Ripple Price Forecast: XRP flashes sell signal in the hourly chart – Confluence Detector

- XRP has had three straight bullish sessions in the daily chart.

- XRP daily confluence detector shows moderate-to-strong resistance at $0.245.

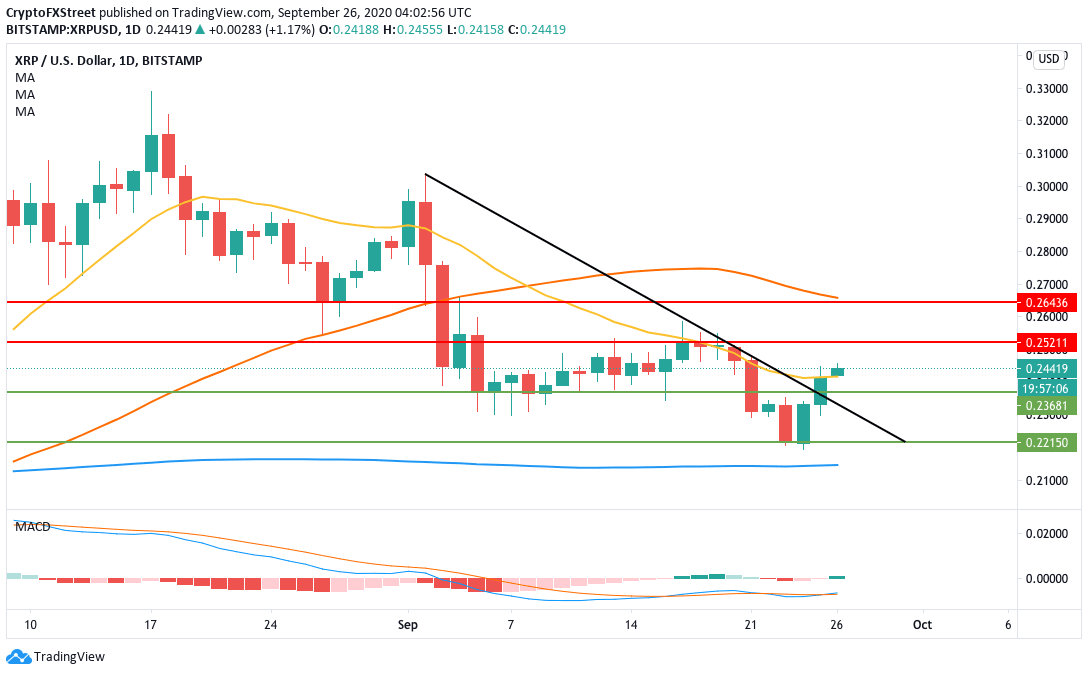

XRP bounced up from the $0.2215 support line and managed to string together three consecutive bullish days, doing up to $0.2445. In the process, the price broke above the SMA 20 curve.

XRP/USD daily chart

The price must now break past the $0.252 resistance line, which has long thwarted the buyers. The MACD has shifted from bearish to bullish, which is another positive signal for the price.

