New sources affirm USDD is on a path to collapse like Terra’s UST

- Crypto investigator Coffeezilla released a video about how Justin Sun’s USDD is on a path of colossal crash, like Terra’s UST.

- The detective argues that Tron DAO could fail to deploy its Bitcoin holdings to safeguard USDD from de-pegging.

- USDD price remains below the peg and at press time is trading at $0.98.

Tron launched its stablecoin USDD in May, at the same time as Terra’s sister tokens LUNC (formerly LUNA) and UST were imploding. The stablecoin recently detached from its $1 peg, sparking fears of a crash.

Tron’s USDD loses $1 peg

Tron’s stablecoin USDD has struggled to maintain its $1 peg, dropping two cents to trade at $0.98. USDD was launched in May 2022, around the time of Terra’s UST implosion and Justin Sun, founder of Tron affirmed that special measures had been taken to avoid a similar fate as TerraUSD.

Sun commented on the colossal crash of TerraUSD (UST) and assured the Tron community that the stablecoin USDD is over-collateralized and that the Tron DAO Reserve would take all the necessary steps to fight a de-peg. Despite Sun’s assurance, there has been speculation of USDD following UST down the path to a de-peg, as the stablecoin struggles to recover to $1 level.

At the time of writing, USDD price is $0.98 after a drop from $0.99 on June 27, 2022. The Tron DAO Reserve has spent over $2 billion in Bitcoin, USD Coin (USDC) and Tron (TRX) to build its reserve. The DAO then spent $10 million to buy USDD and TRX.

Experts have estimated that defending USDD’s peg could emerge as an expensive affair for Tron DAO Reserve.

Crypto detective investigated USDD and found this

A self-proclaimed internet detective, Coffeezilla has investigated Justin Sun’s new stablecoin USDD. The expert believes it is on its path to suffering a de-peg and becoming the next UST. In a recent YouTube video, Coffeezilla said that USDD, with a market capitalization of $723 million, is far from being a decentralized algorithmic stablecoin.

I investigated Justin Sun's new stablecoin USDD, which is trying to be the next #LUNA and already has a $723M market cap.

— Coffeezilla (@coffeebreak_YT) June 24, 2022

Here's what I found out

(NEW VIDEO IS ON YOUTUBE)

The detective argues the design of USDD is similar to LUNA/UST sister token’s design: users burn TRON to mint the stablecoin. The only difference is white-listed institutions are minting USDD and there is no mechanism to burn USDD for TRON.

Though this is great for USDD, and there is no scope for arbitrageurs to push the stablecoin on a death spiral, it makes Tron’s algorithmic asset unstable. Though the Tron DAO Reserve holds collateral for the USDD, Coffeezilla is unsure if they will deploy it to establish the stablecoin’s peg.

Coffeezilla says,

USDD looks like a honeypot for retail traders to get dumped on by Justin Sun himself.

Since the Bitcoin wallet associated with the Tron DAO Reserve has existed for over two years, it is likely that Justin Sun is in control of the wallet, rather than the DAO. Since Sun minted about 94% of the USDD in circulation, the investigator claims that the stablecoin is far from decentralized. There is a possibility that the collateral is in fact the personal holding of Justin Sun, since he is responsible for a large percentage of the mint, he bears the risk for the stablecoin.

Tron’s stablecoin USDD price struggles below $1

Tron price witnessed losses overnight, while stablecoin USDD struggled to recover its lost peg. USDD price is $0.98 at press time and the stablecoin is attempting a recover to $1. Based on data from CoinGecko, USDD lost its peg on June 13, 2022, since then the stablecoin has struggled to make a comeback.

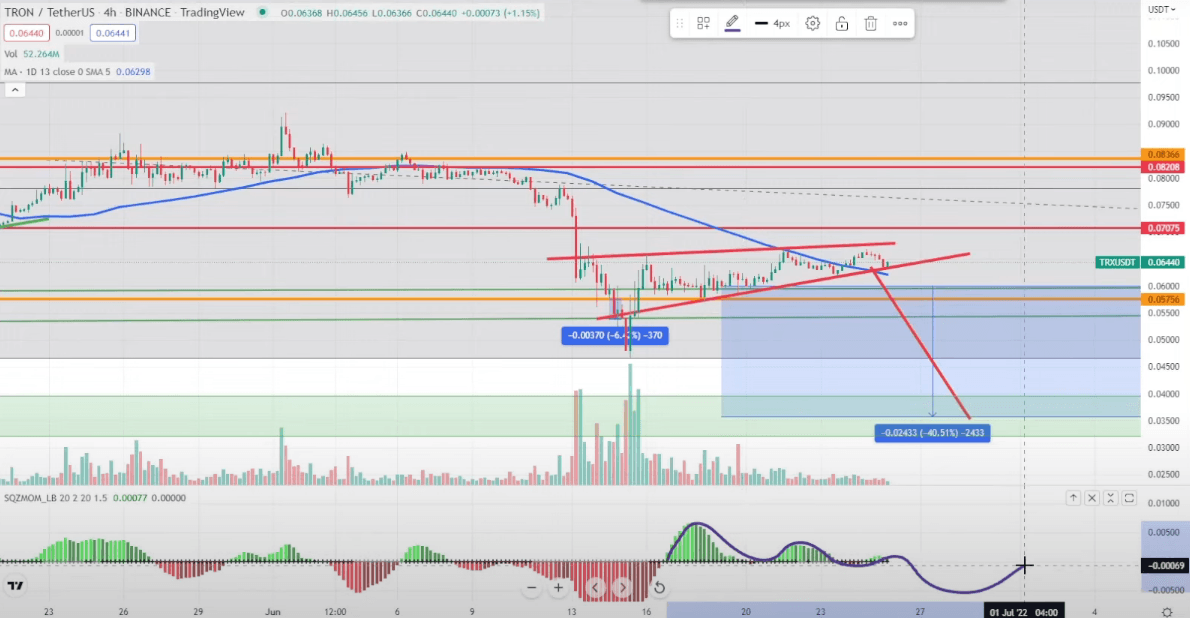

Crypto analysts at Cowboy Trades identified a bear flag in the Tron price chart and predicted a decline to $0.024 as the altcoin forms consistently lower highs.

TRON-USDT price chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.