MKR holders become 115% richer in six weeks as Maker price rally continues

- Maker price has observed a nearly 10% rise to bring the altcoin to $1,340 over the past 24 hours.

- Since the rally first began in mid-June, the cryptocurrency has gained more than 115%, consequently reducing the concentration of investors facing losses by 26%.

- Whales recently dumped over $17 million worth of MKR, which was picked up by larger wallet holders to suggest overall bullishness in the market.

Maker price has been on the rise consistently for the past few weeks, and the same is being reflected in the investors’ holdings. The price rise, in turn, is being supported by investors who are bullish and accumulating large amounts of cryptocurrency. This makes the altcoin relatively safer from a sudden decline.

Maker price hits a 14-month high

Maker price trading at $1,340 is observing an almost 10% increase in price over the past 24 hours. This has added to the mid-June rally, bringing the altcoin up by more than 115%, hitting a 14-month high.

MKR/USD 1-day chart

At the time of writing, MKR is running hot as investors have been largely accumulating since March. The accumulation intensified in June as whales (addresses holding 1,000 - 10,000 MKR) dropped their holdings potentially to take profits, but the supply was then picked up by larger wallet holders (addresses holding 10,000 - 100,000 MKR).

Maker supply distribution

Thus, investors are supporting the cryptocurrency to protect their profits. This is reflected in the positioning of the Relative Strength Index (RSI), which has been lurking in the overbought zone above 70.0. This suggests that the market is overheated, and theoretically, a cool-down is anticipated.

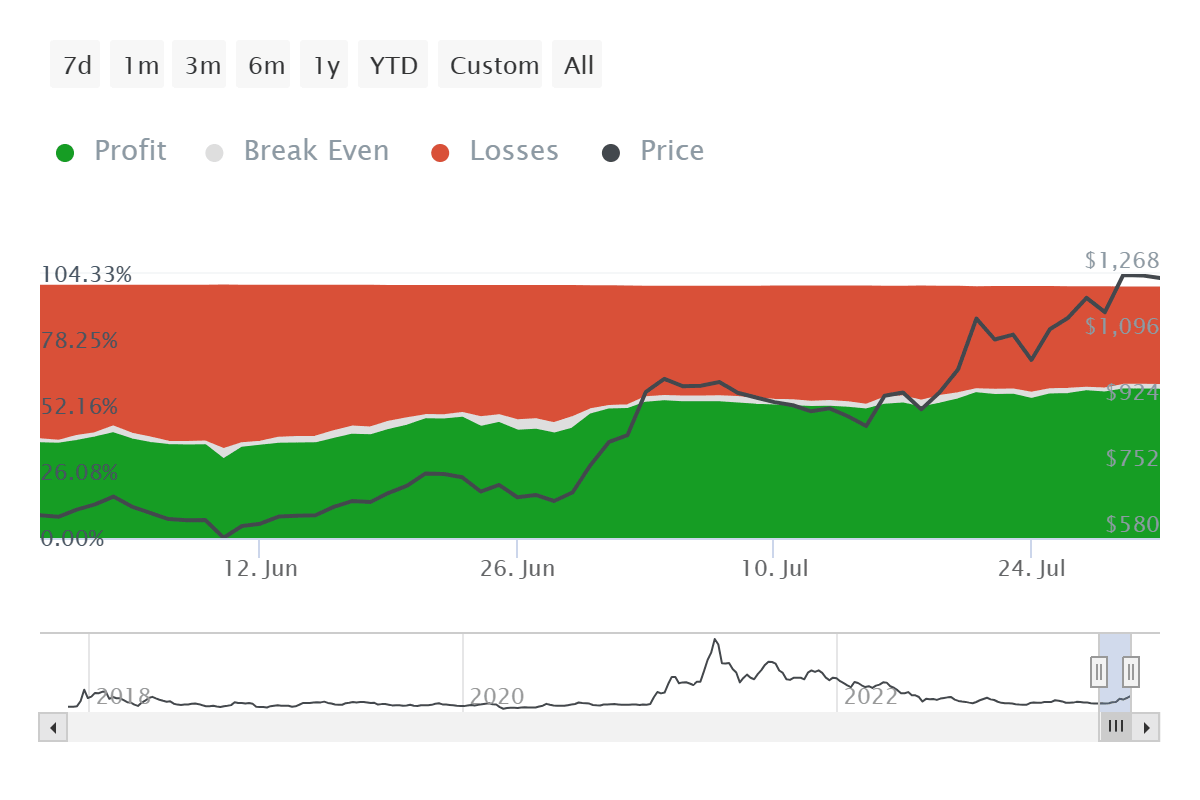

Consistent accumulation would prevent severe corrections, keeping those in profit away from facing losses again. This motivation is strong at the moment. Between mid-June and the end of July, the concentration of investors in losses has reduced by 26%, from 64% to 38%.

Maker investors in profit

To keep this up, MKR holders would need to ensure the movement of tokens is constant and that investors refrain from immediate profit-taking. Otherwise, Maker price could fall back to test $1,107 as support, which acted as a resistance level for almost 13 months.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B05.01.32%2C%252002%2520Aug%2C%25202023%5D-638265320011027266.png&w=1536&q=95)