PEPE price action puts traders on the edge of their seats as pennant gets filled

- PEPE price trades in marginal moves as the consolidation phase continues.

- PEPE is poised to reveal on Friday which way the breakout will go.

- With no real breaks above the pivotal level at $0.0014700, the verdict may favor the bears with a slide to $0.0010000.

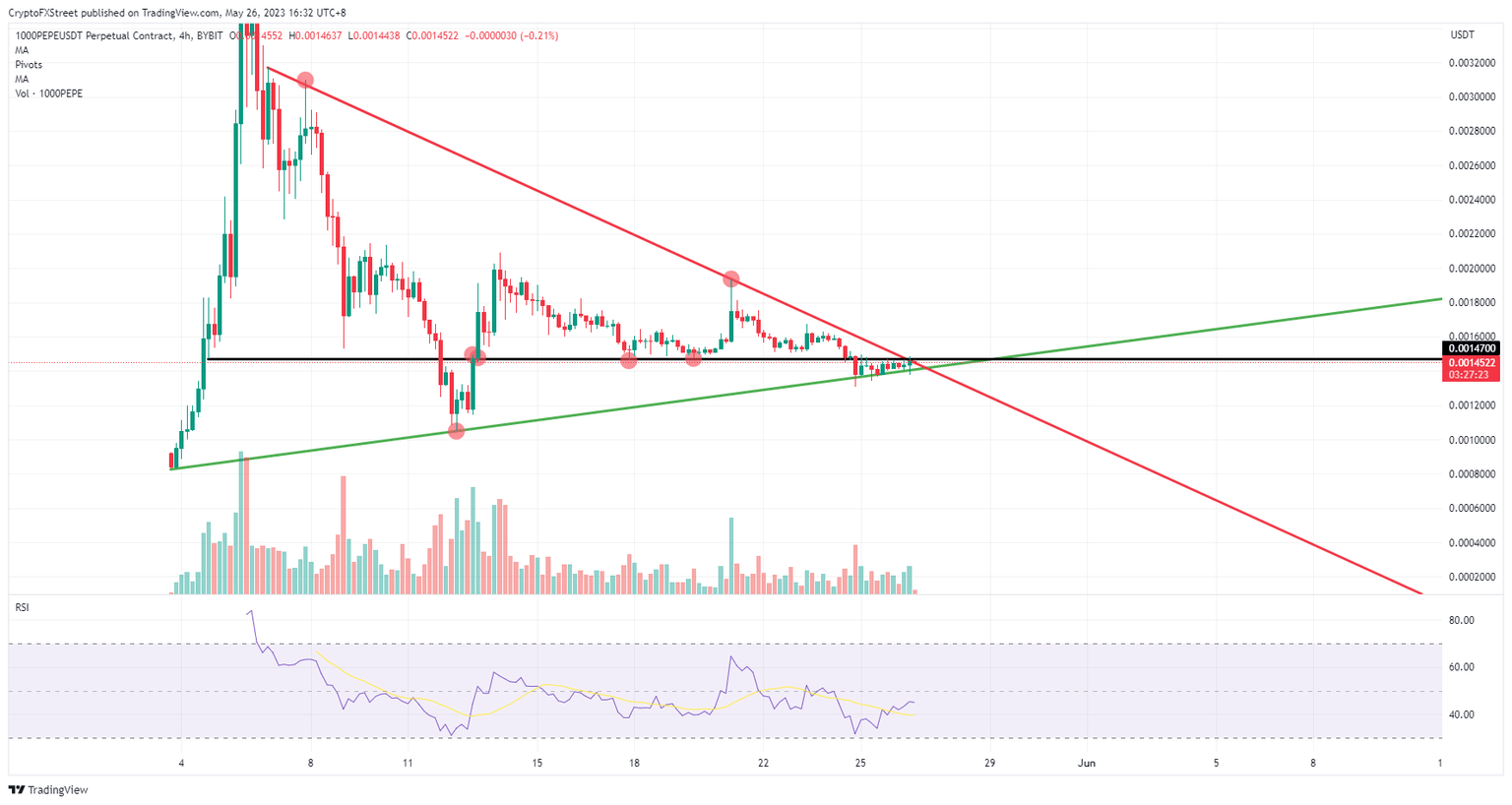

PEPE (PEPE) price is entering the very last possible stage before finally determining whether bulls or bears have the winning hand in this poker game showdown. Analyzing the performances of past sessions and taking into account the Relative Strength Index (RSI), it would appear that the bears will win the game. Expect a breakdown soon of the green ascending trendline and price action heading to $0.0010000 if that is indeed the outcome.

PEPE price to drop 30% as bears go all in

PEPE price is trading in a very narrow and minor range that is even smaller this Friday than on Thursday. Bears and bulls both do not want to give way on their trading positions, and that means that the pennant will decide which way this tug-of-war will go. Seeing the already small slippages below the supportive green ascending trendline, it appears that bears might have the better and tighter upper hand in this.

PEPE price action is reflected in the RSI, which is still under par and even now is starting to tilt to the downside. On the 4-hour chart, it appears that lower highs will soon arrive. A divergence is thus afoot between what the chart is telling us and what the RSI is warning for. Expect to see the next break below the green ascending trendline to be a brutal one with a nosedive move quickly heading to $0.0010000.

PEPE/USD 4H-chart

From the looks of the volume chart, it appears that some buying has happened in the last four candles, while selling was only marginal. This could point to, after all, more bulls being in the trade, and the breakout could still head higher. If that unfolds, expect to see a quick sprint to $0.0020000 on the back of that bullish signal.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.