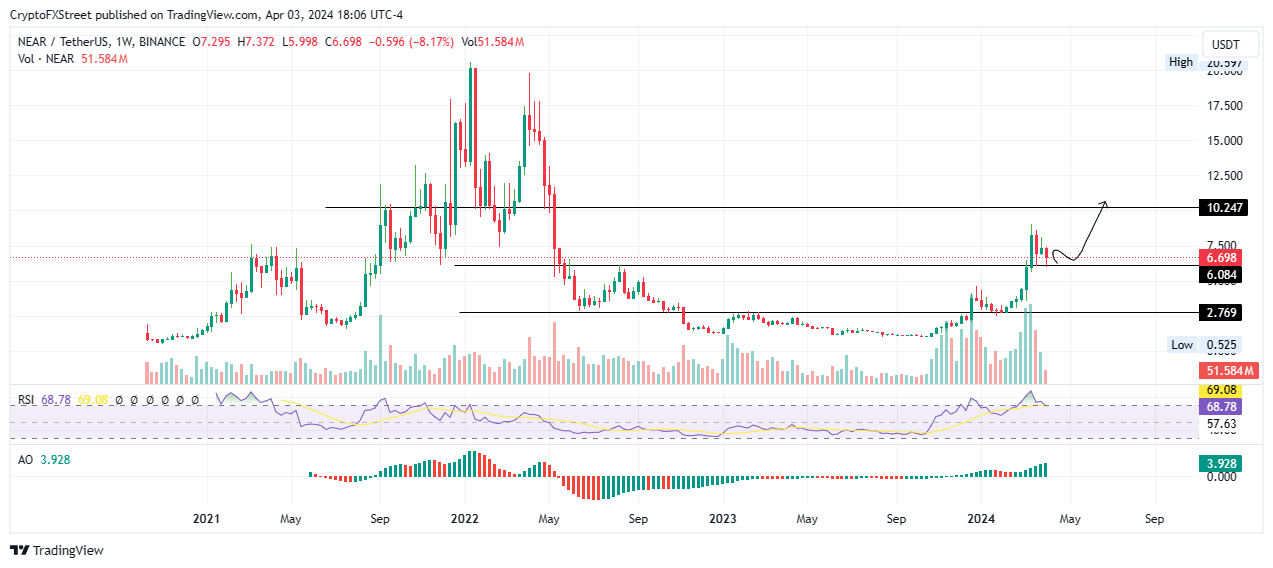

Near Protocol price poised for a strong rally if history rhymes

- Near Protocol price has made a good retest, precipitating an explosive move if bulls hold support.

- NEAR could rally 50% to $10.24 with a successful bounce like it happened after January’s retest of $2.76.

- The bullish thesis would be invalidated upon a break and close below $6.08 on the weekly time frame.

Near Protocol (NEAR) price has broken above two critical roadblocks over the past year. After the first breakout, which happened around December, the AI crypto coin retested the blockade as part of a confirmation of the breakout.

Also Read: Near Protocol Price Prediction: NEAR pumps 10% as investors envision another buy opportunity here

NEAR price eyes 50% gains if history rhymes

Near Protocol price retesting the $2.76 roadblock in January after the December breakout confirmed its next move north to test the $6.08 resistance.

If history repeats or rhymes following a break above $6.08, the current retest of this buyer congestion level could send NEAR price 50% north to clear the resistance at $10.24.

The Relative Strength Index is well above the ‘50’ mean level, toned by growing volumes of the Awesome Oscillator (AO) histograms to show a prevailing bullish trend.

The upside potential for the Near Protocol price is contingent on NEAR bulls defending the $6.08 support. One of the key enablers for this outcome is a show of strength in the Bitcoin (BTC) price.

If the retest is successful and NEAR price nicks the $10.24 barricade, bulls would target $15.00 next, which stands approximately 125% above current levels.

NEAR/USDT 1- week chart

On the flip side, if the $6.08 support breaks, the Near Protocol price could drop. A decisive close below this base on the weekly timeframe would invalidate the bullish thesis, setting the tone for NEAR price to revisit the $2.76 support.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.