- The FSA has already licensed 16 crypto exchanges, while 8 more applications are under review.

- Ripple price is correcting lower on the day, down 5.72%, but the major support is at $0.500.

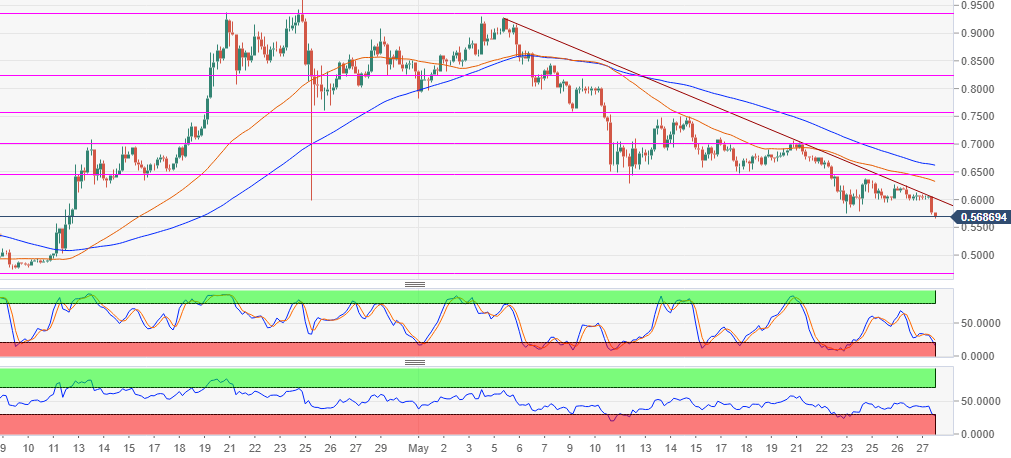

Ripple price has extended declines below the former major support level at $0.60. The crypto is trading at $0.56 and is down 5.72% on the day. The price is approaching the lows traded in the last week of March and the first week of April. There is a bearish trend on the 4-hour timeframe chart threating to test the short-term support area at $0.55.

Japan decided to regulate activities in the cryptocurrency market as opposed to banning the digital assets. This has been achieved through the Financial Services Agency (FSA) which has up to date licensed 16 crypto exchange platforms. There are 8 more exchange platforms whose applications are being reviewed at the moment. The eight have applied to be considered for trading Bitcoin (BTC), Ethereum (ETH), Ripple (XRP) and Litecoin (LTC). The soon to come crypto exchange platforms in Japan include Drecom, Money Forward, Yamane Medical Corporation, Securities Group and Avex. A chartered accountant, Shubham wrote on Twitter:

“Sbi vc is coming soon! Xrp will rule the world after xrapid will launch! It’s just beginning of good days. Xrp community and ripple team will remember forever for this technology!”

Ripple is trading below the 50 SMA and the 100 SMA, moreover, the moving averages show that a continued bear dominance is expected in the near term. Furthermore, the RSI is pointing downwards below the 30 mark, while the Stochastic is moving deeper into the oversold region. The descending trend line is limiting the gains to the upside, but the 61.8% Fib retracement level with the last swing high of $0.93 and a low $0.46 will offer resistance towards $0.65. If the support level at $0.55 fails to stop declines, the major support zone at $0.500 will be very instrumental.

XRP/USD 4-hour chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin is showing rising correlation with the S&P 500

Bitcoin and the crypto market have been in an uptrend since Wednesday following the Federal Reserve's decision to cut interest rates by 50 basis points. Bitcoin is up nearly 3% in the past 24 hours, rising briefly above the $63,000 level for the first time in three weeks.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Consensys case against SEC over Ethereum dismissed by Texas court

Consensys announced dismissal of a case it filed against the SEC in April about the agency's alleged actions against Ethereum. Judge Reed O'Connor of the Northern District of Texas dismissed the case on Thursday. Consensys claims that the court failed to examine the "merits" of its claim against the SEC.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Bitcoin: On the road to $60,000

Bitcoin price retested and bounced off from the daily support level of $56,000 this week. US spot Bitcoin ETFs posted $140.7 million in inflows until Thursday and on-chain data supports a bullish outlook.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.