Is ApeCoin price aiming for new lows?

- ApeCoin price is down 14% since the beginning of October.

- APE price is in extremely oversold territory on the Relative Strength Index while volume pours into the market.

- Invalidation of the bearish thesis can occur if the bulls reconquer $6.35.

ApeCoin price is experiencing a strong sell-off that is unlikely to end soon. Key levels have been defined.

ApeCoin price nosedives

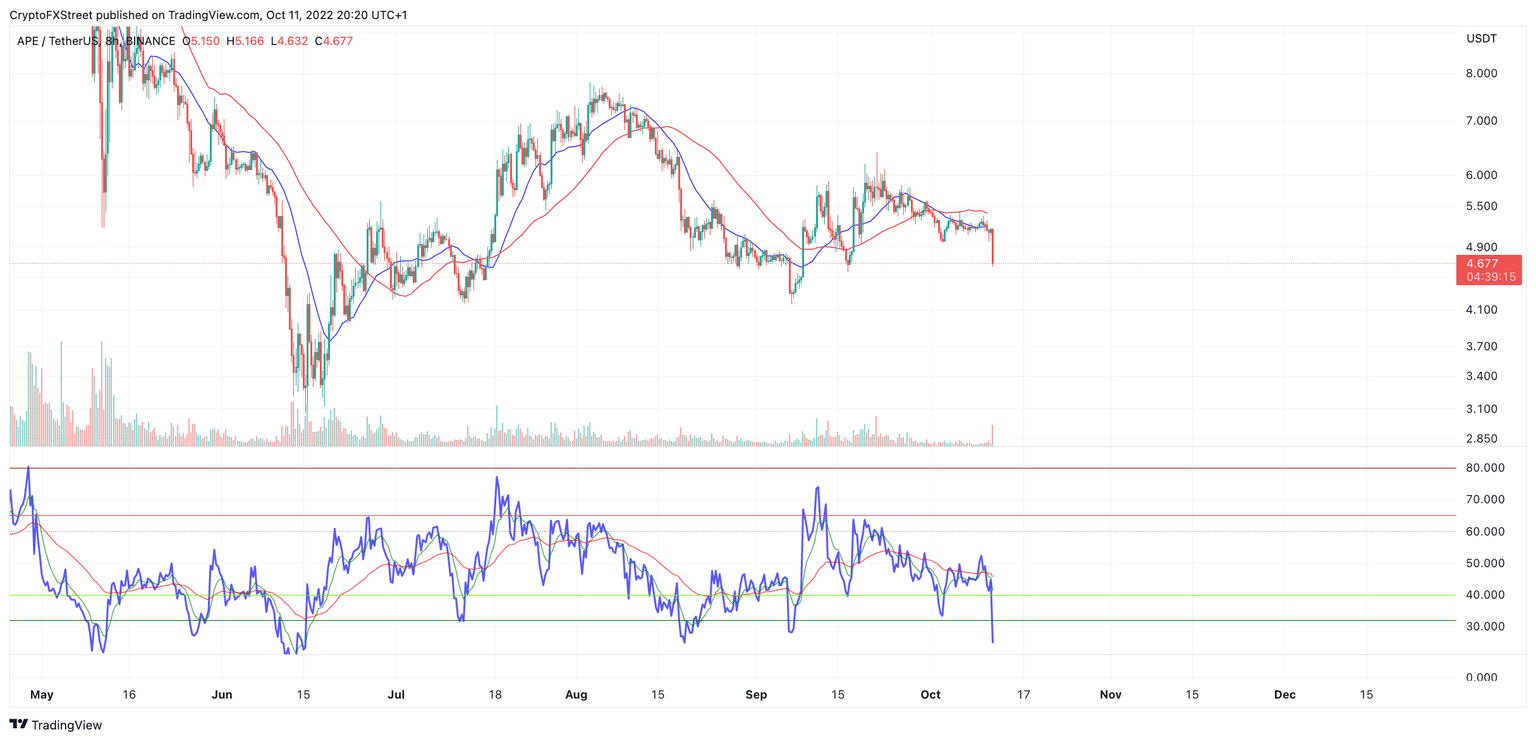

ApeCoin price is currently down 14% for the month of October. The Ethereum-based token witnessed a sharp decline during the start of the second trading week of October, as the bears rejected upward movement from the 8-day Exponential Moving Average. Based on the strong rejection, if the ApeCoin price does not recover soon, a sweep-the-lows event will be imminent.

APE price currently auctions at $4.68. The bears have successfully breached the boundary of support on the Relative Strength Index. As the indicator descends into extremely oversold territory, an influx of bearish volume is spotted on the 8-hour chart. Combining these two factors, APE price should decline further, with September low at $4.29 and the June 15 lows at $3.12 as key targets.

APE/USDT 8-Hour Chart

Invalidation of the bearish thesis can occur if the bulls reconquer the $6.35 swing high produced on September 22. The breach of the latter could trigger a buying frenzy targeting liquidity levels near $10. Such a move would result in a 100% increase from the current ApeCoin price.

In the following video, our analysts deep dive into the price action of Apecoin, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.