Pepe Price Forecast: PEPE could drop 25% as smart money investors turn to Dogecoin

- PEPE had outperformed industry peers like Dogecoin in daily trading volumes last week, recording $227K and $168K, respectively.

- However, tables have turned, with PEPE showing $116K against DOGE's $187K to suggest smart money investors show a refocus.

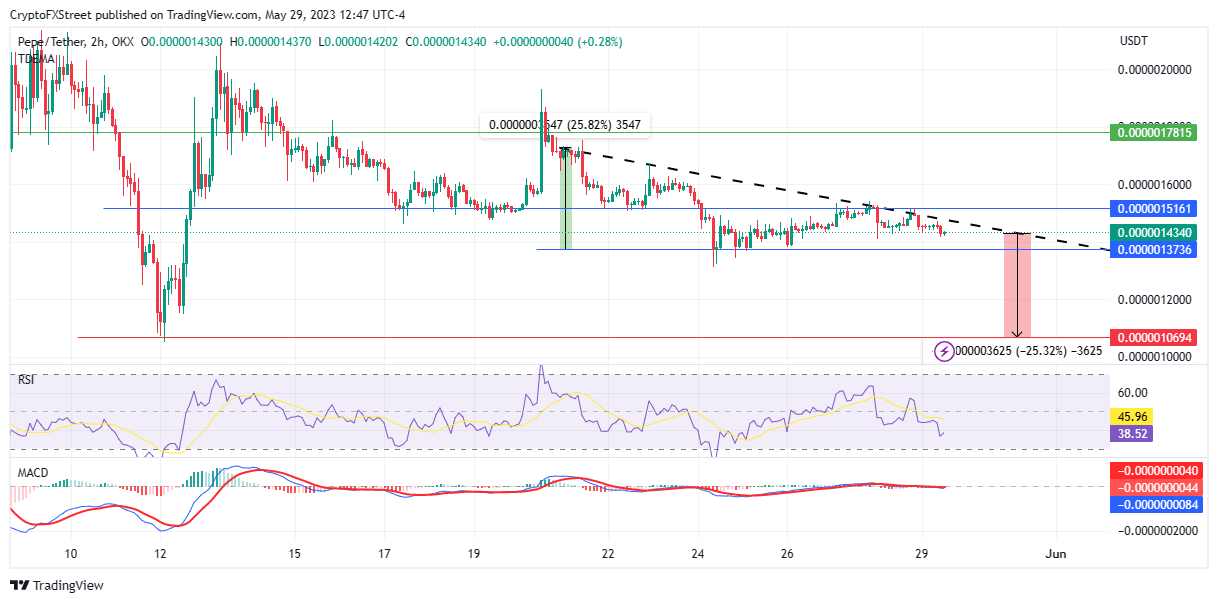

- Accordingly, the meme coin's price action has formed a descending triangle in the 2-hour timeframe, forecasting a 25% downswing.

Pepe (PEPE) price has shown a lack of buyer participation throughout May, switching between neutral and bearish biases as the meme coin's hype and sensation eased. The lack of momentum for PEPE was so extreme that it failed to react to Bitcoin (BTC) price's influence over the weekend as crypto markets rallied.

Also Read: Bitcoin sees capital inflow as Biden, McCarthy agree to raise US debt ceiling

Pepe (PEPE) price has left meme coin enthusiasts in awe after losing ground against Dogecoin in terms of daily trading volume. Last week, PEPE and DOGE recorded $227K and $168K daily trading volumes, respectively, against this week's $116K vs. $187K for DOGE. This suggests smart money investors have switched focus to the king of meme coins.

Also Read: Dogecoin retakes meme coin throne as Shiba Inu, Pepe mania fades

Pepe price action consolidates in a descending triangle

While nothing is interesting for PEPE on higher timeframes, the 2-hour timeframe shows Pepe price action has formed a descending triangle. This chart pattern is often bearish, indicating a potential price drop in the future. The pattern is visible when the asset's price action records a series of lower highs while the support level remains constant. This means the asset supply is increasing against a weakening in demand.

Pepe price is sitting on immediate support at around $0.00000141 while confronting the $0.00000147 resistance marked by the downtrend line of the governing pattern. A break below the triangle's base at the $0.00000137 level could trigger a selling trend, potentially to the May 12 lows around the $0.00000106 support flow.

The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) indicators add credence to the bearish thesis. Their positions below the midline indicate that bears are leading the PEPE market.

PEPE/USDT 2-Hour Chart

Conversely, a resurgence by bulls could see Pepe coin breach the downtrend line resistance level at $0.00000147 before extending a neck up to tag the $0.00000151 resistance level, clearing the path for further gains.

In a highly bullish case, Pepe price could ascend to tag the $0.00000178 resistance level, reclaiming the May 20 high. This move would denote a 25% upswing from the current price level. Although rare, such a scenario is possible considering the RSI had turned north, indicating a reentry of sidelined investors. If this trajectory is sustained, the RSI could soon cross above the yellow band, signaling a call to buy PEPE. Market players heeding this call could be bullish for the meme coin.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.