- “I have faith that prices will rebound and come back up fairly soon,” bullish Charlie said.

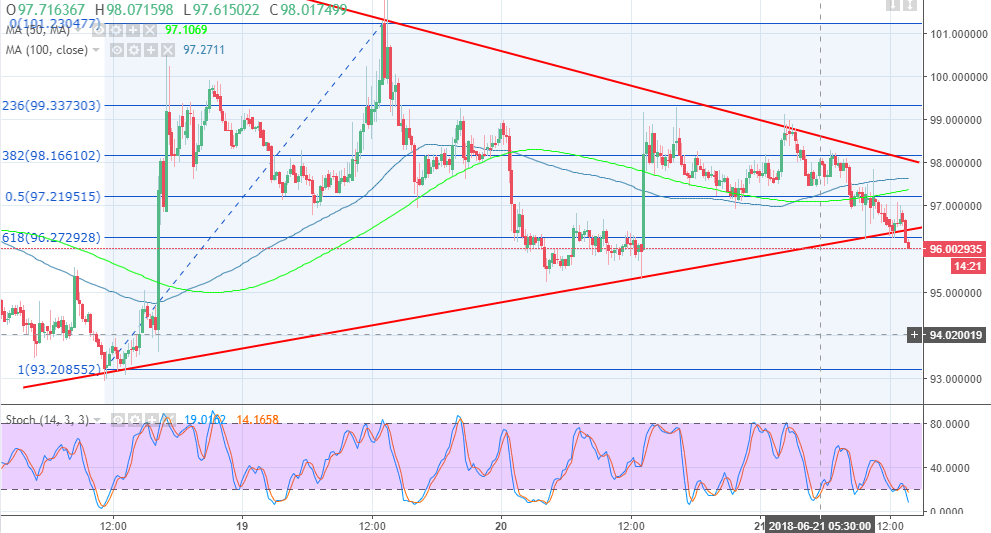

- Litecoin price is testing the key support at $96.00, several barriers are highlighted towards $100.00.

Cryptocurrencies in the market have many barriers to break in order to make higher consolidations. Litecoin price has been stuck below $100, besides applying the Fibonacci retracement highlights several barriers to break before attacking the critical level at $100.00.

In the meantime, Litecoin founder Charlie Lee was in a phone interview with CNBC today and later published a number of tweets regarding security, the risks in the market and cryptocurrency prices at large. He said in relation to the falling prices in the market “I have faith that prices will rebound and come back up fairly soon”. He also commented on the reaction of crypto prices when exchanges are hacked. Lee said:

“It’s like if a bank gets broken in and gold gets stolen, does this affect the price of gold? It shouldn’t. Same with Bitcoin. If the exchange doesn’t protect their coin well enough and gets hacked, it doesn’t really change the fundamentals of the coin that they’re protecting.”

Other experts in the market have also commented on the rising hack attacks in the market. Yo Kwon, CEO of Blockchain Security firm Hosho said with regard to the Bithumb attack:

"These hacks are becoming more frequent as the incentives for hackers remain enticing. Companies need to make a dedicated and continuous effort, through penetration testing and smart contract auditing, for example, to provide the security necessary to protect the assets of their investors and users."

Litecoin price technical picture

Litecoin price must break above the resistance at $97.00 and the 38.2% Fib retracement level with the last high leg at $101.2 and a low of $93.2 close to $98.00. The key resistance is at $100.00, and trading above this level will have the bulls gain momentum to recoil towards higher levels at $110. However, the upper supply zone is at $102.00 and bulls are likely to get a boost after breaking this barrier. The price has broken below the support from the bullish trend line, but battling to find another support above $96.00.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin is showing rising correlation with the S&P 500

Bitcoin and the crypto market have been in an uptrend since Wednesday following the Federal Reserve's decision to cut interest rates by 50 basis points. Bitcoin is up nearly 3% in the past 24 hours, rising briefly above the $63,000 level for the first time in three weeks.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Consensys case against SEC over Ethereum dismissed by Texas court

Consensys announced dismissal of a case it filed against the SEC in April about the agency's alleged actions against Ethereum. Judge Reed O'Connor of the Northern District of Texas dismissed the case on Thursday. Consensys claims that the court failed to examine the "merits" of its claim against the SEC.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Bitcoin: On the road to $60,000

Bitcoin price retested and bounced off from the daily support level of $56,000 this week. US spot Bitcoin ETFs posted $140.7 million in inflows until Thursday and on-chain data supports a bullish outlook.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.