Institutions pour $3.6M into Polkadot ahead of parachain auctions, pushing DOT to breakout

- The 12th auction on Kusama is set to commence on October 23.

- The staking rate on Polkadot has dropped to 58.5%; it has relatively stayed constant for Kusama at 42.8%.

- Kraken announced support for Parachain auctions.

- The platform empowered clients to invest $35 million in Kusama auctions.

- The DOT founder recently announced a $774 million development fund for DeFi.

Digital asset managers have reported a rise in the institutional capital inflow in Polkadot as the overall cryptocurrency market capitalization climbs higher. A Polkadot founder announced $774 million dedicated for developing DeFi projects.

Polkadot is a top choice among institutions, investment flow in DOT spikes

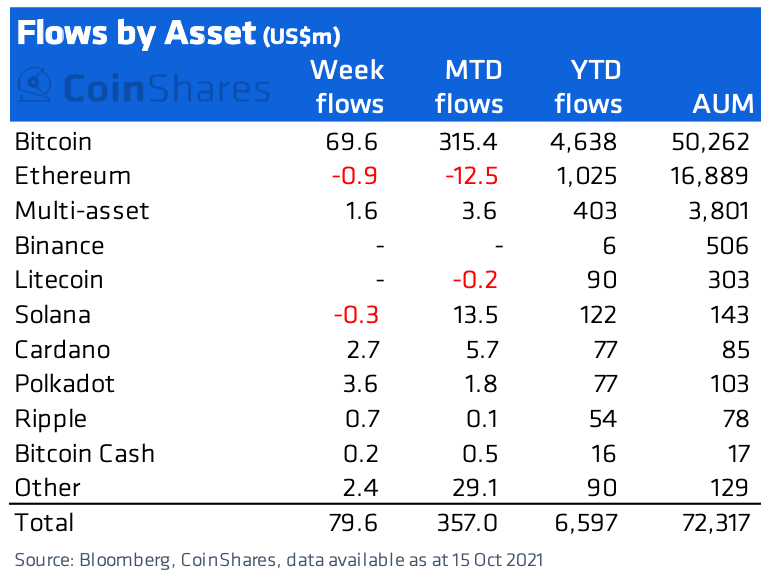

Over $80 million in institutional investment flowed into cryptocurrency funds last week. Of the $80 million, $3.6 million was dedicated to Polkadot products.

Institutional inflow by assets as of October 15, 2021.

The Polkadot ecosystem has been abuzz with new updates since the announcement of the Parachain launch. The 12th Kusama auction is set to go live on October 23. The new proposal on Kusama aims to schedule 1 auction per week for the next 48 weeks. Winning parachain projects will be onboarded at the beginning of the following lease period as per the proposal.

Based on the community's response to the Polkassembly post "The Case For Continuous Auctions", a council member submitted a motion for council to vote on scheduling the next auctions. If passed, the first auction will be at block #9777777 [Oct. 23, 2021].https://t.co/Av8OpeMxY8

— kusama (@kusamanetwork) October 18, 2021

Proponents expected the staking rate on Polkadot to remain steady; in contrast, there was a drop to 58.5%. Kusama’s staking rate remained steady at 42.8%. The news of the Polkadot-Kusama bridge project led to a bullish outlook on KSM price since it boosts the interoperability of assets on both blockchains.

Leading cryptocurrency exchange Kraken announced support for Parachain auctions. Last week there was an announcement that the world’s largest cryptocurrency exchange, Binance, supporting the auction. Clients on Kraken’s platform invested over $35 million in Kusama parachain auctions.

Gavin Wood, the founder of Polkadot and Kusama, recently announced $774 million slated for a development fund for DeFi. Wood teased that the fund is ready to spend on innovative ideas. Instead of burning slowly, the network’s governance is keen on investing in anything it believes is valuable.

The @Polkadot treasury currently has 18,936,300 DOT (DOT, not USD - do the math) in it ready to spend on *your* ideas for building, improving, educating and indeed, anything else that the Polkadot governance believes valuable.

— Gavin Wood (@gavofyork) October 17, 2021

FXStreet analysts have evaluated DOT price and predicted that the altcoin is primed to hit higher highs after cracking $40.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.