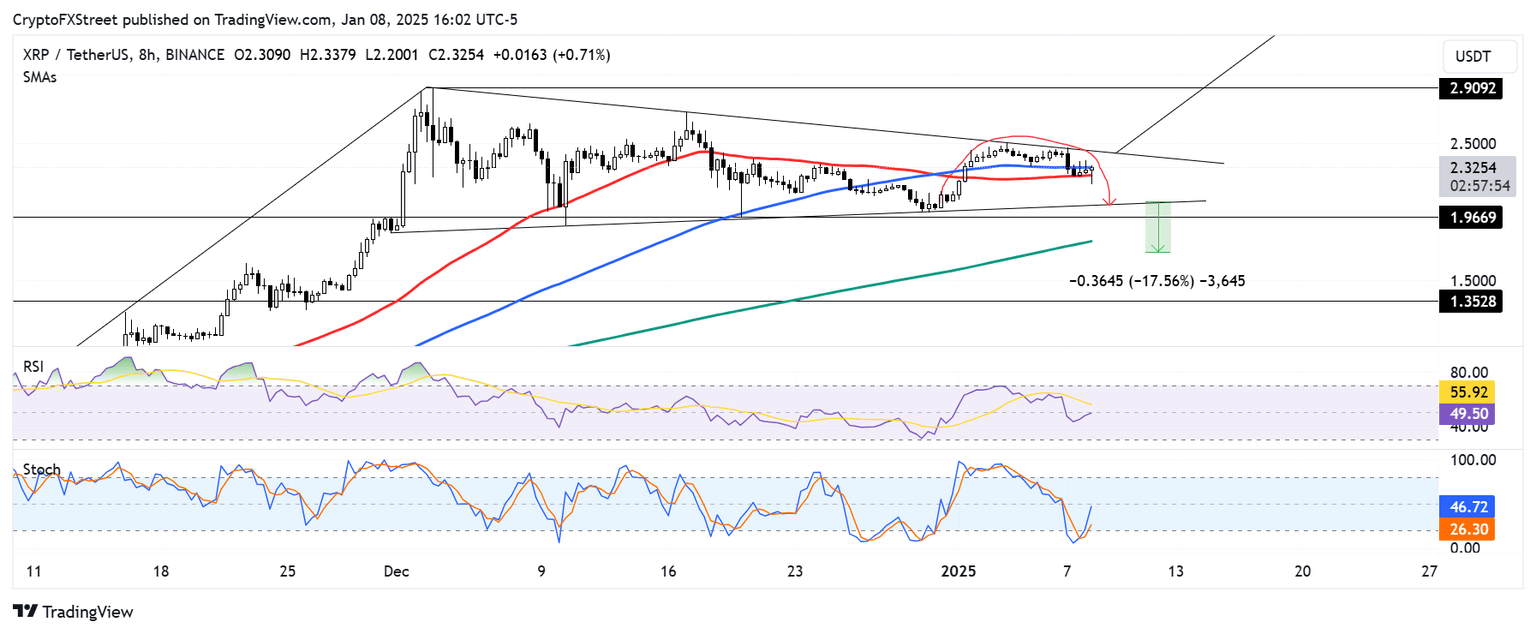

XRP is struggling to find its next direction after constantly seeing a rejection near the upper boundary line of a bullish pennant pattern. As a result, it is looking to find support near the 200-day and 50-day Simple Moving Averages (SMAs).

XRP/USDT 8-hour chart

If XRP breaks above the pennant with a high volume and holds the upper boundary line as a support level, it could rally to set a new all-time high. However, it faces a key hurdle at its 2024 high resistance of $2.9. A successful move above this resistance could fuel the bullish momentum.

Conversely, XRP risks a massive decline if it validates a rounding top pattern by declining below the pennant's lower boundary line and the $2.00 psychological level. Such a move could send XRP toward $1.70 — a level obtained by measuring the height of the rounding top pattern and projecting it downward.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) momentum indicators are testing their neutral levels. Sustained crosses above will strengthen the bullish thesis.

A daily candlestick close below $1.70 will invalidate the thesis.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi

%2520%5B22.30.04%2C%252008%2520Jan%2C%25202025%5D-638719704444316044.png&w=1536&q=95)