Linear Finance explodes 145% following LINA listing on Binance

- Binance lists Linear Finance, expanding its exposure in the cryptocurrency market.

- LINA goes ballistic following the listing and achieving an all-time high of $0.29.

- A correction is likely to come into the picture if the immediate resistance at $0.29 remains intact.

The Malta-based Binance exchange has announced the addition of Linear Finance to its list of supported trading instruments. According to the exchange, support will be available in the Innovation Zone.

Linear Finance deposit live on Binance

Binance is introducing LINA on a Launchpad subscription format. Linear users will enjoy a 30% discount when purchasing LINA using Binance Coin (BNB) before the trading begins. This subscription had been scheduled to begin “shortly at 2021-03-18 5:00 AM (UTC) and will be open for 4 hours.”

Linear trading will take place using three pairs; LINA/BTC and LINA/BUSDm, and LINA/USDT. The actual trading commenced at “2021-03-18 12:00 PM (UTC).” The news on the listing was received well by the community, which explains the ballistic price action.

Linear faces retreat after gigantic upswing

Linear Finance is trading at $0.28after rising by more than 145% over the last 24 hours. Most of the accrued gains took place after the crypto was listed on Binance. The Launchpad subscription is likely to have encouraged most traders to buy more before the trading kicked off, adding weight to the tailwind

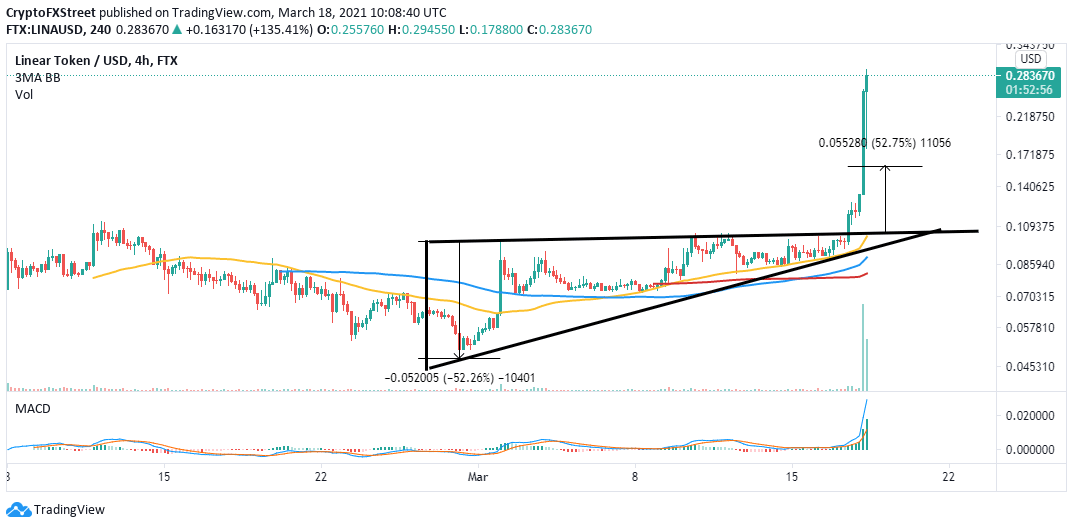

The 4-hour chart highlights a recently formed ascending triangle. The breakout from the pattern also bolstered the token upwards. However, a correction is most likely to take precedence as the listing craze cools off. Therefore, higher support must be established to ensure the upswing continues.

LINA/USD 4-hour chart

Looking at the other side of the picture

On the upside, trading the recent high will leave open-air as the price enters the discovery mode. On the upside, eyes are glued on $0.3 with the Moving Average Convergence (MACD) reinforcing the bulls’ influence.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren