Is the Axie Infinity price setting up for a monsoon upswing?

- Axe Infinity price is up 5% on the day

- AXS price could rally towards $15.

- Invalidation of the Bush thesis would arrive from a breach below the $9.26

Axie Infinity price could rally considerably to challenge liquidity levels from 2022's $15-$20 range. Still, other cryptocurrencies are showing more promise in the market, and thus Traders must be conscientious of the risk that trading Axie Infinity price bears.

Axe Infinity price shows potential

Axie Infinity price (AXS) is moving in unison with the rest of the Crypto market as the digital risk assets show potential for more gains. The 5% rise on the day may be a part of a much larger move, but caution should be applied as the technicals have not provided a confirmation signal as of yet.

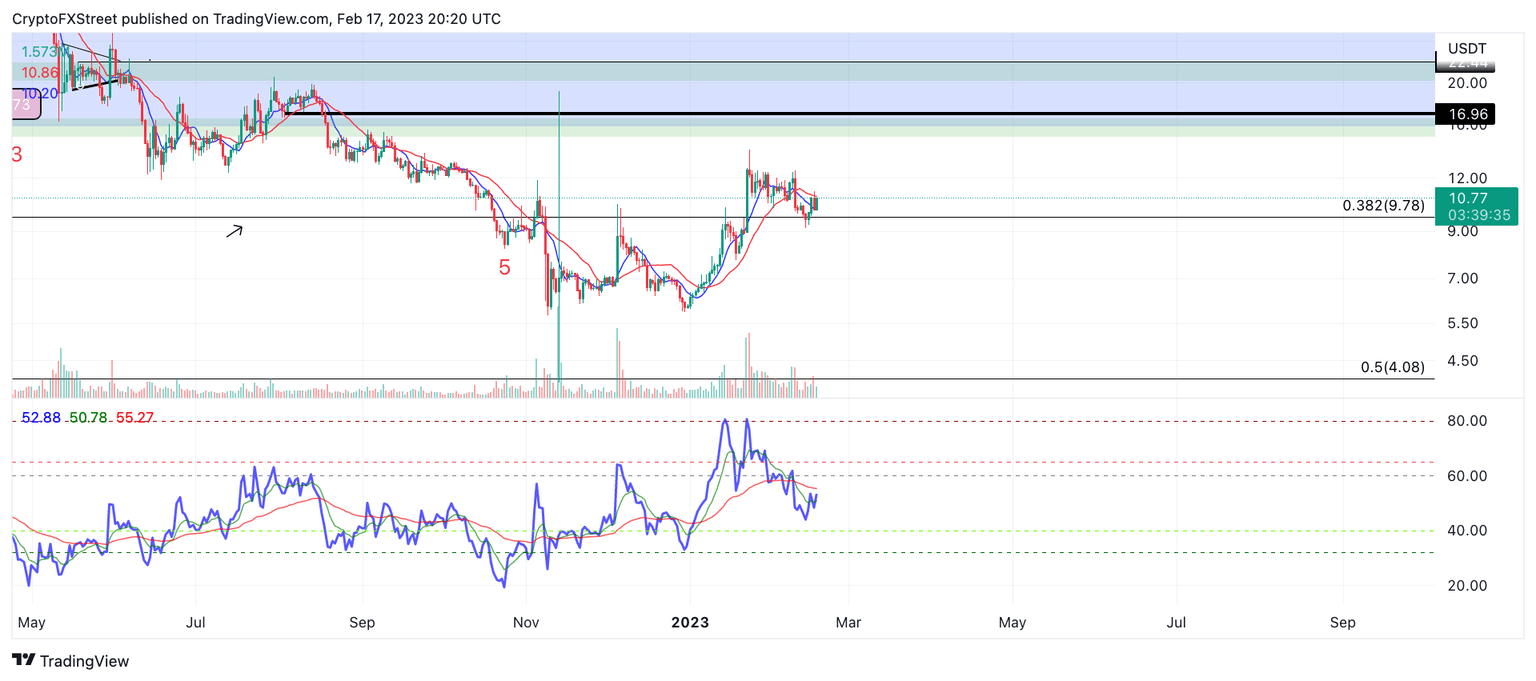

Axi Infinity price currently auctions at $10.64 as the bulls have found support from the 21-day simple moving average (SMA). At the time of writing, the AXS price is consolidating between the 21-Day SMA and the 8-day exponential moving average (EMA). This is a common display of congestion before an uptick in volatility enters the market. Traders should utilize this time to prepare for a volatile swing in the coming days.

If the market is genuinely bullish, the AXS price could rally as high as 65% to target liquidity levels from the 2022 sell-off near $15.15

However, it should be noted that there are several cryptocurrencies in the market presenting stronger confluence signals. The Relative Strength Index and an indicator used to gauge momentum by analyzing previous swing points, does not show a bullish divergence within the current range as it does on other cryptocurrencies such as OCEAN. Considering this evidence, the confidence of a strong move for AXS may be stifled, leading to traders looking elsewhere in the market.

AXS/USDT 1-Day Chart

Thus, traders should make sure to perform healthy risk management if they are to engage with the AXIE Infinity price. Invalidation of the bullish thesis would occur if the bears happen to tag the $9.16 swing low that was established on February 13th. In doing so the AXS price could decline towards the $8 liquidity zone which would result In a 22% decrease from Axie's current market value.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.