- Polkadot price fails to impress this week as the broader cryptocurrency market shines.

- Price compression will lead to price expansion to the upside.

- Polkadot Index Network Token (PINT) gives holders access to the top projects.

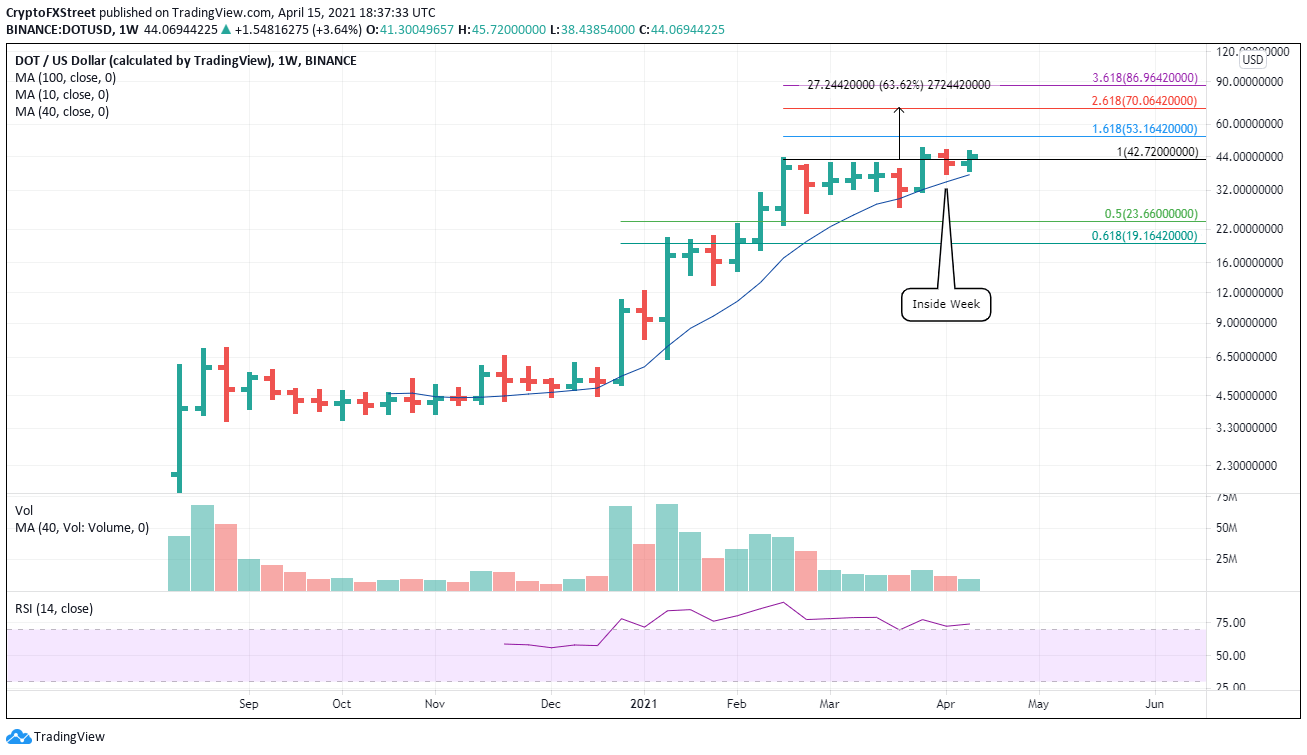

Polkadot price is trading in a tight weekly range and may close with a second consecutive inside week. The current outlook projects that the last two weeks’ price compression will release to the upside and carry DOT to the 261.8% Fibonacci extension at $70.06.

PINT creators envision it as a “treasury reserve asset” for the Polkadot ecosystem

As one of the fastest-growing interoperable blockchains and backed by the Web3 Foundation, DOT has captured special interest from developers and investors and is the home of literally hundreds of projects in development.

To ease the burden of combing through the projects, the Polkadot Index Network Token will enable investors to make a diversified wager on the total ecosystem and permit instant access to the leading projects.

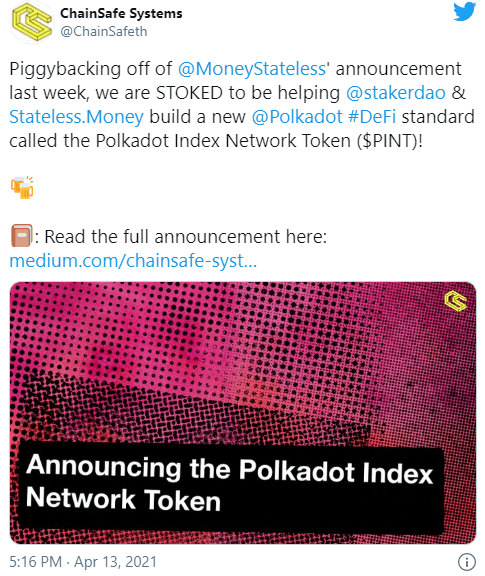

Chainsafe said it would soon launch PINT in collaboration with PoS infrastructure provider Stateless money.

PINT will be split into four partners: Stateless Money, Chainsafe, a PINT council of Polkadot experts, and a Constituent Committee that includes a representative from each project with assets in the index.

Already, six projects have given preliminary commitments to being part of the index, including Acala, Equilibrium, HydraDX, Litentry, Moonbeam, and Plasm.

Polkadot price needs to reclaim the February high on a weekly close

A daily close above the February high may be enough for very short-term speculators, but a weekly close raises the probability of success. If DOT does trigger, the bullish outlook projects a test of the 161.8% Fibonacci extension of the February bear market at $53.16 followed by a push to the 261.8% at $70.06, representing a gain of over 60%.

If the rally commands volume, it should reach the 361.8% extension at $86.06 in the medium term.

DOT/USD weekly chart

To play devil’s advocate, speculators need to monitor DOT’s divergence with the broader cryptocurrency market. If it persists, it could indicate the market is questioning the quickly evolving fundamental story.

The 10-week simple moving average (SMA) at $37.06 is the first significant support level. The next level is the March low at $27.30, followed by the February low at $25.83.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Crypto traders brace for short-term volatility with $2.4 billion options expiry on Friday

Bitcoin and Ethereum options market looks bullish on Friday, according to data from intelligence tracker Greeks.live. The firm said it has identified two Bitcoin calls that show an underlying bullish sentiment among market participants.

XRP recovers from week-long decline following Ripple’s response to SEC motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

Lido adds 4% gains as protocol rolls out first step towards decentralization

Lido takes the first batch of simple DVT validators to live, a step taken to decentralize the protocol. Lido leveraged technology to expand the protocol to multiple node operators, inviting both solo and community stakers.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Bitcoin: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.