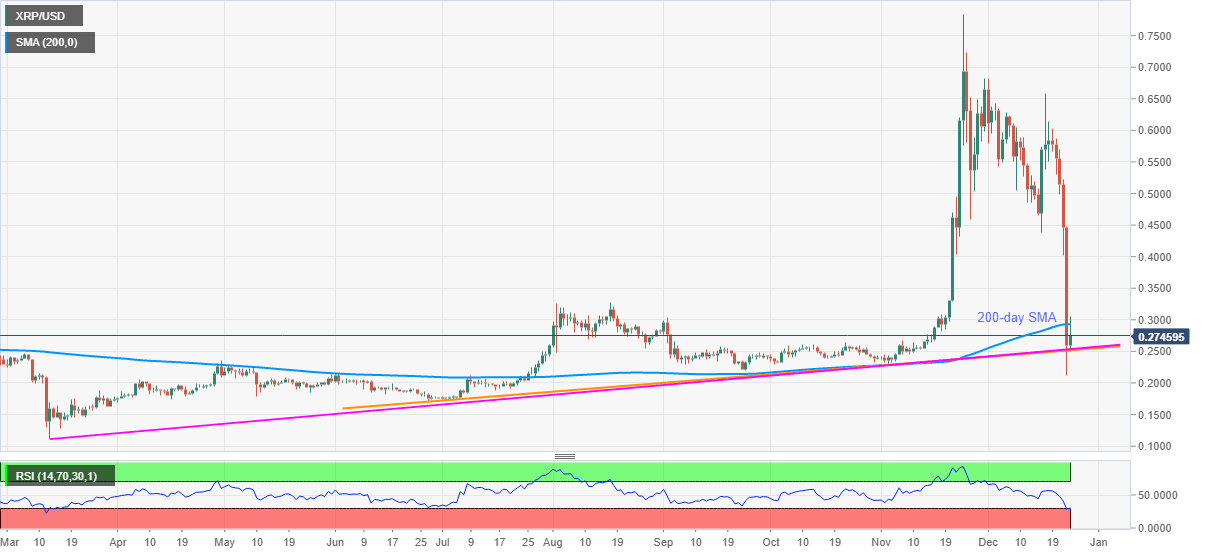

Ripple Price Analysis: XRP pulls back from 200-day SMA, multi-day-old support lines in focus

- XRP/USD fades corrective recovery from five-month low, prints intraday gains.

- Failure to cross 200-day SMA redirects sellers toward ascending trend lines from June and March.

- Oversold RSI conditions negate further downside, August top can lure buyers beyond the key SMA.

XRP/USD eases from the intraday top near 0.3058 to 0.2730 during early Thursday. In doing so, the Ripple pair fails to keep the bounce off key support lines while taking a U-turn from 200-day SMA.

The crypto major dropped to the lowest since late July the previous day amid fundamental concerns relating to delisting of the Ripple from Hong Kong’s exchange.

While fundamentals keep the bears hopeful, not to forget the pair’s inability to cross 200-day SMA, oversold RSI favors further consolidation of losses.

As a result, a clear upside past-200-day SMA level near 0.2935 will propel XRP/USD towards an August high near 0.3280. However, any further rise will not hesitate to recall the early month low near 0.4375.

Alternatively, a clear downside below the stated support lines around 0.2535 and 0.2520 can take rest near April top surrounding 0.2355 before challenging September’s bottom of 0.2197 and the latest multi-month low of 0.2126.

XRP/USD daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.