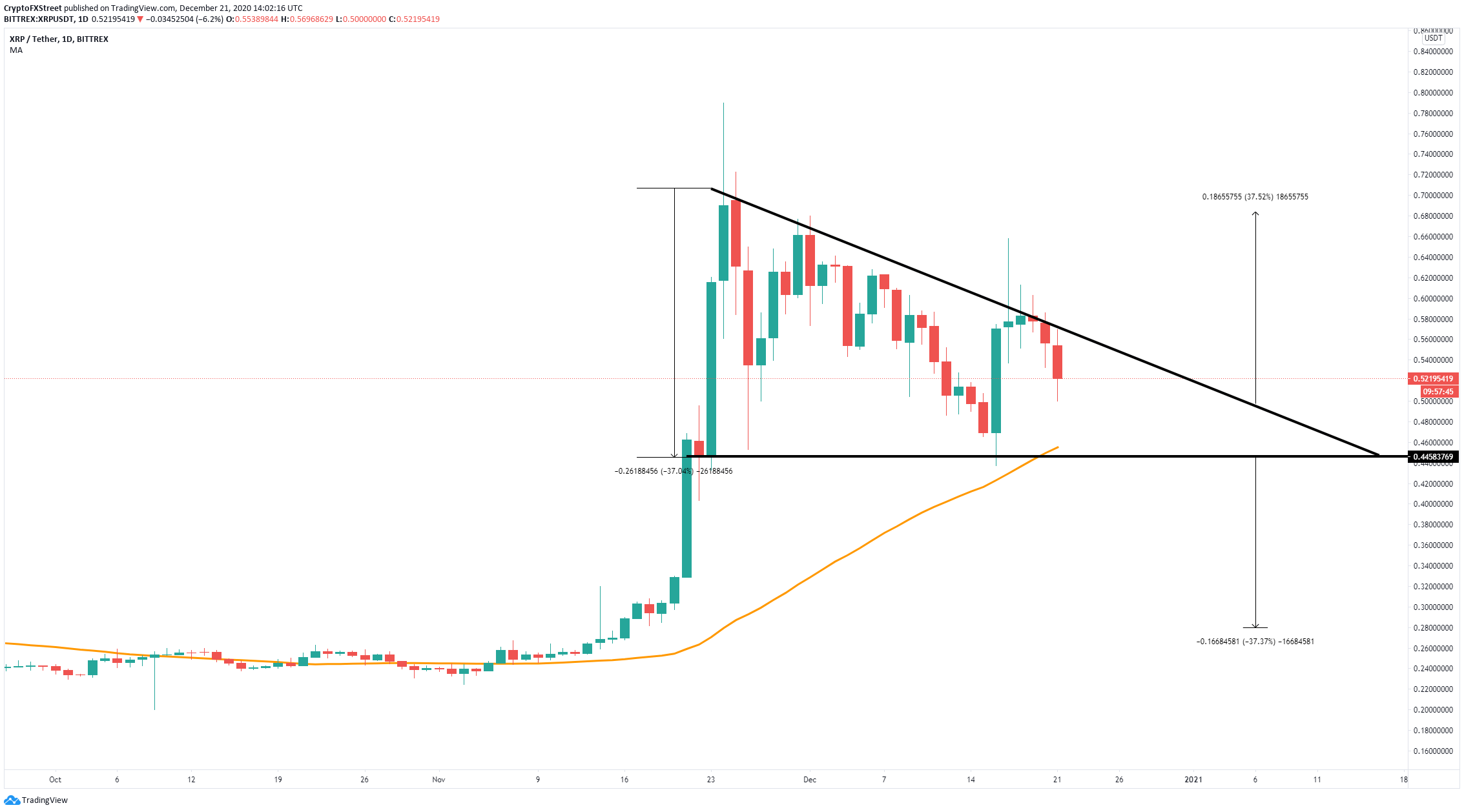

- Ripple price is contained inside a descending triangle pattern on the daily chart.

- The digital asset is on its way towards the triangle's x-axis at $0.44.

Ripple had a significant pullback after the SPARK airdrop ended on December 12, but managed to recover promptly. Now that the rest of the cryptocurrency market seems to be in consolidation mode, XRP bears are targeting $0.44.

Ripple price faces short-term correction

XRP price action has formed a descending triangle pattern on the daily chart. The third-largest cryptocurrency by market capitalization was recently rejected from the triangle's hypotenuse, indicating that is bound for a correction towards the underlying support at $0.44.

The 50-day SMA coincides with the triangle's x-axis, which further strengthens this support barrier.

If the bulls can indeed defend the $0.44 level, Ripple price will likely rebound towards the descending trendline at $0.55. A breakout above this hurdle can push XRP to a high of $0.70.

XRP/USD daily chart

It is important to note that even though large XRP holders sold off their tokens following the SPARK airdrop to take advantage of the upward price action, some of them appear to be reentering the market. Most importantly, the number of whales holding 10,000,000 XRP or more, worth roughly $5,200,000, continues making a series of higher highs.

Such a rising demand for this cryptocurrency among institutional investors adds credence to the bullish outlook.

XRP Holders Distribution chart

Regardless, investors must pay close attention to the $0.44 support level. A breakdown below this demand wall can quickly drive Ripple price towards $0.30.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AAVE proposes a slew of upgrades and expansions in plan for 2030

Aave has proposed a Unified Liquidity Layer, V4, and solutions to enhance and compete with zero-knowledge networks in its plan for 2030 and beyond. The proposal states that Aave aims to implement its plan together with the community within the next three years.

Top 3 meme coins Dogecoin, Shiba Inu and Bonk: Recovery likely if Bitcoin freefall ends

Meme coins Dogecoin (DOGE), Shiba Inu (SHIB) and Bonk (BONK) look primed for recovery, according to technical indicators, despite the broader crypto market correction prompted by the sharp drop in Bitcoin (BTC) price.

XRP tests $0.52 resistance while XRP Ledger developers propose lending protocol on the blockchain

Ripple has failed to close above $0.52 for five consecutive days, struggling with the sticky resistance. XRP holders digested the news of US Securities and Exchange Commission’s response to Ripple in its filing that addressed the issue of “expert testimony.”

Pepe whales buying spree could trigger 55% rally Premium

Pepe price shows signs of a potential comeback as it retest the a declining resistance level. A successful breakout could kick-start a 56% move to the upside as whales continue to accumulate on dips.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

%20[15.03.25,%2021%20Dec,%202020]-637441563779790163.png)