LINK Price: Sell-off in the cards as crypto lending platform Genesis suspends withdrawals

- LINK price stability remains shaky as investors and crypto companies adjust to the aftermath of the FTX crisis.

- Crypto lending unit Genesis suspends withdrawals and new loan applications, citing loss of confidence in the industry.

- Huobi and Bybit are the latest exchanges to announce their cold wallet reserves.

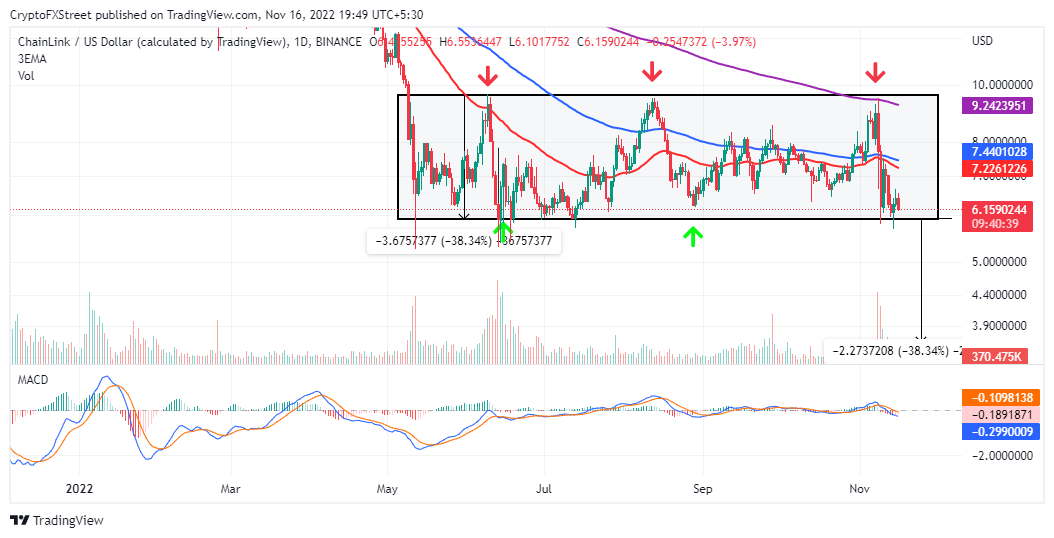

- Chainlink price stares at a 38% descent if rectangle pattern support at $5.96 breaks.

-637336005550289133_XtraLarge.jpg)

Chainlink price is barely holding onto support at $6.00 as the effects of the FTX crisis continue punching holes in an already battered crypto market. Fear is also spreading amid forecasts of the crypto winter stretching to the end of 2023. Meanwhile, Chainlink price trades at $6.19 while bulls work around the clock to prevent a possible 38% move south of its support at $6.00.

Crypto lending unit Genesis suspends withdrawals

The lending unit of crypto investment bank Genesis Global Trading has announced a temporary suspension of withdrawals and new loan applications, citing challenges caused by the collapse of FTX.

According to the company’s website, Genesis Global Capital, the lending unit that serves institutional clients, reported approximately $2.8 billion in active loans for the third quarter of 2022.

Genesis Global Capital interim CEO Derar Islim told investors via a call on Wednesday the unit’s custody services will continue to operate as normal. The unit is currently seeking alternative sources of liquidity.

“This decision impacts the lending business at Genesis and does not affect Genesis’s trading or custody businesses. Importantly, this decision has no impact on the business operations of DCG and our other wholly owned subsidiaries,” reads a statement by Genesis Global Capital’s vice president of communication and marketing, Amanda Cowie.

The FTX crisis has put centralized exchanges (CEXs) in the spotlight, forcing them to disclose their reserves. According to the latest developments, Bybit and Huobi exchanges have released their cold wallet reserves, totaling $1.91 billion and $3.26 billion, respectively. Market participants still wait for Gate.io and MEXC exchange platforms to disclose their reserves. Binance was the first to make public its proof-of-reserves in a bid to foster transparency in the market.

Chainlink price dangerously holds at the edge of a cliff

The crypto sell-off since early last week saw Chainlink abandon the push to break a stubborn rectangle pattern resistance at $9.59. Intriguingly, the declines that followed cooled off at the pattern’s support, as highlighted at $5.91. Bulls attempted a recovery, but due to the many opposing forces in the market, LINK price was forced to retest the same support line at $5.91.

LINKUSD daily chart

A 38% freefall is foreshadowed if Chainlink price cracks the rectangle support. Although the rectangle pattern is neutral, a breakout is expected in the same direction as the trend preceding its formation. The 38% target equals the width of the rectangle – extrapolated below LINK’s breakout point at $6.00.

A sell signal from the Moving Average Convergence Divergence (MACD) indicator cements the bears’ presence in the market. However, short positions may be triggered after the price extends the leg below the rectangle pattern. Otherwise, Chainlink will be looking forward to the resumption of its uptrend, where LINK price could shatter the rectangle resistance at $9.58.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren