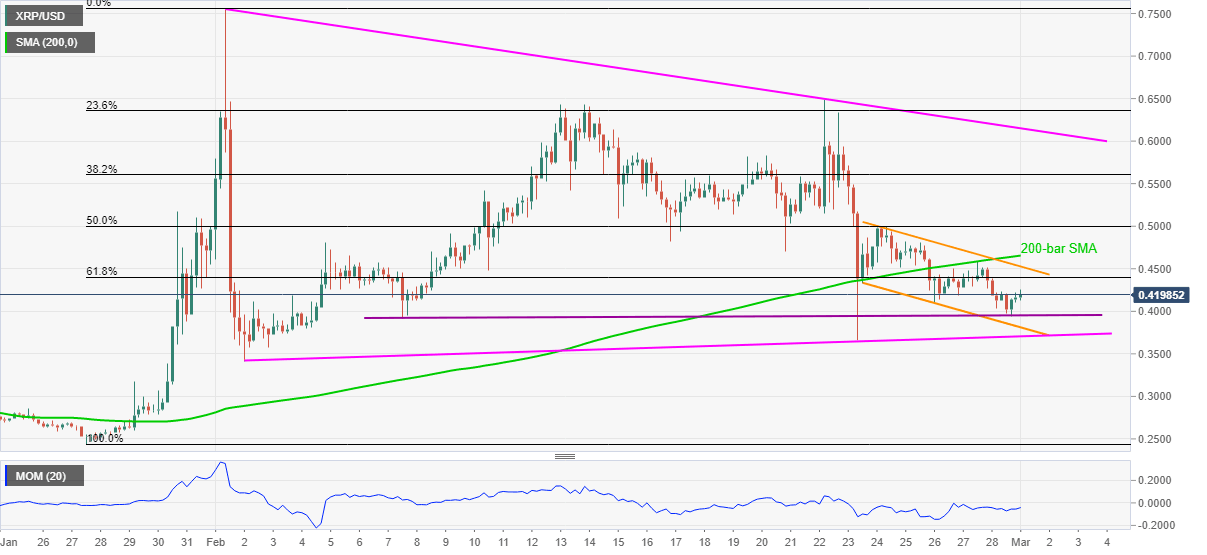

Ripple Price Analysis: XRP bulls prepare for a bumpy road, $0.47 be the key hurdle

- XRP/USD wavers around intraday high inside a bearish chart pattern.

- Momentum indicator suggests further recovery from three-week-old support.

- 61.8% Fibonacci retracement, channel’s resistance line will test buyers before 200-bar SMA.

- One-month-long ascending trend line adds to the support.

XRP/USD eases from an intraday high of $0.4258 to currently around 0.4216 during early Monday. Even so, the altcoin keeps the bounce off short-term horizontal support while flashing 1.5% gains on a day.

With the Momentum indicator favoring the recovery moves, Ripple buyers are up for confronting 61.8% Fibonacci retracement of its January 27 to February 01 upside, at $0.4400.

However, the quote’s upside past-$0.4400 will be questioned by the upper line of the one-week-old falling channel and 200-bar SMA, respectively near $0.4525 and $0.4655.

Although XRP/USD upside past-$0.4655 becomes doubtful, a sustained run-up will not hesitate to challenge the $0.5000 and one-month-old resistance line around $0.6150.

On the flip side, the stated horizontal support of $0.3950 precedes the support line of the immediate channel, near 0.3810, to restrict the altcoin’s immediate downside.

Also acting as the downside filter is an ascending trend line from February 02, currently around $0.3700.

To sum up, XRP/USD is ready for a corrective pullback but the bulls are less likely to be pleased.

XRP/USD four-hour chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.