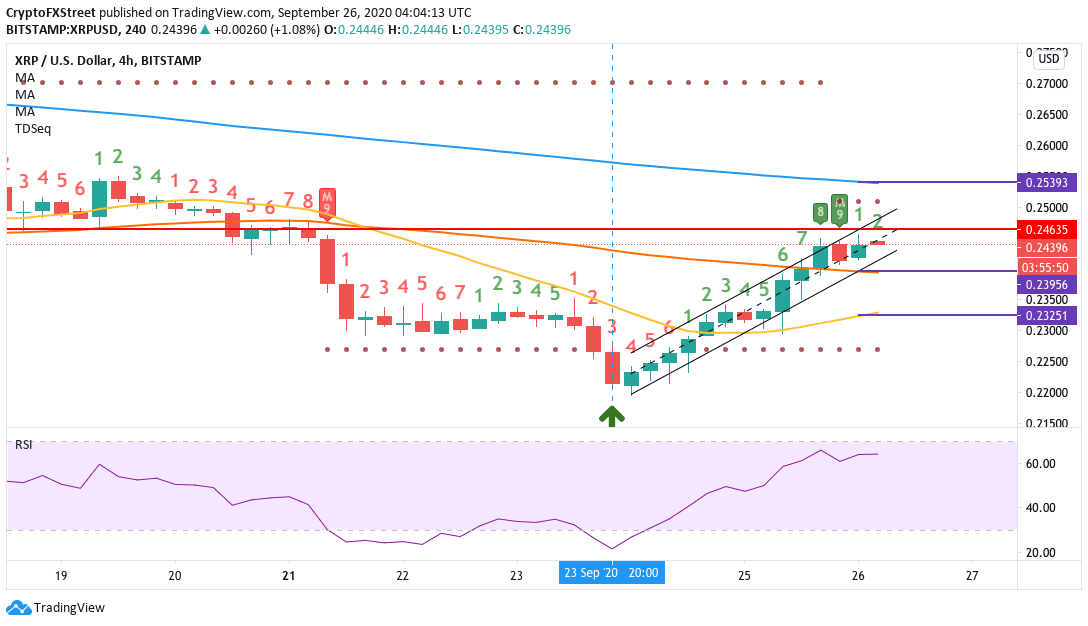

XRP/USD 4-hour chart

XRP has managed to do five straight bullish sessions as the price trends in a flag formation. The price now faces immediate resistance at $0.2452 to break above the SMA 50. The relative strength index (RSI) is hovering around 52.85, giving the bulls enough space to do their thing before the asset moves into the overbought territory. As such, conquering the SMA 50 curve shouldn’t be an issue.

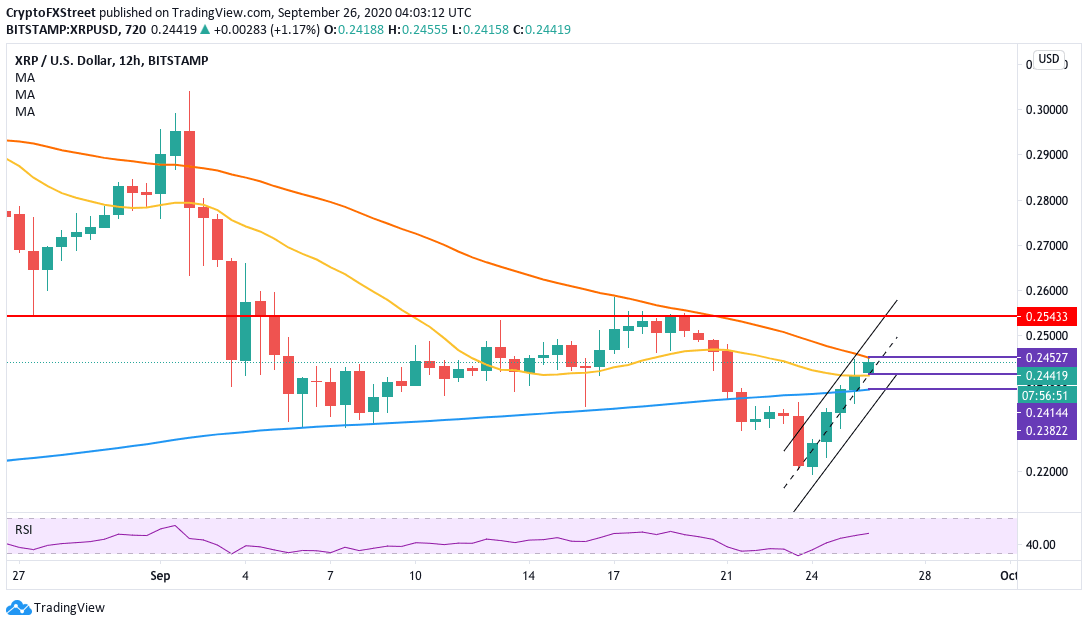

XRP/USD hourly chart

The hourly chart is also trending upwards in a flag formation. During this movement, the RSI has gone up from the oversold zone and is currently trending around 63.75, next to the overbought territory.

However, while every other sign so far has been positive, there is a sign that could trigger a short term bearish correction. The hourly XRP chart has flashed the sell signal in the TD sequential. Although the bearish formation has yet to be formed, a short-term correction may be imminent.

XRP social volume

The social volume chart for Ripple shows a spike this Friday and Saturday. During this time, the price has reacted positively to the spikes. However, increased attention is not necessarily a good sign for the continuation of the uptrend. When prices pump and the crowd starts paying attention, then the dump usually follows shortly after.

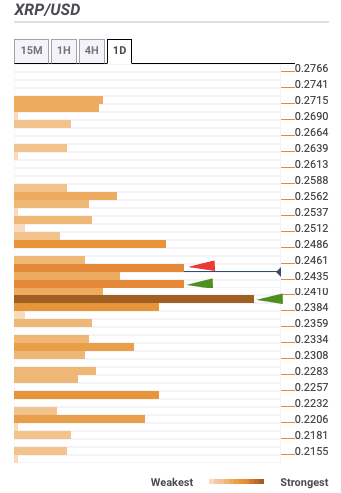

XRP daily confluence detector

As per the daily confluence detector, XRP faces immediate moderate-to-strong resistance at $0.245. On the downside, there are two healthy support levels at $0.2425 and $0.24.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.