Litecoin debuts in Estonia’s LHV Pank while LTC price struggles to overcome stiff resistance

- Estonia's first bank, LHV Pank, has announced trading in Litecoin and direct investment in crypto assets.

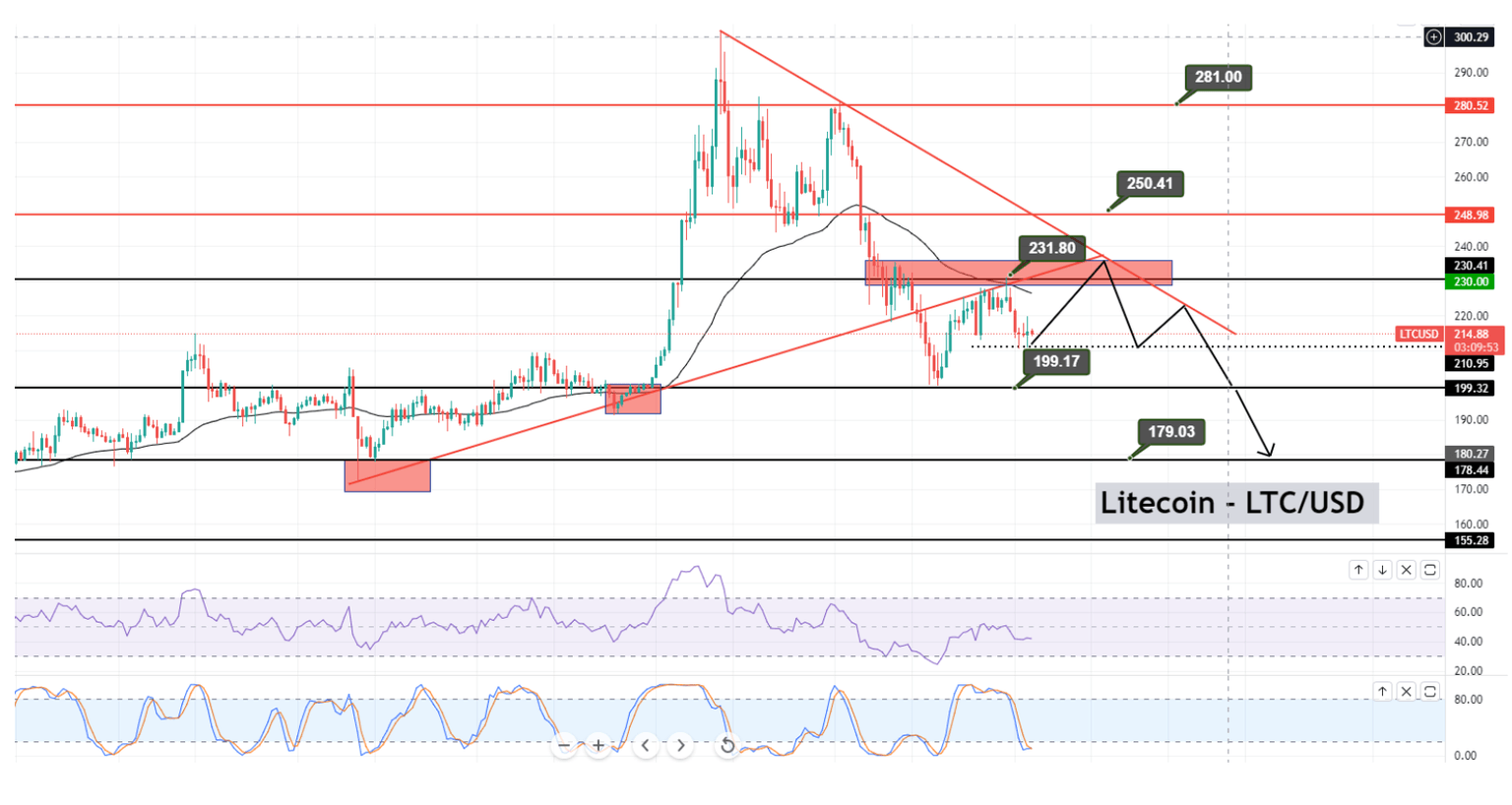

- LTC price faces rejection below the $230 hurdle, and it’s demonstrating a bearish trend.

- Only by overcoming the $230 level can Litecoin rise towards $250.

Litecoin (LTC) is gaining traction as the first bank in Estonia, LHV, announced trading in LTC and other crypto assets. The token now consolidates in a narrow trading range between $230 and $210 despite the significance of the news.

LHV Pank enables access to cryptocurrencies

LHV Pank, Estonia's first bank and the country's largest domestic financial group, has announced trading in Litecoin and direct investment in altcoins. Investors can now buy and sell cryptocurrencies through financial institution, but the digital assets cannot be utilized to pay for goods or services.

Although customers can store cryptocurrencies at LHV for free, all purchases and sales are subject to a 0.5% service fee. The firm enabled access to eight of the most popular cryptocurrencoes, including Bitcoin, Ethereum, Litecoin, Uniswap, ChainLink, Stellar Lumens, Polygon, and Aave. Hence, the participation of Estonia’s first bank can underpin the demand for these digital assets.

Litecoin price looks weak below $230

Litecoin’s technical outlook remains bearish as LTC has disrupted an upward trendline and has crossed below the 50-day exponential moving average at the $230 level. At the moment, the 15th-largest cryptocurrency by market cap is trading with a slight bearish bias. Failing to regain $230 as support could trigger a downswing towards $199 or even $179 support levels.

The technical indicators, such as the RSI and Stochastic RSI, are holding at 41 and 7, respectively, adding credence to the pessimistic outlook.

Litecoin (LTC) 4-hour timeframe - Upward Trendline Breakout

Only a 4-hour candlestick close above the $230 resistance level can invalidate the bearish thesis. If this were to happen, Litecoin would likely see the bulls get back into their long positions pushing prices towards $250. Breaching this hurdle might extend the uptrend to $281.

Author

FXStreet Team

FXStreet