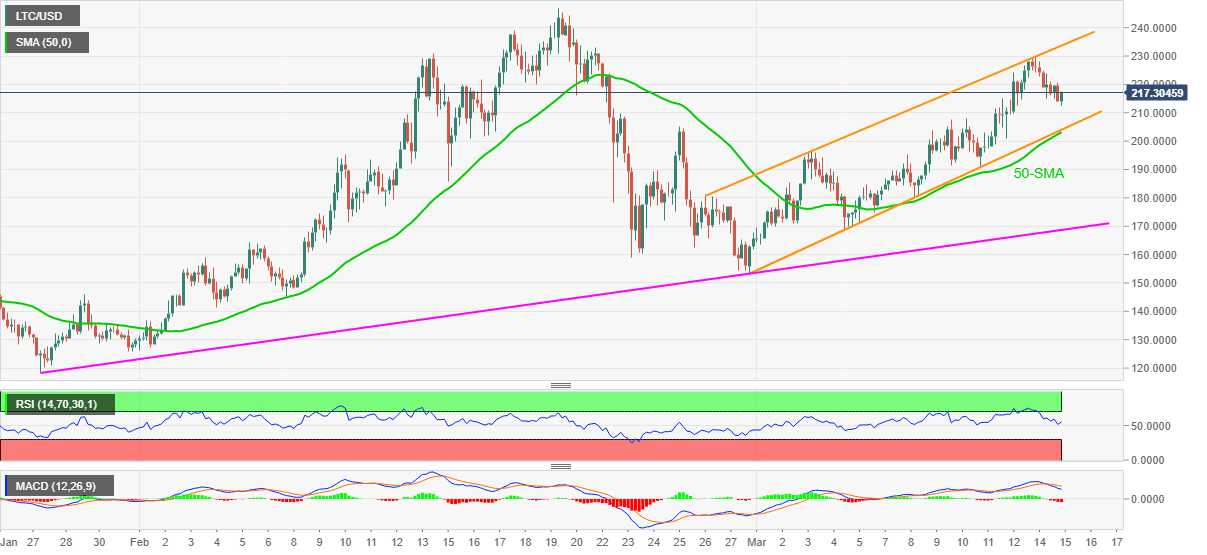

Litecoin Price Prediction: LTC recovery moves eye $233.00 inside rising channel

- LTC/USD bounces off three-day low inside a bullish chart pattern.

- A confluence of channel’s support, 50-SMA tests short-term sellers, bulls aim for February’s high.

LTC/USD picks up bids near $218.00, up 1.82% intraday, during early Monday. In doing so, the cryptocurrency pair recovers from the lowest since Friday as RSI pullback from overbought territory catches a breather inside a three-week-old rising channel.

Given the pair’s rejection to the previous consolidation, inside a bullish chart pattern, LTC/USD eyes to revisit the $230.00 round-figure during the latest upside momentum.

However, the stated channel’s resistance line around $233.00, followed by February’s high near $247.00, will be tough nuts to crack for LTC/USD bulls.

Meanwhile, sellers will find it difficult unless breaking convergence of 50-SMA and the stated channel’s support line, around $203.00, a break of which can drag the quote towards an ascending trend line from late January, currently around $168.00.

If at all, LTC/USD sellers dominate past-$168, February’s bottom surrounding $153 will be the key.

Overall, LTC/USD remains in an upward trajectory with a bumpy road to the north.

LTC/USD four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.