Is Uniswap the best-performing DEX exchange?

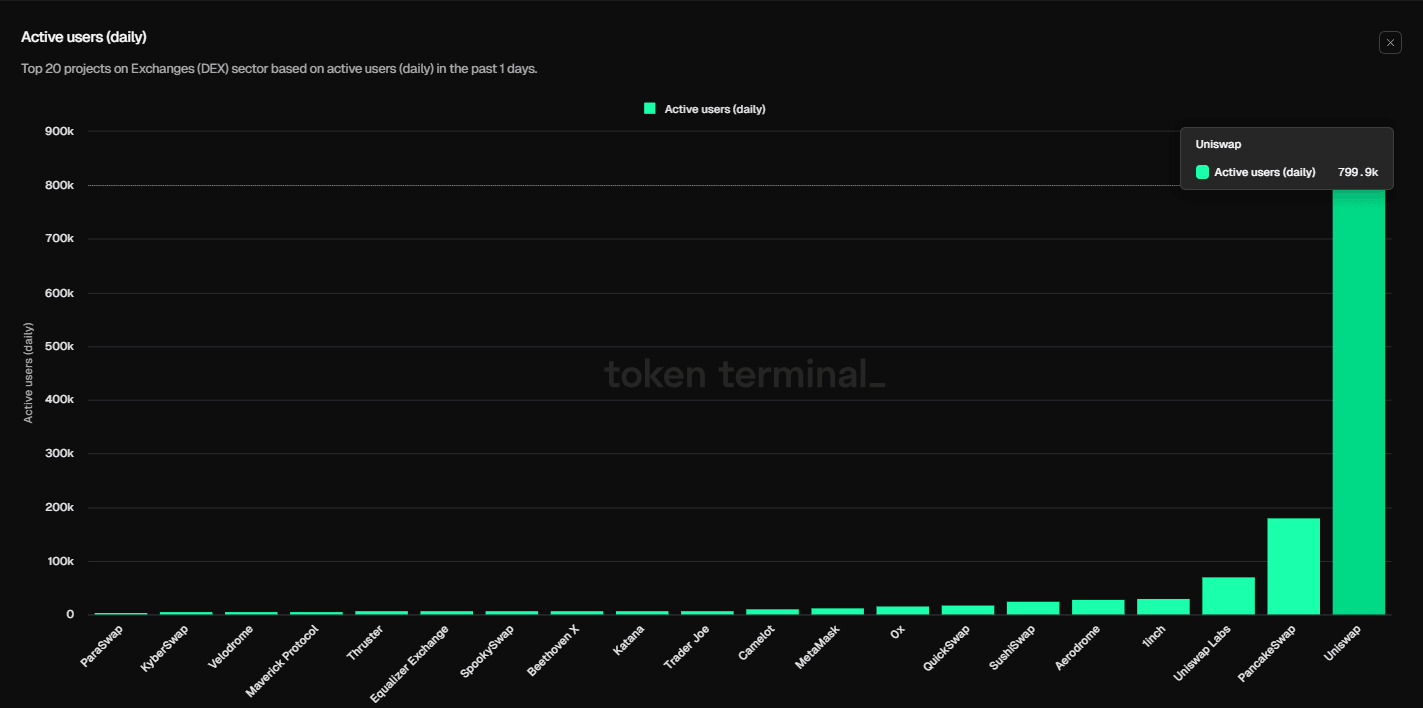

- Uniswap daily active users are the highest than other DEX exchanges.

