Institutional crypto investors spooked as Bitcoin spot ETF approvals could face delay

- Institutions have pulled out more than $107 million in the week ending August 4 after 21 weeks, as bearishness seems to be exceeding optimism.

- While the future of spot Bitcoin ETFs continues to hang in the balance, Cathie Woods believes that most probably all ETFs will be approved at once or none would be.

- Bitcoin price is most likely set to face a price drop to $24,700 or potentially $21,400.

The lack of recovery in the crypto market seems to be getting to the investors, especially the large wallet holders. Their behavior had already been displaying bearish tendencies; their recent moves reaffirmed this scenario. Additionally, skepticism regarding the recent Bitcoin spot ETF filings is further fueling a bearish narrative.

The crypto market loses more than just money

Institutional investors have been one of the biggest driving factors for the recent rally, and their withdrawal tends adversely affect the market. A similar situation seems to be developing at the moment, with the big-buck investors taking a step back from crypto-related assets. The week ending August 4 noted more than $107 million pouring out of crypto products.

Institutional investment

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

These outflows are the highest observed in about 21 weeks, making this move a concerning development for Bitcoin price. As it is, BTC has been ranging under the $30,000 mark with no intentions of flipping the price point into a support floor. According to an FXStreet analysis, there is a much larger potential for a price drop than a rise.

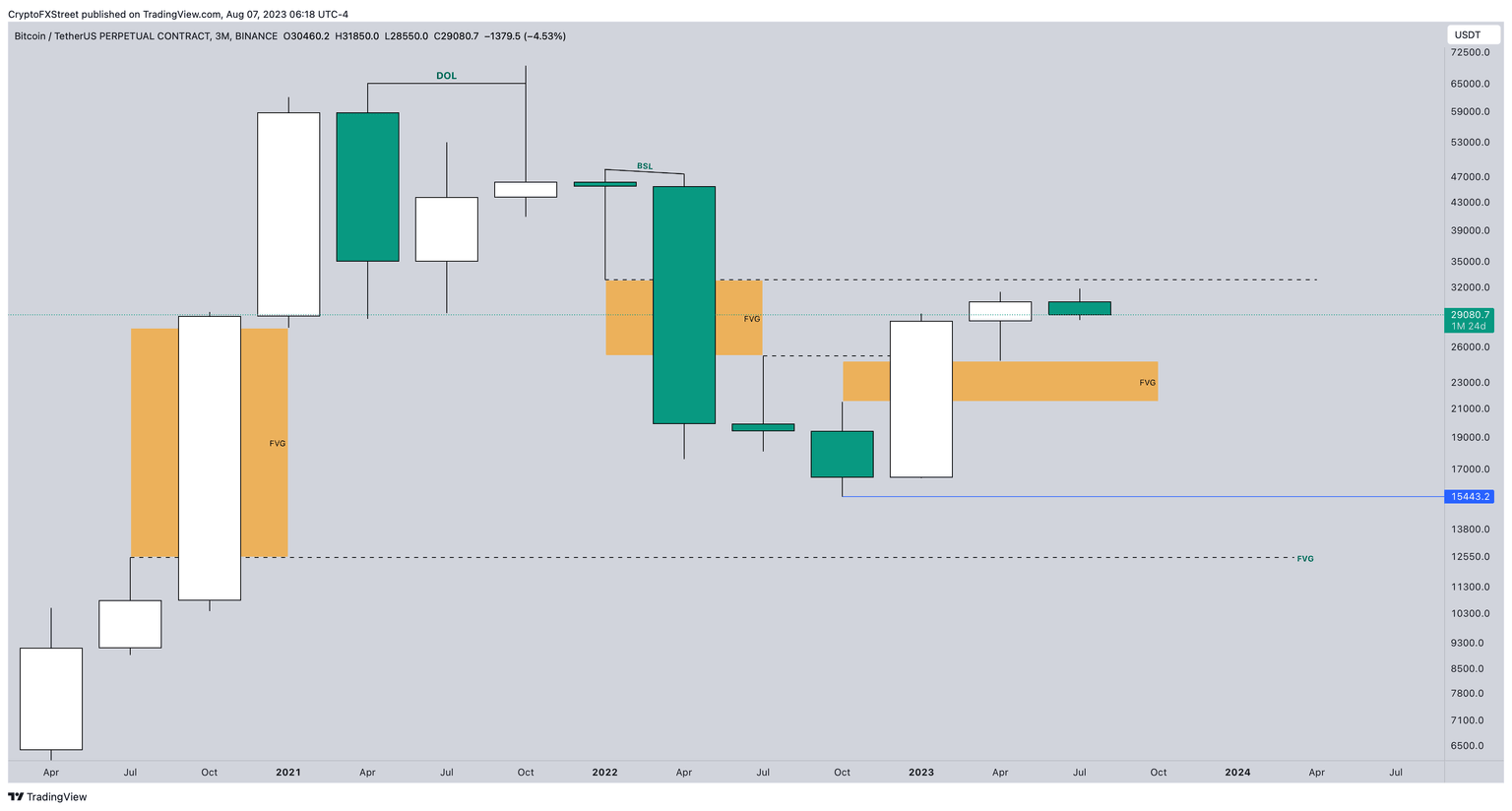

The range between $24,777 and $21,473 on the quarterly chart is facing an FVG (fair value gap), which represents an imbalance in the order flow. This would open up short sellers to gains, although flipping the $30,000 level into support could invalidate this bearish thesis and enable a jump beyond $35,000.

BTC/USDT 3-month chart

But the likely scenario is bearish since that is the sentiment held out by authorities and top crypto players, particularly in regard to the recent spot Bitcoin ETF filings. The Securities and Exchange Commission (SEC) has 45 days to respond to the applications filed, which ends this week. However, the entire market is expecting a delay to be announced.

Addressing the same, Cathie Woods, founder of ARK Invest, stated,

“I think the SEC, if it’s going to approve a Bitcoin ETF, will approve more than one at once.

ARK recently claimed to be the first to file for a spot Bitcoin ETF, although BlackRock was the first to announce it in the past couple of weeks. While initially, all the filings were found to be inadequate, refreshed and updated filings have since been added to the regulator’s docket for consideration, pending results this week.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.