Ripple price could move to greener pastures as Pornhub adds XRP as a payment option

- XRP price might finally see a bullish breakout after positive news.

- Pornhub has added XRP, BNB, USDC and DOGE as payment options.

- The uncertainty about Ripple’s situation over the SEC's lawsuit still has a strong effect on XRP.

XRP has lost over 60% of its value since November 24, 2020, after peaking at $0.78. The digital asset plummeted after the SEC sued Ripple, alleging that the company sold illegal securities to investors. On December 29, 2020, XRP price dropped to $0.173 but managed to recover and it’s currently trading at $0.288.

Pornhub adds support for XRP and other cryptocurrencies

In December 2020, Visa and Mastercard announced that they would be cutting ties with Pornhub amid several allegations about the platform allowing illegal videos to be uploaded. Mastercard was the first to drop Pornhub, followed by Visa.

Back in 2019, Paypal, the largest online payment system, also blocked Pornhub, which pushed the platform to accept a wide variety of digital currencies as payment options. Pornhub currently accepts over 10 different cryptocurrencies including XRP, DOGE, Monero, Verge, and others.

Can XRP price benefit from Pornhub’s announcement?

Although the announcement is quite new, it doesn’t seem that XRP price is reacting at all. The digital asset had a significant spike on January 19, jumping from $0.289 to $0.33 within two hours but 24 hours later dropped lower at $0.282.

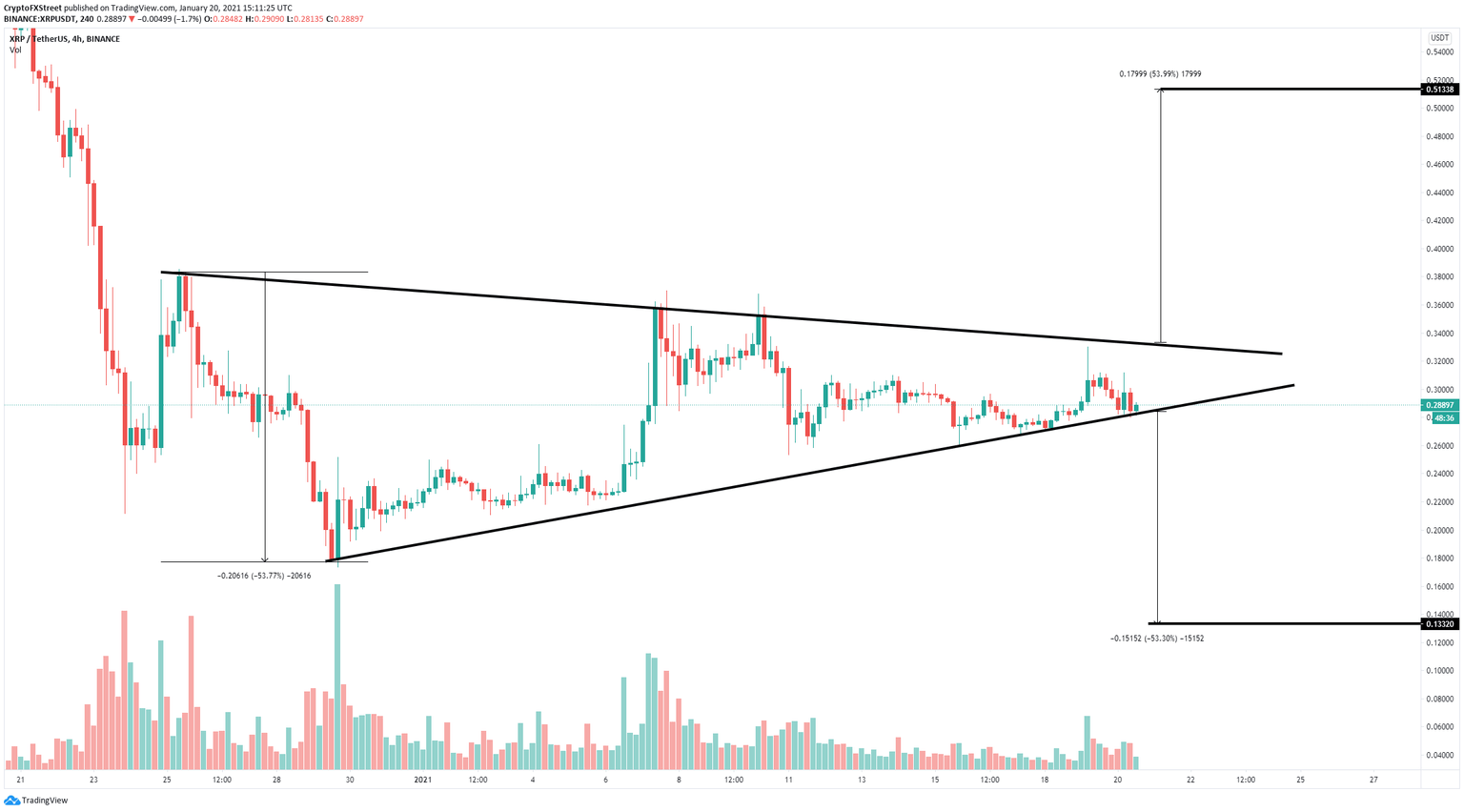

XRP/USD 4-hour chart

XRP has been trading sideways for the past two weeks and established a symmetrical triangle pattern on the 4-hour chart. XRP price is on the verge of a breakdown below $0.28, which would drive the digital asset down to $0.133.

On the other hand, if the bulls can hold the crucial support level at $0.28, XRP price can rise towards the upper trendline at $0.33. A breakout above this point would push it to a high of $0.51.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.