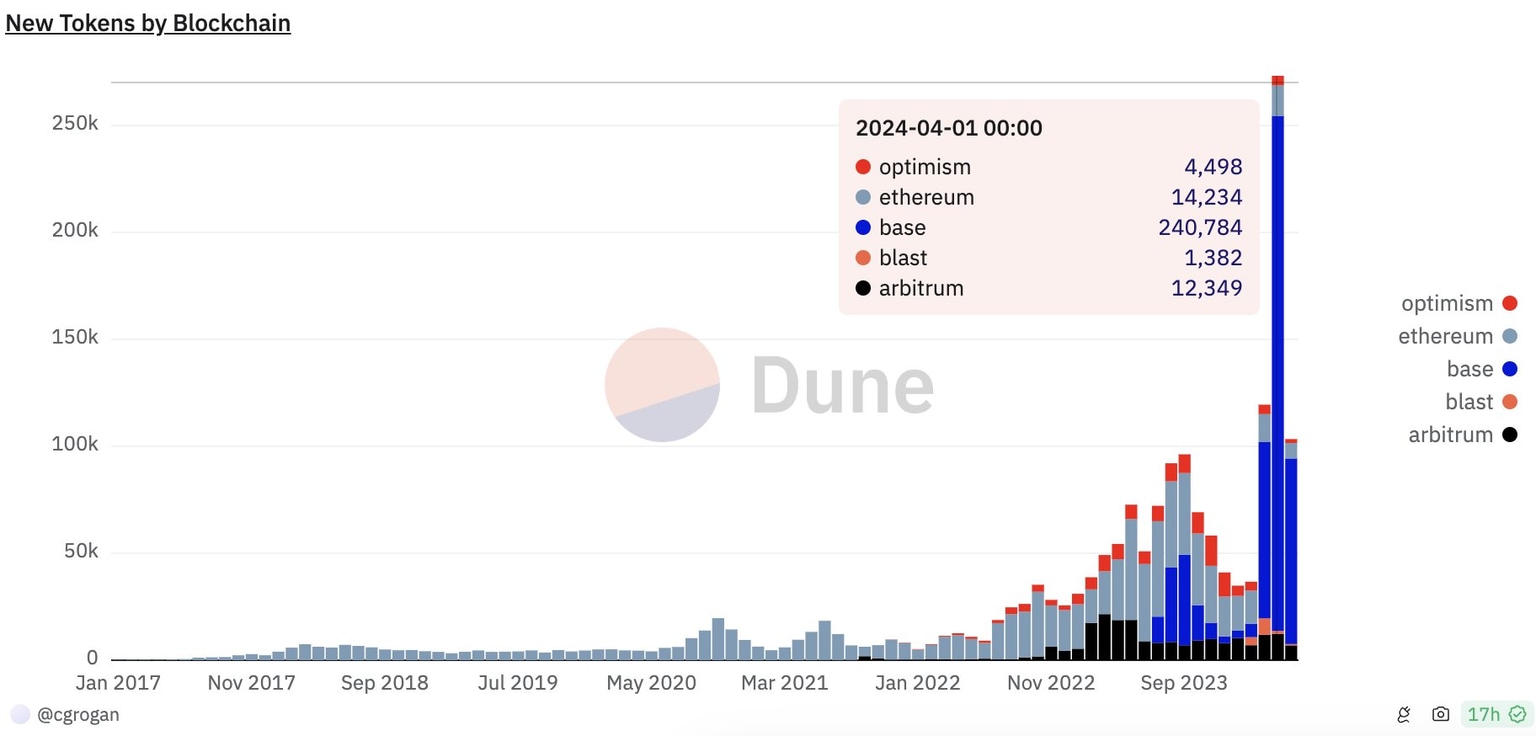

Over a million new crypto tokens issued in three months, 90% on Base

- Base supports nearly 90% of the 1 million new coins issued in the past three months.

- Total value of assets locked in Coinbase’s Layer 2 chain is second to Arbitrum.

- Base is currently the biggest contributor of monthly active users on the decentralized exchange of Uniswap.

The resurgence in meme coins in the past three months has resulted in over a million new tokens being issued in the crypto ecosystem. Data from crypto intelligence tracker Dune Analytics shows that 90% of the new coins in the Ethereum ecosystem are issued on Base.

Base is Coinbase’s Layer 2 scaling solution for Ether.

Most of the newly created tokens are not visible on trackers like CoinMarketCap or Coingecko, due to low liquidity and listing on decentralized exchanges or liquidity pools. An investigation report from Cointelegraph showed that 1 in 6 meme coin tokens on Base are a scam and 91% have vulnerabilities.

A million crypto tokens, rug pulls and scams

Coinbase’s Layer 2 chain supports nearly 90% of the 1 million new tokens issued in the past three months. The launch of several new crypto tokens has pushed the total value of crypto assets locked on Base higher.

New tokens by blockchain

Data from DeFiLlama shows that Base’s TVL is $1.459 billion as of May 15. Base is second only to Arbitrum ($2.563 billion). Base’s competitor Optimism’s TVL is $773.16 million.

Base TVL on DeFiLlama

It’s important to note that even the trending projects on the Layer 2 chain may have low liquidity or vulnerabilities. The sheer volume of crypto tokens issued on the chain makes it difficult to distinguish the projects that have a utility or use case and likely rug pulls or scams.

Crypto data aggregator platform CoinMarketCap has listed 500 newest tokens on its platform in the past thirty days, most of which are meme coins. Similarly, CoinGecko has added a meme coin category and listed over 600 assets with a market capitalization above $55 billion.

The GameStop rally and return of the legendary trader “Roaring Kitty,” who was behind the 2021 gains in the stock, fueled the relevance of the meme token category in cryptocurrencies. Read more about this here.

Data from TokenTerminal shows that Base is currently the largest contributor of Monthly Active Users (MAUs) to the decentralized exchange Uniswap. This outlines Base’s role in the crypto ecosystem, with the surge in assets issued on the chain and its rising TVL against competitor Arbitrum.

Uniswap is Based.@Uniswap has 3.4m MAUs; 1m from @base.

— Token Terminal (@tokenterminal) May 14, 2024

Base is currently the biggest contributor to Uniswap's growth. pic.twitter.com/EvICthVtoK

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.