TRON’s USDD is de-pegging as TRX price plummets

- TRON’s stablecoin USDD recently lost its peg with the USD amidst marketwide fears of a crash.

- Justin Sun informed the community that TRON DAO reserve will deploy $2 billion to re-establish USDD’s peg.

- Terra whistleblower FatMan identifies a pricing bug that shows USDD as completely collateralized, 100%, despite the decline in TRON price.

TRON’s decentralized stablecoin USDD lost its peg by nearly 1%. Justin Sun has assured the community that the TRON DAO reserve will protect USDD from a de-peg.

TRON’s USDD could face a similar fate as Terra’s LUNA

TRON’s decentralized stablecoin made headlines over the past two weeks for the over-collateralization of USDD. The stablecoin, however, suffered a de-peg today, slipping nearly 1% from its peg of $1.

After Terra’s LUNA collapse, Justin Sun, the founder of TRON, informed the community that a planned move had been accelerated, and the decentralized stablecoin USDD was modified to avoid a similar fate as Terraform Lab’s UST.

Sun assured users that the TRON DAO Reserve would be very active in the market. The algorithmic stablecoin made its debut in May 2022 and decided to boost transparency and add collateral to safeguard against a crash.

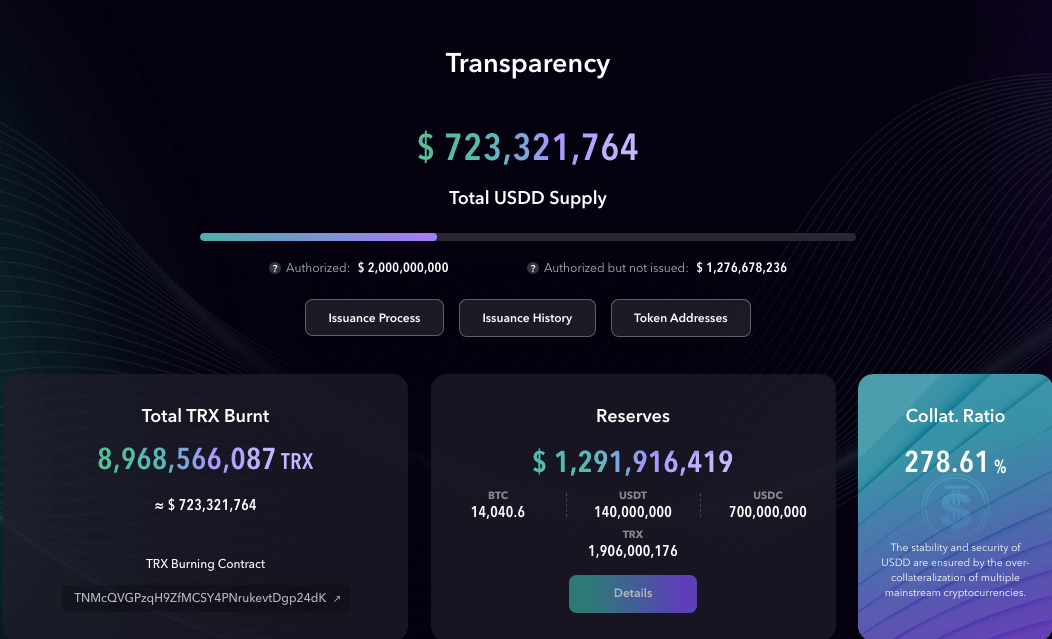

The estimated circulating supply of USDD is $723.3 million, as indicated by CoinGecko and usdd.io. The collateralization ratio is indicated as 278.58% as of June 13, 2022. TRON started on June 12, 2022, guaranteeing a minimum collateral ratio of 130%.

The collateral ratio is the ratio between the collateral and the issued stablecoin. However, crypto Twitter and experts believe this is a bug.

USDD reserves and collateral ratio details from usdd.io

A member of Proximity Labs, a global team of coders and experts, has said the USDD collateral ratio is incorrect. Interestingly, FatMan, a whistleblower from the Terra community who has investigated the collateral ratio, asked his followers if the USDD burnt (locked) collateral was hard coded to display a fully backed USDD supply despite the TRX price falling?

Actually, after looking it up on Twitter, I don't think it's a bug. Worse - it's intentional design. They're claiming the burning contract is collateral but are using an old TRX price instead of the current one... It makes both the collateral figures and ratio false & misleading.

— FatMan (@FatManTerra) June 13, 2022

The whistleblower argues that it could be an intentional design instead of a bug since the “burnt” collateral is worth exactly the same as the USDD supply.

Justin Sun assured USDD peg will be maintained

After USDD’s de-peg, Justin Sun, founder of Tron, assured the community that the TRON DAO Reserve would deploy funds to protect TRX from the funding rate of the asset being shorted on Binance.

TRON DAO will therefore deploy $2 billion, to fight short positions on Binance and fight a negative 500% APR. Sun told followers that a short squeeze was coming. The DAO’s reserve has seen an injection of 800 million USDC to defend the peg of the decentralized stablecoin USDD.

$800 million USDC has been deployed to Binance by TRON DAO reserve at the time of writing.

Funding rate of shorting #TRX on @binance is negative 500% APR. @trondaoreserve will deploy 2 billion USD to fight them. I don't think they can last for even 24 hours. Short squeeze is coming. pic.twitter.com/VRExM6UK70

— H.E. Justin Sun (@justinsuntron) June 13, 2022

Analysts identify weekly top losers

FXStreet analysts have evaluated the top cryptocurrencies to identify losers from the past week. These cryptocurrencies could witness further price decline. For more information, watch this video:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.