OMG Network Price Forecast: OMG holds firmly to critical support as buying pressure builds

- OMG Network bulls are building momentum upon the crucial support at the 50 SMA.

- A breakout to $5 could materialize if OMG/USD pierces through the resistance at $3.2.

OMG Network made a remarkable recovery from the lows in March to the yearly highs of $9.9, achieved in August. Despite the month-over-month gains, bears swung into action, hence the losses under the descending trendline.

The declines became unstoppable until OMG/USD recently embraced support at the 50 Simple Moving Average (SMA) on the 3-day chart. At the moment, OMG is looking forward to massive price action amid growing buying pressure.

OMG prepares for a massive liftoff

The value transfer token is changing hands at $2.8 at the time of writing. OMG is ranked 35th in the market and boasts of $391 billion in market capitalization. The token has attracted a 24-hour trading volume of $423 million.

OMG Network’s immediate downside is supported by the 50 SMA, as mentioned earlier. If this buyer congestion zone continues to hold, prices may rebound to $3.2. Breaking above this critical seller congestion zone could catapult the token above the descending trendline. OMG’s bullish outlook will then be validated with prices setting up for a 50% rally to levels around $5.

OMG/USD 3-day chart

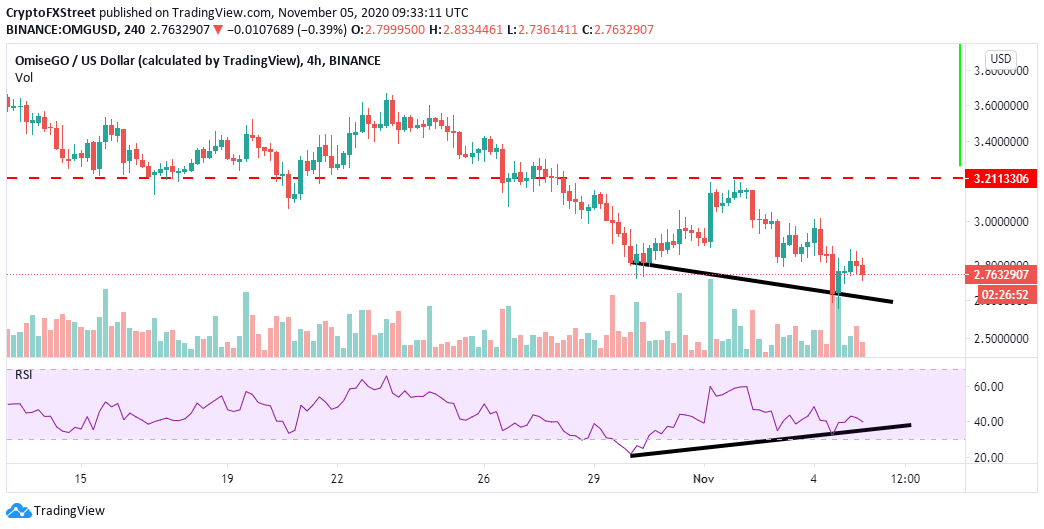

The Relative Strength Index (RSI) adds credibility to the bullish outlook – take a look at the divergence formed since October 20 between OMG price and the RSI.

It is worth stating that the bullish divergences mainly occur when an asset price makes a lower low pattern, while the RSI makes a high low pattern. In this case, the technical pattern does not provide an exact entry point for buy orders; instead, it highlights that the medium-long downtrend may be approaching exhaustion.

OMG/USD 4-hour chart

On the downside, the bearish outlook will be invalidated if the 50 SMA support on the 3-day chart is broken. The declines that might ensue will likely pull OMG Network to the tentative support at the 200 SMA in the same timeframe.

OMG Network IOMAP chart

The IOMAP model by IntoTheBlock discredits the technical optimism after revealing strong resistances ahead of OMG. If bulls manage to overcome the seller congestion at $2.8 and $2.9, it is uncertain that they will slice through the next crucial resistance.

A massive seller congestion range lies between $2.96 and $3. Here, nearly 1,400 addresses had previously bought around 5.4 million OMG. On the flip side, the lack of a formidable suggests that OMG might breakdown to $2.5.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637401656970545949.png&w=1536&q=95)