MATIC price could rally 55% as bulls challenge bears

- MATIC price is grappling with the $0.674 hurdle.

- A successful flip of this resistance could trigger a 55% upswing to $1.01.

- A three-day candlestick close below $0.440 will invalidate the bullish thesis for Polygon.

MATIC price is hovering below a critical resistance level that has prevented gains. If bulls manage to conquer this barrier, the chances of an uptrend will improve drastically, allowing Polygon to trigger a quick run-up.

MATIC price ready to rumble

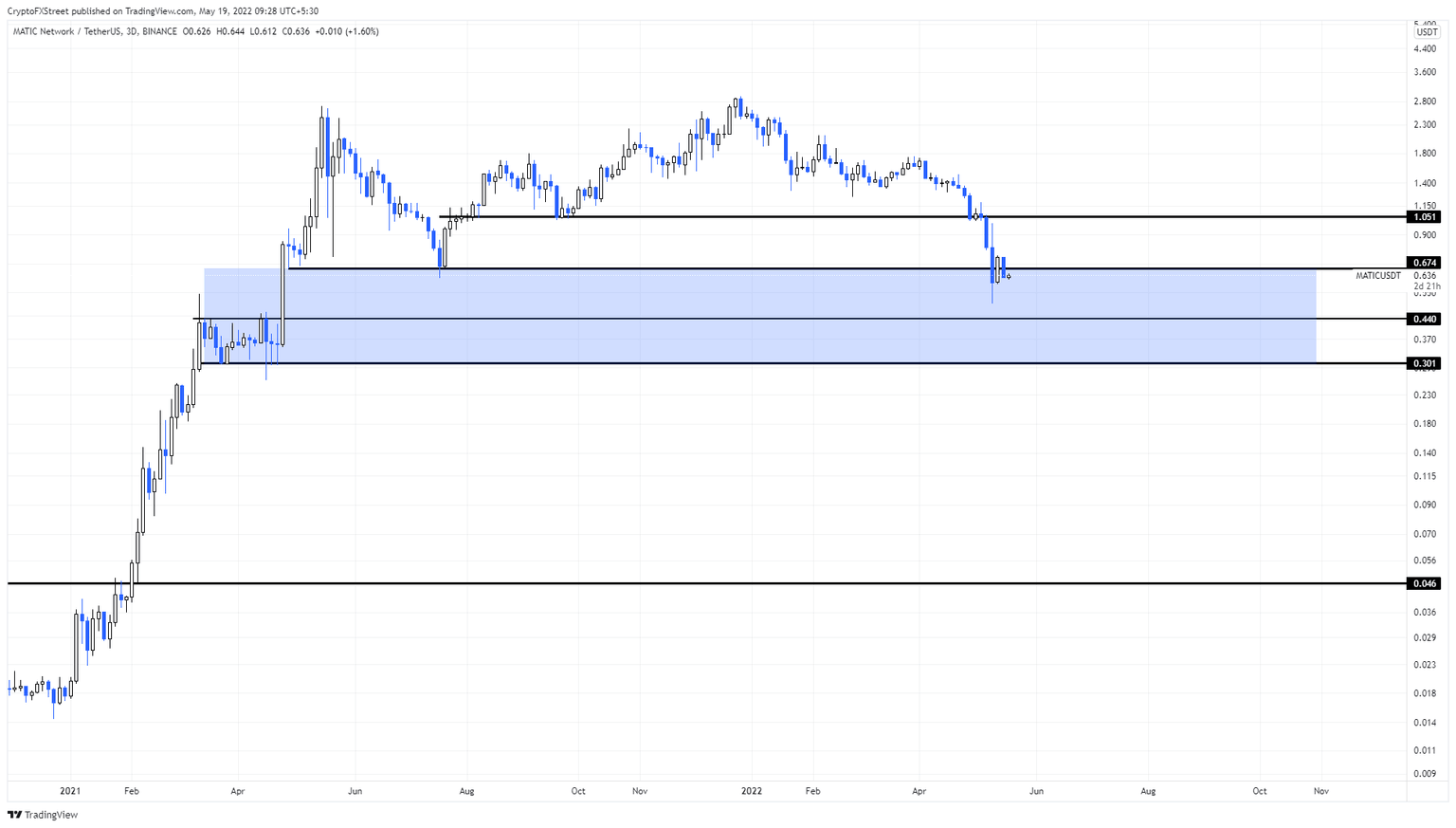

MATIC price, like many altcoins, has suffered a bearish fate in the last ten days or so. Polygon has lost 57% of its market value and flipped the $1.05 and $0.674 support levels into a resistance barriers.

