Is it time for ETH beta rotation as Ethereum Dencun Upgrade and Ether ETF narratives catch steam?

- Ethereum price is coiling up for a move north with abounding bullishness amid broader market optimism.

- With Dencun upgrade and Ether ETF speculation, ETH could make it to the $4,000 psychological level.

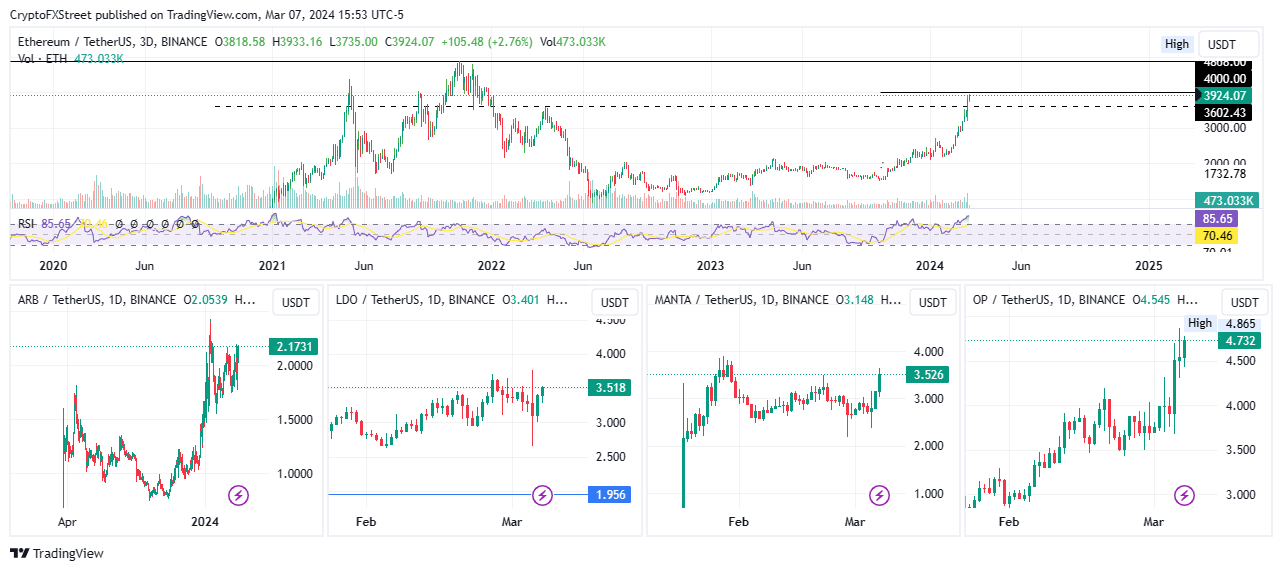

- The liquidity rotation could bode well for Ethereum betas ARB, LDO, MANTA and Op, which are beginning to wake up.

All eyes remain peeled on Ethereum (ETH) price after Bitcoin price had its own day earlier this week when it recorded a new all-time high (ATH) at $69,324. While Ether’s all-time high of $4,868 remains a rather ambitious target for now, the $4,000 threshold may come sooner than expected with the right drivers.

Also Read: Nearly $200 million in ETH burned as Ethereum gears up for Dencun upgrade

Bullish outlook among Ethereum holders

Ethereum (ETH) price is eyeing the $4,000 psychological level, a region last tested in January of 2022. Ether price could hit its target soon as two bullish fundamentals steer the Ethereum price.

Ethereum holders are anticipating the two catalysts that are likely to drive an ETH price rally this cycle. The upcoming Cancun-Deneb (Dencun) Hard Fork and the SEC’s decision on the Spot Ethereum ETF are the two catalysts for the altcoin.

The ETH price continues to increase as investors appear to be pricing in the positive effects of the upcoming Dencun upgrade and the possibility that the US Securities & Exchange Commission (SEC) approves exchange-traded funds (ETFs) that track Ether before the year is out.

The next in line for a potential all-time high test is #Ethereum.

— Michaël van de Poppe (@CryptoMichNL) March 6, 2024

Why?

- Dencun upgrade.

- Potential Spot ETH ETF approval.

Crucial resistance is approaching, but the $BTC pair has barely moved.

We'll likely see more strength coming from this asset. pic.twitter.com/LyWh8ht9ow

With these two fundamentals at play, Ethereum betas are likely to benefit, potentially becoming the next sector category to explode. Already, some of them are waking up, including Arbitrum (ARB), Lido DAO (LDO), the Manta Network (MANTA) and Optimism (OP). The liquidity from the Ethereum market could spill over into these betas to inspire a surge in their prices.

In the meantime, data according to Token Terminal shows that the Ethereum network leads by far with $34.6 million on metrics of the top 25 projects in all market sectors based on daily cumulative fees. The Uniswap network follows at a distance with $6.3 million.

Market sectors daily cumulative fees

On metrics of active daily users, however, the Ethereum network does not fare so well, coming in at position seven after Bitcoin and Solana, respectively.

Market sectors active users

Meanwhile, Ethereum price is edging close to the $4,000 psychological level after breaching the $3,900 milestone. At the time of writing, Ethereum price is trading for $3,924.

ETH/USDT 3-day chart, ARB/USDT 1-day chart, LDO/USDT 1-day chart, MANTA/USDT 1-day chart, OP/USDT 1-day chart

Ethereum development FAQs

After the Merge, the Ethereum community is looking at the Sharding upgrade next, which has been slated for sometime later in the year. The development can be summarized in four words, “scalability through more efficient data storage.” The software update will increase the capacity of the blockchain, widening the amount of data that can be stored or accessed. At the same time, all services running atop the Ethereum blockchain will enjoy significantly reduced transaction fees.

A fork is the splitting of a blockchain after developers agree and proceed to implement upgrades. The decision comes after these developers reach a consensus for a software upgrade. The ensuing part will see one part continue with the status as is, while the other one will proceed with new features combined with the former ones. A hard fork basically entails permanent divergence of a new side chain from the original one, while a soft fork is doing the same, only difference being that it is temporary.

EIP-4844 is an improvement proposal for the Ethereum network. The upgrade promises reduced gas fees, which is a valuable offering considering the high transaction cost that continues to daunt crypto players. It has been a long-standing concern for the Ethereum network. The proposal is also referred to as “proto-Danksharding,” with an unmatched ability to increase the speed of transactions on the Ethereum blockchain. At the same time, it helps to reduce the transaction cost as everything becomes decentralized.

Gas token is a new, innovative Ethereum contract where users can tokenize gas on the Ethereum network. This means they can store gas when it is cheap and start to deploy the gas once the market has shifted to the north. The use of Gas token helps to subsidize high gas prices on transactions, meaning investors can do everything from arbitraging decentralized exchanges to buying into initial coin offerings (ICOs) early.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.