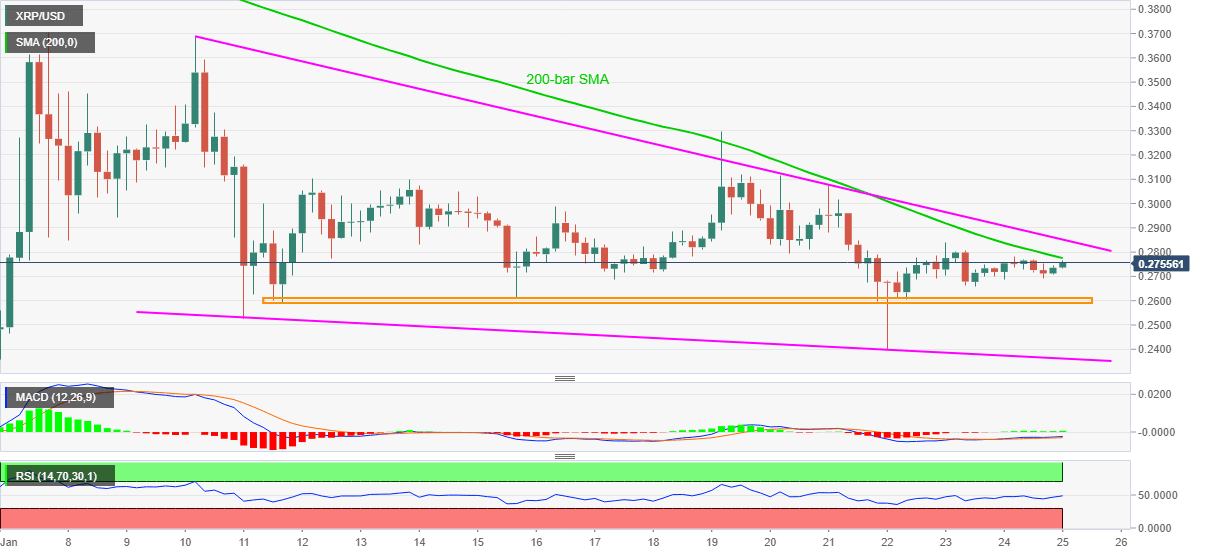

Ripple Price Analysis: XRP bulls attack 200-bar SMA inside two-week-old falling wedge

- XRP/USD picks up bids inside bullish chart pattern.

- Upbeat RSI, MACD conditions suggest further upside, 0.2590-2610 restricts short-term downside.

XRP/USD stays strong near the recently flashed intraday high of 0.2767, currently around 0.32760, during early Monday. In doing so, the crypto pair flirts with 200-bar SMA while extending the weekend bounce off 0.2692.

With the MACD and RSI conditions further smoothening the drive for XRP/USD buyers, the quote is likely to confirm the falling wedge bullish chart pattern established since January 10.

However, a clear break above 200-bar SMA and the stated formation’s upper line, respectively around 0.2775 and 0.2850, becomes necessary for bullish conviction.

Should XRP/USD prices manage to confirm the chart play, 0.3300 and the monthly high near 0.3685 will probe buyers targeting the Christmas Day top surrounding 0.3850.

On the downside, multiple lows marked since January 11, around 0.2610-2590, limits the quote’s short-term declines ahead of the support line of the stated chart pattern near 0.2360.

If at all the XRP/USD sellers manage to conquer 0.2360, the monthly bottom close to 0.2100 and the 0.2000 psychological magnet will be in the spotlight.

XRP/USD four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.