Litecoin Price Prediction: The Bullish vs Bearish Scenario

- Litecoin price hovers within a descending parallel channel.

- The 200-week moving average is currently 65% above the current market value.

- Key levels have been identified for both a bearish and bullish scenario.

Litecoin price is inching towards a breakout, but jumping in too soon could result in a whirlwind of pain.

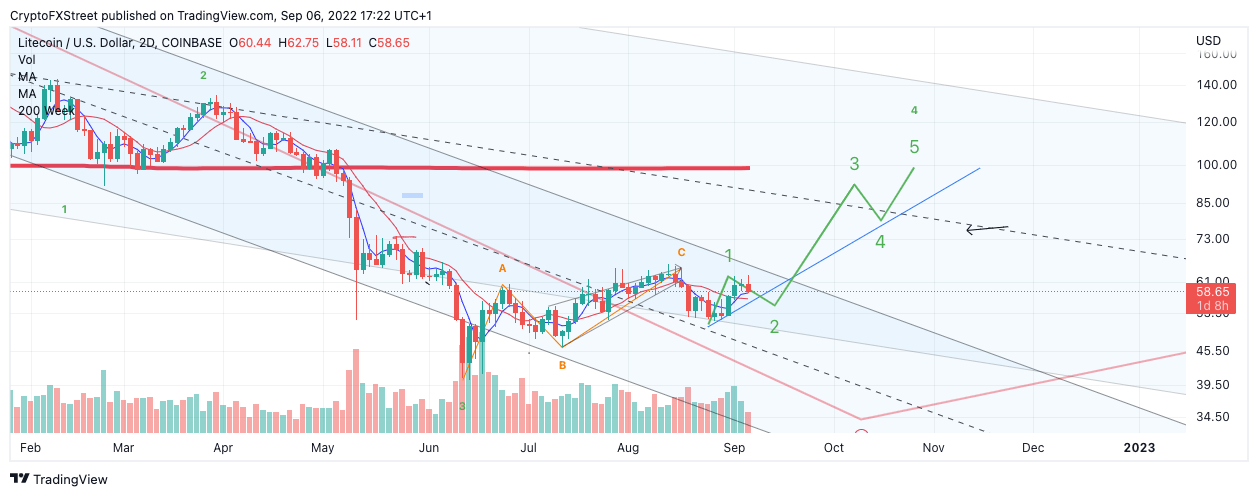

Litecoin price bullish scenario

Litecoin price currently trades at $58.78 as the bulls and bears collide on smaller time frames. Although the Litecoin price has witnessed significant suppression from the bears throughout the summer, a reversal can always occur.

Litecoin price has breached both the 8- and 21-day simple moving averages, which confounds the idea that bulls are ready to retaliate. Additionally, there is an uptick in volume amidst the recent breach.

LTC USD 4-Hour Chart Bullish Scenario

If the bulls can produce a closing candle above $75, a rally towards $90 at the 200-week moving average will be in the cards. Such a move would result in a 65% increase from the current market value.

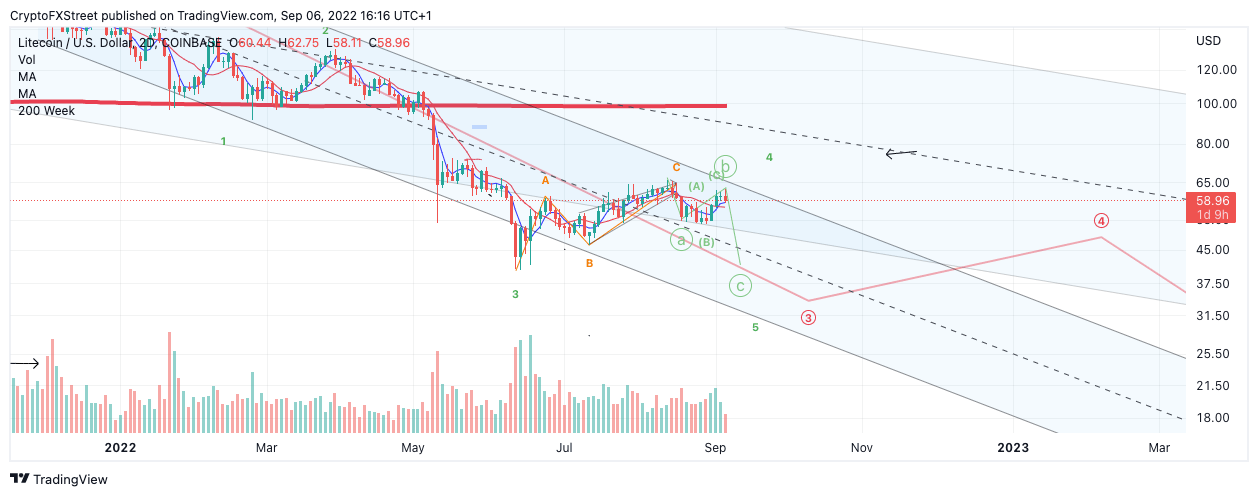

Litecoin price bearish scenario

Litecoin price still has significant boundaries to cross before confidence starts pouring into the market. Litecoin price has not provided a clear five-wave impulse since the June 18 crypto selloff. Additionally, the largest 2-day candle dating back to December 3, 2021, remains unchallenged in size.

Litecoin price will need to stabilize above the 8- and 21-day-SMA's without waking up sleeping bears. Any close below the indicators could provoke a bearish cross and prompt institutional traders to join in for a quick profit.

LTC USD 2-Hour Chart Bearish Scenario

A closing candle below $56 on the 2-day chart could catalyze a plummet into the $30 price zone, resulting in a 48% decrease from the current Litecoin price.

In the following video, our analysts deep dive into the price action of Litecoin, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.