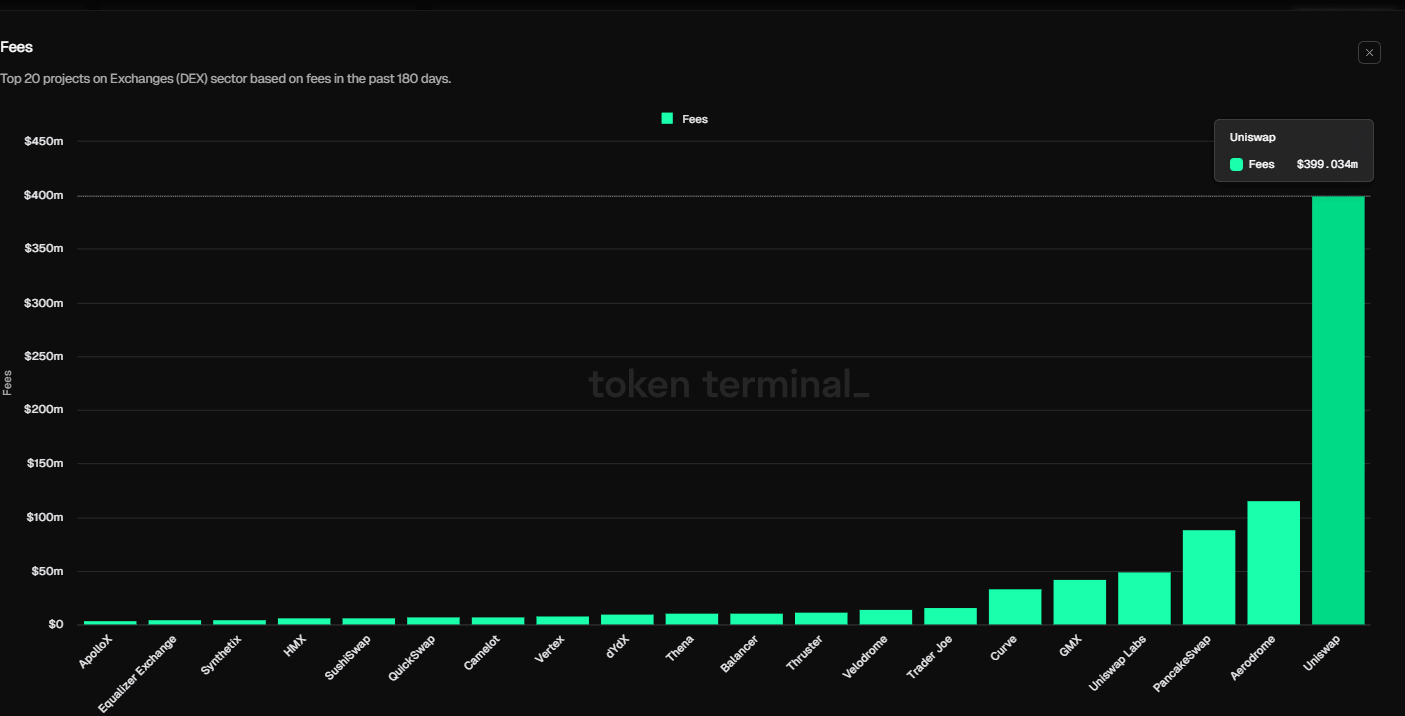

- Token Terminal data show UNI has collected $399 million in fees in the past three months.

