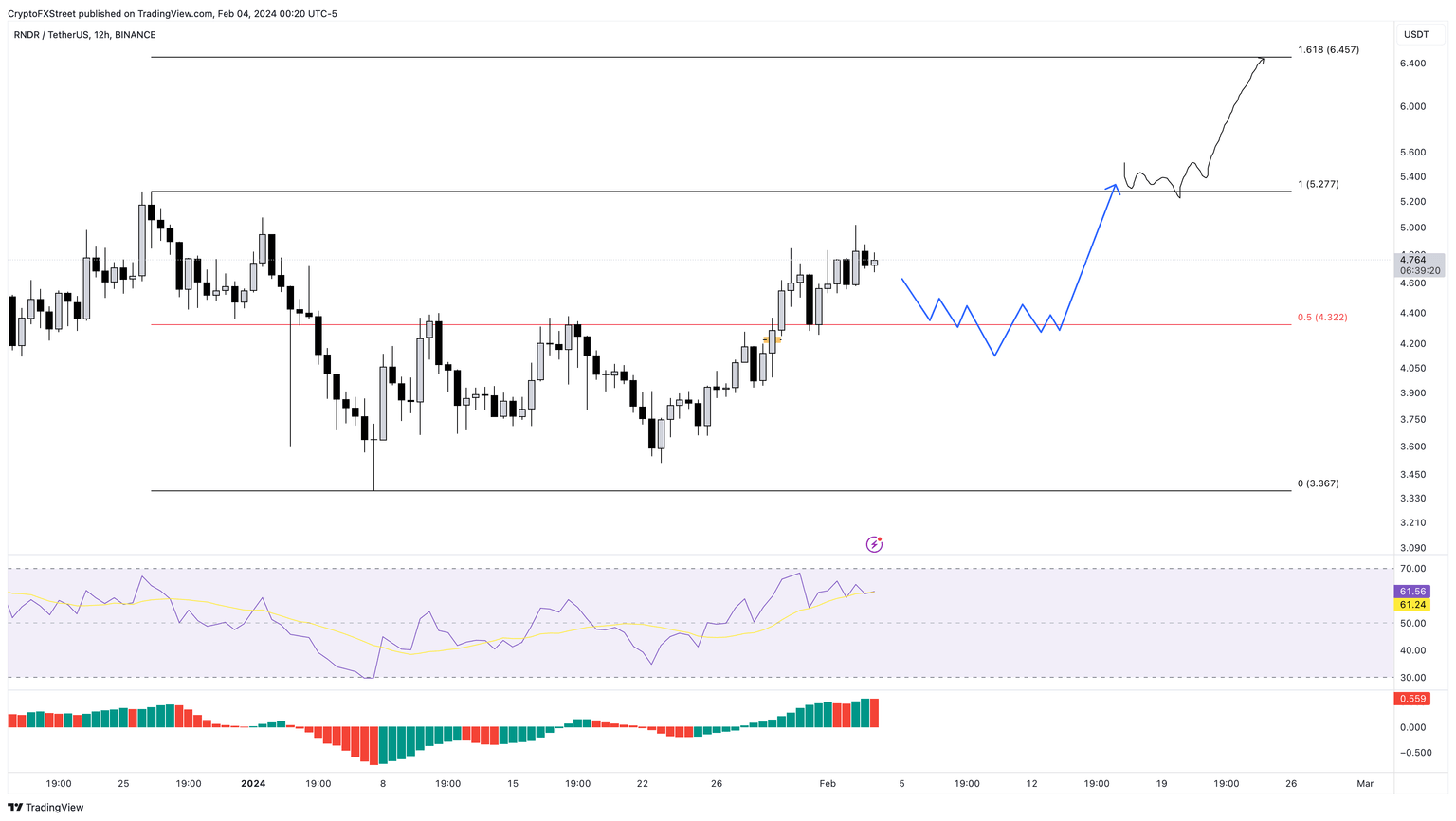

Render Price Prediction: RNDR bulls prepare to revisit $5.27

- Render price is planning to escape its $3.36 to $5.27 range after the recent uptick.

- RNDR is likely to revisit the range’s midpoint at $4.32 or the imbalance, extending from $4.24 to $4.19.

- NVIDIA Corp’s earnings on February 21 could drive the AI-related token to retest the range high of $5.27.

- If RNDR flips the $4.32 support into a resistance level, it will invalidate the bullish thesis.

Render (RNDR) price managed to end its consolidation and trigger a rally that flipped a key resistance level into a support level. This development has now opened the gates for RNDR bulls to take control. Additionally, the NVIDIA Corp’s earnings are set to be announced on February 21, which could affect the AI-related tokens like it did in November 2023.

RNDR’s market value inflated by 68%, a week ahead of the NVIDIA Copr’s earnings on November 21, 2023. So, if history repeats, investors can expect the Render price to restart a similar uptrend.

Also read: Render price trades within a supply zone, risks a 20% fall unless this happens

Render price eyes a range high retest

Render price created the $3.36 to $5.27 range between December 26, 2023 and January 7, 2024. For most of this rangebound movement, RNDR remained below the range's midpoint. The recent burst in buying pressure pushed it to overcome the range’s midpoint at $3.27 and flip it into a support floor.

Now, Render price trades around $4.76, eyeing a retest of the range high at $5.27. There are two outlooks on how this move could play out.

RNDR moves from the current position to retest the range high due to NVIDIA Corp’s earnings in February.

RNDR retraces into the four-hour imbalance, extending from $4.24 to $4.19 before it kickstarts a move to retest range high.

If NVIDIA Corp’s earnings beat expectations by a huge magnitude, then investors can expect the Render price to extend beyond the range high of $5.27 and tag the 161.8% Fibonacci extension level at $6.45.

RNDR/USDT 12-hour chart

In the short-term, the optimistic outlook for the Render price is dependent on the recent flip of the range’s midpoint at $4.32. However, a breakdown of this level will invalidate the bullish thesis and potentially trigger a 22% correction to retest or sweep the range low at $3.36. In this case, RNDR could slide nearly 11% and tag the $3 psychological level.

Also read: Render price skyrockets by 25% as Binance announces RNDR listing on its Japanese exchange

(This story was corrected on February 4 at 10:58 AM GMT to say that the RNDR remained below the range's midpoint instead of RNDR remained below the range low.)

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.