This massive crash came as a result of the UST-LUNA collapse, the ripples of which are still keeping the market in check. MATIC price, however, is trading between the $0.301 and the $0.674 barriers and has the $0.40 foothold as a cushion.

The bulls are trying to take control from the bears and overcome the $0.674 ceiling to trigger a quick run-up. Considering the recent liquidity purge downswing in Bitcoin price, an uptrend seems likely. Therefore, investors need to be prepared for a recovery above $0.674 and a further ascent to $1.01. This move would represent a 55% gain.

MATIC/USDT 3-day chart

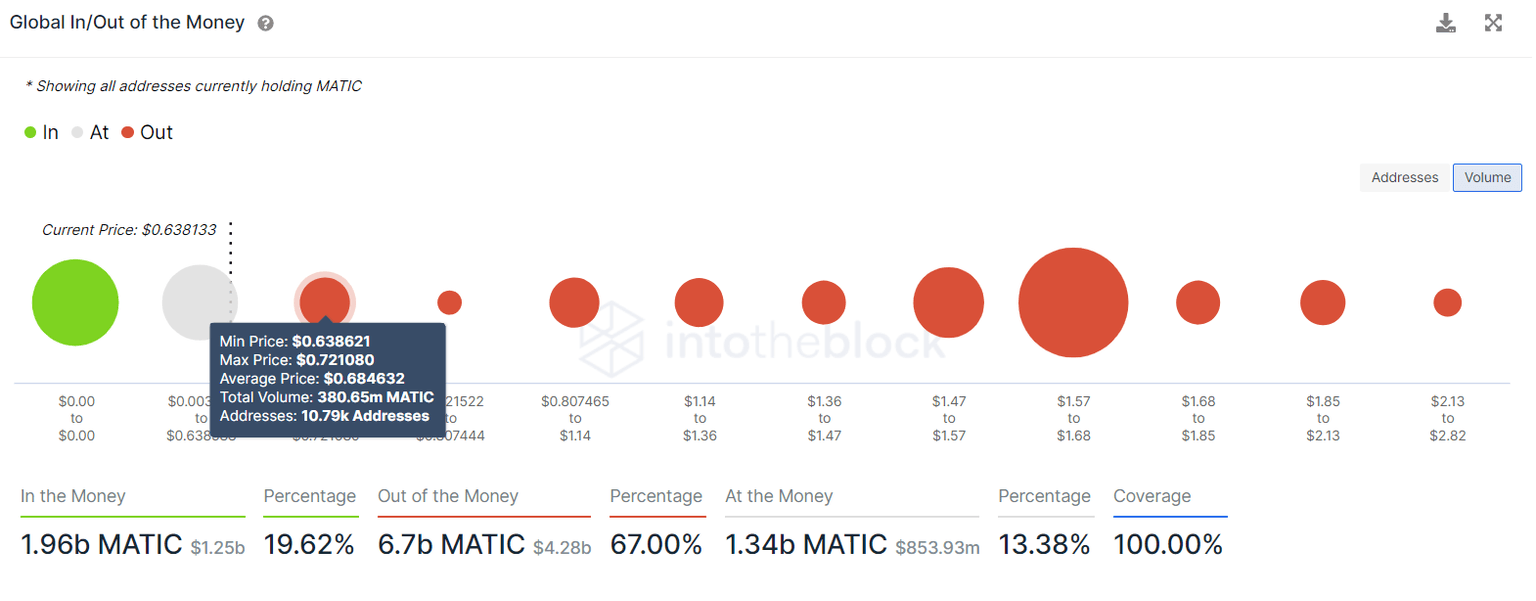

Supporting this uptrend for MATIC price is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This index shows that the next hurdle for bulls extend from $0.638 to $0.721, where roughly 10,800 addresses that purchase roughly 380 million MATIC tokens at an average price of $0.68 are “Out of the Money.”

Interestingly, the GIOM forecasts a much conservaive target of $0.721 but the technicals suggest a move to $1.01. Either way, Polygon seems ready for a quick upswing.

MATIC GIOM

While things are looking bullish for Polygon, a three-day candlestick close below $0.440 will invalidate the bullish thesis by producing a lower low. This development could trigger a 31% crash if the new support fails to absorb the selling pressure.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.