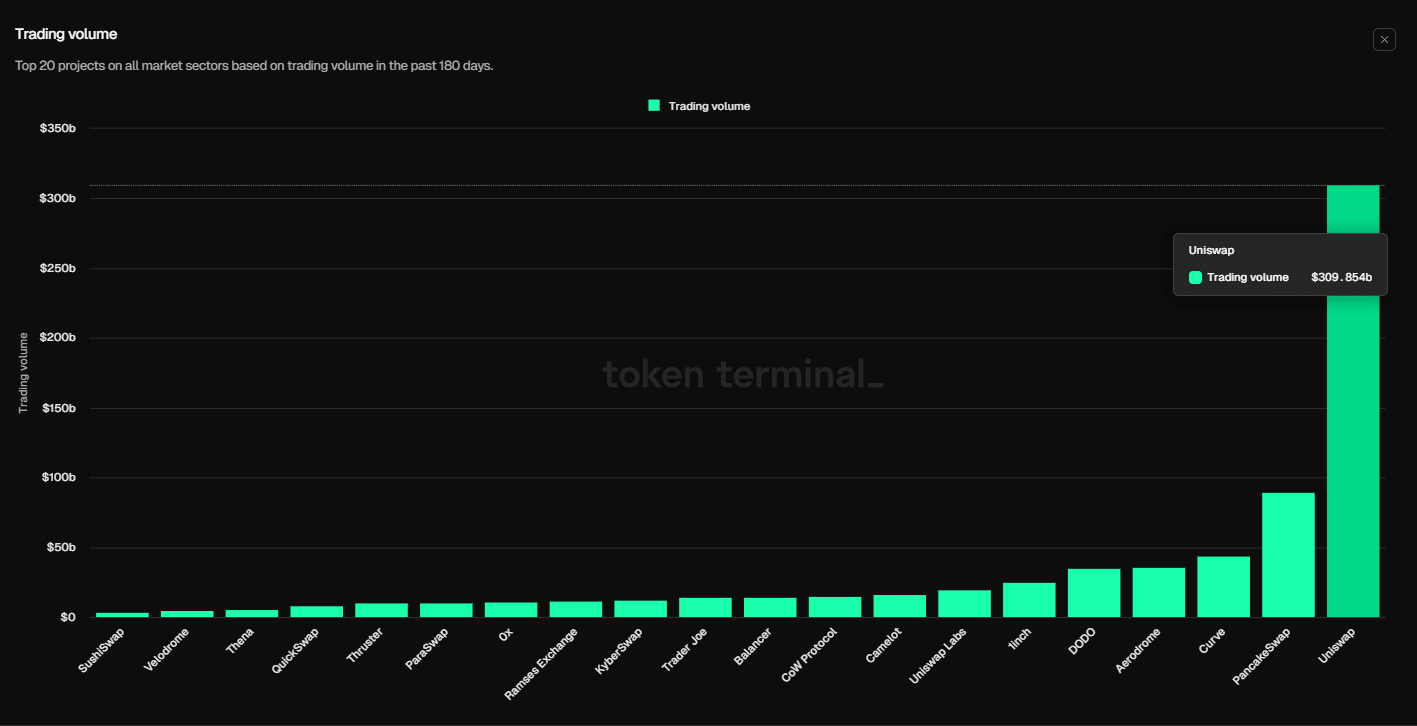

- UNI’s 180-day trading volume is the highest in the DEX sector.

Uniswap (UNI) price trades above $7.8 and gains over 6% at the time of writing on Thursday, reflecting optimism as on-chain metrics indicate strong performance. Token Terminal data shows UNI has outpaced other decentralized exchanges (DEX) platforms in daily active users, fee collection, and trading volume over the past three months. Furthermore, the Santiment’s Supply on Exchanges metric has constantly declined since August, suggesting increasing confidence among investors and a potential rally ahead.

Uniswap outperforms most DEX exchanges

The crypto aggregator platform Token Terminal data shows how Uniswap has outperformed most decentralized exchanges over the last three months.

Uniswap’s daily active users help track network activity over time and align with the bullish outlook. The graph below shows that the daily active users on the Uniswap platform are 799,900, the highest daily users compared to the top 20 projects in the DEX sector. This indicates that demand for UNI’s platform usage is increasing, which could propel a rally in Uniswap price.

Top 20 DEX projects active daily users chart. Source: Token Terminal

Additionally, Uniswap’s fee collection surpasses that of other platforms in the DEX sector. In the past three months, UNI has collected over $399 million in fees, further bolstering the bullish outlook for UNI’s price.

Top 20 DEX projects Fees chart. Source: Token Terminal

Another aspect bolstering the platform’s bullish outlook is a surge in traders’ interest and liquidity in the UNI chain. UNI’s 180-day trading volume is $309.85 billion, the highest compared to the top 20 projects in DEX sectors.

Top 20 DEX projects trading volume chart. Source: Token Terminal

Lastly, the Santiment Supply on Exchanges metric declined from 76.74 million on September 28 to 75.58 million on Thursday and has constantly declined since August. This 1.5% decline in supply on exchanges indicates increasing confidence among investors as holders remove UNI tokens from exchanges and store them in cold wallets, reducing selling pressure on UNI’s price.

%2520%5B14.32.02%2C%252010%2520Oct%2C%25202024%5D-638641598247134338.png&w=1536&q=95)

UNI Supply on Exchanges chart. Source: Santiment

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.